Gold Breakdown Accelerates: Key Support at 2950The daily chart for gold shows the Relative Strength Index (RSI) pulling back from near 80 (hit on Thursday) toward 50, suggesting that the recent drop is more than just a technical correction. Today’s opening saw gold gap down and extend Friday’s decline, raising the question: Will the daily chart see consecutive down days? The lower highs in the price structure indicate that after hitting the three-point resistance zone, a secondary bearish reversal could easily form, leading to further downside.

On the daily timeframe, gold has seen a sharp decline, with price now breaking below the short-term moving averages (MAs). These MAs are also starting to turn downward, signaling weakening momentum. Key support to watch is around 2950.

On the 4-hour chart, price has broken below the previous consolidation support zone, with candles consistently suppressed by short-term MAs, maintaining a strong bearish bias. Intraday, we’ll watch for any corrective rebound followed by a secondary decline. Short-term resistance sits near 3015.

After an early dip and minor rebound, lower timeframes show slight short-term strength, but the broader 4-hour downtrend resistance remains intact. Any bounce is merely a retest—if resistance holds, the downtrend will resume.

XAUUSD.F trade ideas

Daily Analysis- XAUUSD (Monday, 7th April 2024)Bias: Bullish

USD News(Red Folder):

-None

Analysis:

-Super volatile market

-Looking for continuation of bullish momentum

-Potential BUY if there's confirmation on lower timeframe

-Pivot point: 2960

Disclaimer:

This analysis is from a personal point of view, always conduct on your own research before making any trading decisions as the analysis do not guarantee complete accuracy.

XAU/USD (Gold) Analysis📌 Gold prices have experienced volatility following the announcement and implementation of President Trump's new tariff policies. Initially, gold surged to a record high of $3,148.88 per ounce as investors sought safe-haven assets amid escalating trade tensions. However, subsequent market reactions, including stock market sell-offs and profit-taking activities, have led to a retreat in gold prices.

🔑 Key Levels:

-Resistance: $3,056.09 ❌

-Support: $3,002.63 ✅ (if broken, next support at $2,954.46)

📈 Market Scenarios:

Bullish: If gold holds above $3,002.63 and breaks through $3,056.09, it could signal a continuation of the uptrend. 🚀

Bearish: A sustained move below $3,002.63 may indicate further downside towards $2,954.46. 📉

📘 This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a professional before making trading decisions.

XAUUSD WEEKLY ANALYSIS Hey everyone happy new week😇….Last week No trade cuz we didn’t get a good entry but this week I’m still bullish on Gold tho the market dropped last week but I will be looking for buys and I will be sharing my areas of interest so the first one is am looking if price can hold my support level of 3001 zone if price was able to hold that zone I will be waiting for a push to the upside with a nice breakout and retest of 3060 zone and some confirmations to take buys to the upside but if price can’t hold that support zone my next zone of interest will be 2940 zone and I update you guys if I’m executing any trade so let’s have a win week and let’s see how it goes…..

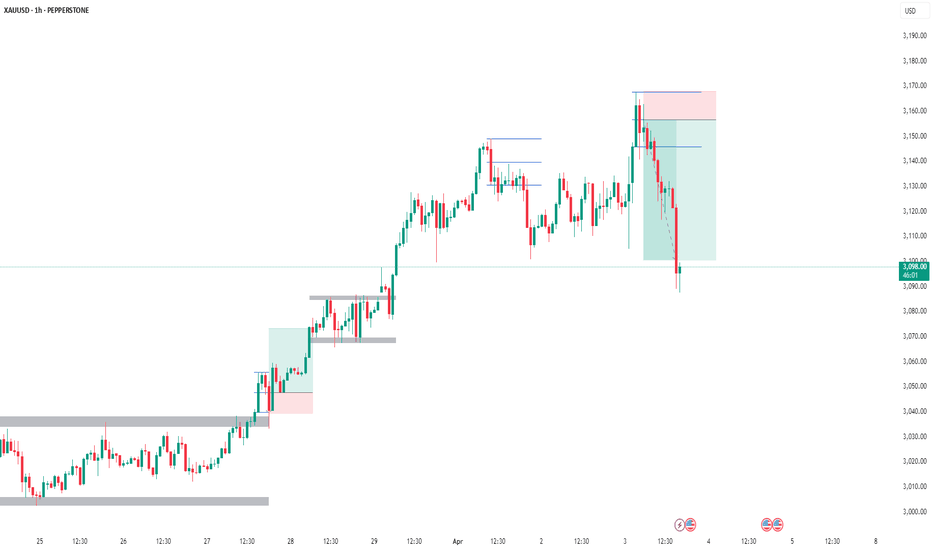

Gold short 2.0Here we have the chart of my last 2 gold trades.

