XAUUSD.F trade ideas

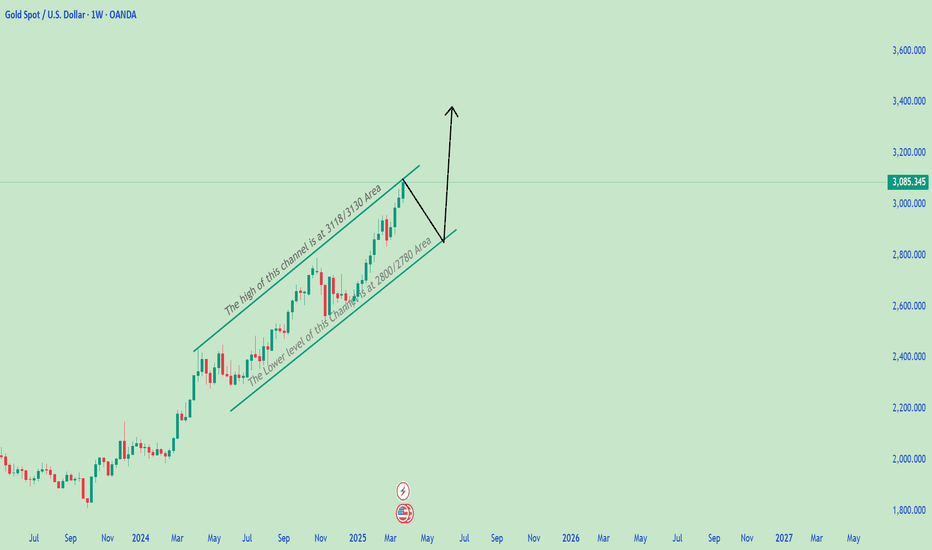

This is my Idea about the potential move of Gold marketThe bulls have been in strength and pushing the price to new high levels, The price is at extreme levels and there is possibility for one more push up and then fall the test the downward of the trend on weekly basis. The price has already made HH on weekly basis and hitting the top of the ascending channel being manifested on the chart . Price is more likely to test 3118/3138 areas and then price would surely fall sharply to hit the down line of the ascending channel lies at 2800/2780 areas . This is my own observation based on my 11 years of practical experience.

Note: If price keep pushing higher above the trendline and manage to close daily or 4 hour candle above 3118/3138 areas , then bulls are more likely to hit 3150/3168/3214 areas.

Feel free to ask more about potential move of the goal

Gold - They All Call Me Crazy!Gold ( TVC:GOLD ) is just starting the next rally:

Click chart above to see the detailed analysis👆🏻

Just a couple of months ago, Gold perfectly broke out of the long term rising channel formation. After we then witnessed the bullish break and retest confirmation, it was quite clear that Gold will head much higher. This just seems to be the beginning of the next crazy major bullrun.

Levels to watch: $4.000

Keep your long term vision!

Philip (BasicTrading)

Gold continues to hit new highs! Trend analysisGold hit a new record high again, rising from 2858 to 3086. After four rounds of surges, gold is now close to the 3100 mark. The overall bull market is still there, and the general trend is still bullish. For gold's upper pressure, pay attention to the breakthrough of 3085-90 US dollars, which is the upper track position of the weekly Bollinger band. For upward breakthrough, pay attention to the integer position of 3100 US dollars, which is also the upper track position of the daily Bollinger band.

Strategy: Gold 3070 long, stop loss 3060, target 3100

ATH 3127, continues to aim for big growth⭐️GOLDEN INFORMATION:

Gold's record-breaking rally continues unchecked as buyers push prices past the $3,100 milestone for the first time ever. Mounting concerns over a potential global trade war and rising stagflation risks in the United States (US) have further fueled demand for the safe-haven metal, reinforcing its status as a store of value.

A recent report from The Wall Street Journal (WSJ) suggests that US President Donald Trump may introduce even higher and broader reciprocal tariffs on April 2, known as “Liberation Day.” This prospect has sent fresh waves of risk aversion rippling through global markets, amplifying investor uncertainty.

⭐️Personal comments NOVA:

Tariff pressure, fears of trade war outbreak in April. Gold price is growing continuously, expected to reach 3127

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3126 - $3128 SL $3133

TP1: $3120

TP2: $3110

TP3: $3100

🔥BUY GOLD zone: $3092 - $3