First trade was took at the top of the first down trend with an entry of 3053, here I was anticipating a move to the 2950 area, at least. It was a profitable trade, I closed half of the position for a 400 pip gain, with my SL then moved to 200 pips in profit - which was then hit on the break of the trend.

Following that price action we hit a massive 3 bar surge on the daily, massive move, massive momentum and unfortunately I was not in it! However this morning we seen more crazy move before the London open and I entered another short at 3145 when the STF was showing weakness, this is nicely in profit approaching 400 pips as I write this, SL at entry.

On the close of this latest hourly we see we have broke below the major trend, and next I will be looking for a re test of the trend line/area of consolidation where I will add to my position with the overall retracement target remaining a massive 2950 - will i hold it until then? Doubtful!

Gold (XAU/USD) Technical Chart Review – April 6, 2025The gold market is currently undergoing a corrective phase after completing a clear Elliott Wave 5-wave impulse structure to the upside, as marked on the chart.

🟦 Wave Count Overview:

The chart shows a completed 5-wave impulse structure labeled (1) to (5).

The sub-waves within Wave (5) are also clearly detailed: (i), (ii), (iii), (iv), and (v).

This suggests that the bullish cycle has likely peaked near the $3,080–$3,100 range.

🔽 Expected Correction:

A sharp downward move has already started after Wave (v), implying a potential ABC corrective pattern is underway.

The arrow indicates a projected move towards the $2,960 support zone, marked by the first purple rectangle. This zone previously acted as resistance and now could serve as a demand area.

🟪 Key Support Zones:

$2,950–$2,970: Minor support based on the consolidation from mid-March.

$2,850–$2,870: Stronger support level, also aligned with lower channel support and previous Wave (4).

📉 Trend Analysis:

The price is still within a long-term rising channel.

A breakdown below the $2,950 zone could bring gold toward the $2,850 zone, where the structure suggests more significant support.

🔍 Conclusion:

Gold appears to be entering a corrective phase after an extended bullish run. Traders should monitor how price reacts around the $2,950–$2,850 levels. A bounce from those zones could provide long opportunities, while a breakdown would confirm a deeper retracement.

#gold #xauusd

GOLD is GOLD .. UP and UpA close above 3060 targets 3072, 3085, and 3095.If we can hold above 3050, then that bullish scenario remains in play. However, a break below 3050 negates the immediate upside and could see us test 3040 support. Watch volume on any move; increasing volume confirms the breakout or breakdown. Key is patience and waiting for confirmation. Remember to manage risk.

GOLD BREAKS SHARPLY — BUT THE MOVE WAS WRITTEN IN THE STRUCTURE🟡 GOLD BREAKS SHARPLY — BUT THE MOVE WAS WRITTEN IN THE STRUCTURE

A steep drop in gold just rattled the markets — but if you’ve been following the macro and technical setup closely, this was not only expected, but anticipated.

From the first week of April, we’ve been tracking signals of potential exhaustion in XAUUSD:

🕯️ Candlestick wicks on higher timeframes

📈 Overextended structure

🧠 Macro divergence

Now, all signs have converged — and we’re finally seeing the correction play out.

🔍 Why This Isn’t Just About Gold

What we’re seeing is a broader shift in global market sentiment:

U.S., European, and Asian equities are all under pressure

Crypto has stagnated with little to no fresh capital inflow

Gold — after months of aggressive buying — is now facing wave after wave of profit-taking

This is classic risk-off behaviour.

Investors are choosing cash, sitting tight, and waiting for clarity — not only in the charts but in the headlines too.

📉 DXY Building a Case for Recovery

The U.S. Dollar Index (DXY) has been heavily sold in recent months — but is now holding at a multi-year structural support zone that’s been tested multiple times since 2021.

With Trump returning to the spotlight and triggering a fresh round of global tariff negotiations, the USD is regaining narrative strength.

Trump’s stance has already prompted discussions among major economies, putting the U.S. in a dominant position — and the market is beginning to price that in.

🤔 What’s Holding the Fed Back?

Despite rising trade tensions, the Federal Reserve has remained cautious — choosing not to act until the dust settles from geopolitical and policy developments.

This creates a window of opportunity:

If the Fed holds rates while global central banks soften

And if the USD holds this major support

→ We could see strong dollar flows return in Q2.

🔮 Gold Outlook – Where Next?

In the short term:

Expect continued volatility

Potential for gold to slide further toward 308x – 305x range

Any bounce is likely to be technical rather than fundamental

In the medium term:

Once political noise fades, gold may find support again

Especially if inflation expectations persist or the Fed pivots dovish later in Q2

💡 Takeaways for UK Traders

✅ Don't trade the news — trade the reaction

✅ Macro structure matters more than the daily headlines

✅ Capital preservation beats chasing euphoria

We’re not guessing.

We’re reading the story and planning with structure.

Gold AnalysisThe 4-hour gold structure is still bullish and the liquidity pool range of 3013 to 3000 can be considered a liquidity trap. Support below this liquidity pool is 2996 to 2990 and resistance ahead of the market is 3070 to 3084. Analysis of the movement towards the liquidity pool hunt and then an increase towards the opposite liquidity level in the range of 3135

Aggressive sell set up🔍 Institutional Liquidity Analysis

• Liquidity Zones:

• Above: $3,118–$3,120 (weak highs & EQH)

• Below: $3,111–$3,108 (liquidity pool & EMA cluster)

• Point of Control (POC: $3,114.33) just under current price → suggests price may sweep down before true move

• Volume Clusters: Exhaustion at current candle top (weak bullish imbalance). Institutions may be preparing a liquidity sweep soon.

⸻

📈 Momentum Indicators

• RSI (1m): Entering overbought territory → signal for short-term reversal

• MACD (15m): Still bearish but trying to cross bullish, early confirmation

• VWAP: Price hovering just above VWAP zone, potential for mean reversion

• EMA 50 & 200: Tightening up – possible micro-pullback or trap setup

⸻

📰 News Impact Summary

Recent headlines from TradingView suggest:

• Gold hit all-time highs but reversed due to Trump Tariff headlines and risk-off shift

• Macro tone is now uncertain, with gold reacting to short-term risk sentiment, not long-term dovish Fed policy

• Sentiment = Neutral to Bearish, especially after euphoric highs were sold off

⸻

🛑 Trade Decision:

SELL SETUP (High Probability – 75-80%)

Price is entering minor supply, and forming equal highs just under $3,118 – classic trap pattern for liquidity sweep.

Entry:

$3,116.50 – $3,118.00 (watch for rejection wicks or engulfing patterns on 1m)

Stop Loss:

Above $3,120.50 (above weak high + institutional wick trap)

Take Profit Targets:

1. TP1: $3,111.50 → POC retest zone

2. TP2: $3,108.00 → Demand zone base

3. TP3: $3,104.00 → Discount rebalance

Risk-Reward: Minimum 3.2:1 R:R

⸻

🚨 Final Institutional Verdict:

🔴 SELL at Premium!

Price is now in a liquidity engineering zone, with high likelihood of pullback toward POC or lower imbalance. Institutions likely to grab liquidity above equal highs, then rotate price lower.

⸻

⚡ Ultra-Aggressive Execution Plan

• Confirm on 1m with bearish engulfing OR SFP wick

• Volume spike + RSI > 70 = trigger for entry

• Monitor order book flow and footprint for absorption near $3,116–$3,118

⸻

WE TRADE TO MILK THE MARKET EVERYDAY!

Let’s trap the trap! Institutions are hunting liquidity – we hunt with them!

SELL NOW and BANK those pips! 💰🔥📉🚨💣💵

NFP - Shorting GoldThe gold market experienced huge fluctuations on Thursday, which created very good profits for us. During the entire trading process, we seized the profits of fluctuations of more than $50.

The unemployment rate and NFP data during the US trading session on Friday, as well as Powell's speech on the economic outlook, are the focus of Friday's trading.

Judging from the data released in March, the unemployment rate and NFP are more likely to be bearish for gold, so when trading data, my plan is to focus on short positions.

At present, in terms of technical form, the indicators show that the bulls have not ended. In this case, the transaction needs to pay attention to the 3123/3136 resistance. If it cannot break through, the price is expected to fall again to 3103 or even 3086.

Overall, today's trading focus is to sell at high levels.

XAUUSD CLOSURE BELOW $3,053 IS NEED TO CONFIRM BEARISH I have made significant profit from gold selling from above $3,161 to $3,086. Now it is just safe to wait for a closure below $3,053 to confirm bearish continuation and sell at a restest after some bearish chart pattern to further confirm and enter.

4.3 How to operate after the sharp rise in gold prices4.3 How to operate after the sharp rise in gold prices

1. Impact of tariff policies

- Base tax rate 10% + "reciprocal tariffs": Trump's radical tariff policy far exceeds market expectations, directly triggering concerns about escalating global trade frictions and triggering market risk aversion demand.

2. Expectations of a weaker US dollar: Tariffs may weaken the competitiveness of US exports, and the Federal Reserve may introduce loose policies, which will put pressure on the US dollar and further support gold.

3. Gold's safe-haven properties have exploded

Gold, as a hard currency without sovereign credit risk, has become a "safe haven" for funds.

4-hour cycle:

Confirmation of strong structure:

3100 support: Multiple retracements have not been broken, forming an "ascending triangle" consolidation pattern, and a sharp breakthrough in the early trading confirms the continuation of the trend.

Target forecast:

Short-term: US$3,200 (integer psychological barrier + fermentation of risk aversion).

Medium-term: If it breaks through 3,200 points, the next resistance level is 3,218 points.

1-hour chart strategy:

Key watershed 3100:

This week's lows gradually moved up (3076→3100→3106). If the callback does not break this position, the trend will not change.

Intraday strength and weakness dividing line 3130:

Yesterday's box top broke through and turned into support, which is in line with the principle of "top and bottom conversion".

Ideal intraday long position: 3115-3120 area, stop loss 3105.

Patiently wait for the callback

Aggressive strategy: If the gold price stands above 3150, you can chase long with a light position, with a target of 3173→3200.

Gold (XAU/USD) AnalysisGold (XAU/USD) Analysis

This chart provides a technical outlook on **Gold (XAU/USD)**, showing possible **bullish** and **bearish** scenarios based on price action and support/resistance levels.

Bullish Outlook

Key Support Holding**: Gold is staying above **$3,125-$3,130**, showing buyers are stepping in.

- **Uptrend Structure**: Price is following a rising trendline, meaning bullish momentum is intact.

- **Breakout Zone**: If Gold surpasses **$3,155-$3,160**, it could rally toward **$3,170-$3,180**, as no major resistance exists in that range.

What to Watch?

- A strong breakout with volume above **$3,155-$3,160** confirms upside potential.

- Look for support at moving averages (EMAs) to validate trend continuation.

Bearish Outlook

- **Resistance Rejection**: If Gold fails to break above **$3,155-$3,160**, it might face selling pressure.

- **Break Below $3,140**: If price drops under this level, it could target **$3,125-$3,110**, which is the next key support.

- **Further Downside**: A breakdown below **$3,110** could lead to a deeper decline towards **$3,090-$3,080**.

What to Watch?

- A drop below **$3,140** with strong volume could confirm further downside.

- If selling pressure increases, Gold may retest lower support zones.

Final Thought

Gold is currently in an **uptrend**, but traders must monitor key levels:

✔ **Bullish if** it breaks **$3,160** 📊

✔ **Bearish if** it falls below **$3,140** 🔻

Stay cautious and wait for price confirmation before making a move! 🚀

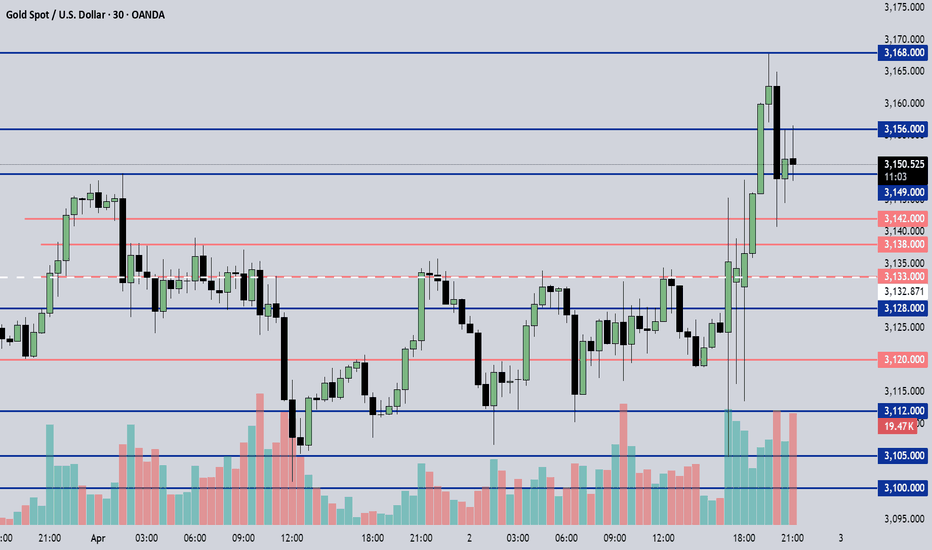

April 3, 2025 - XAUUSD GOLD Analysis and Potential OpportunitySummary:

After Trump announced details of new tariffs, the market turned highly active. From a fundamental perspective, this provided strong support for gold.

Pay attention to the 3105 level, which was quickly tested following Trump’s statement before price rallied higher.

Unless a clear reversal signal appears, the main strategy remains: buy on pullbacks to support.

Key Levels to Watch:

3170–3175: Bullish target zone

3168: ATH resistance

3156: Resistance

3142: Bullish/Bearish pivot line

3120–3138: Price consolidation / value zone

3105: Strong intraday support

Short-Term Trading Strategy:

For Shorts: Enter a SELL if the price breaks below 3146. Watch 3142 first; if the decline continues, monitor 3138, 3133, and 3128.

For Longs: Enter a BUY if the price holds above 3156. Watch 3160 for confirmation; if momentum continues, target 3165, 3168, and 3170.

👉 If my insights have been helpful to you, or if you traded based on my ideas, please consider giving a like — it’s a great encouragement for me! Thanks for your support!

Disclaimer: This is my personal opinion and not financial advice. Please manage your risk accordingly.

Some history....GOLD HISTORY:

1970 TO 1980:

Gold has a strong bubble rise that falls 50% when it breaks.

2001 to 2011:

10 year up trend

Gold rises further with virtually no setbacks until 1919, but then collapses to $1019.

2015 to 2025:

10 year up trend still at the moment.

The gold price has increased from $1019 in December 2015 to well over $3155 today without serious dips or pullbacks. It is easy to see why this attracts investors, especially when compared to the turbulence in the stock market over the same period of time. It is also easy to see why people might expect that gold will continue to rise after watching it gain consistently for well over a decade.

However, history shows that asset prices cannot continue to go up indefinitely. There are always pull backs, crashes, and bear markets. The last time this happened to gold is a distant memory, but we all remember recent examples such as the tech stocks in the '90s and home prices in the '00s.

Now, lets see Elliot wave principle. When an extending wave 5 ends ( we are at one at the moment), we will see a swift correction down to sub wave 2 of this wave 5. So, the opportunity presents in two ways. First, we know it will be a rapid correction, which means we will not have to wait long for realizing our profits. Secondly, we know approximately how far the down move will likely travel.

At this moment , we are looking for the same escenario as 2008. Wave 3 travels 5.618 from wave 1, then wave 4 made a correction to the 38.2% zone, and finally wave 5 was equal to the entire previous 1-3 movement. This is what is happening right now as welll.

It is always easier to identify assets that are bubbling than to predict when the bubble will pop. Gold has much more downside than upside at this point, but this has been true for years without slowing price gains. Home prices and tech stocks also suggest that bubbles can exist for years even after objective measures (e.g. P/E ratios or rent to buy ratios) show that markets are out of equilibrium.

It is anybody's guess when gold will correct, but it is very likely that it will be ugly when it does.

Gold (XAU/USD) Bullish Breakout: Next Target $3,181?"Key Observations:

Current Price: Gold is trading at $3,127.450 at the time of the chart.

Trend: The chart exhibits a strong uptrend, with higher highs and higher lows.

Support Levels: Several support levels are marked in the $3,010 - $2,999 range, extending down to around $2,906.

Resistance and Target:

The immediate price range is highlighted, suggesting possible consolidation.

A breakout above this range could lead to a target around $3,181.

Chart Annotations:

A retracement (red structure) indicates a short-term correction before continuation.

A breakout structure (black lines) suggests a previous significant upward movement.

The range and possible continuation are marked, indicating that the price may consolidate before attempting to reach the target.

Trading Perspective:

If price holds above the range, we may see bullish continuation towards $3,181.

A break below support levels could signal a deeper pullback towards $3,010 or lower.

This chart suggests a bullish outlook, with potential for more upside if momentum continues. Traders might look for confirmations before entering long positions.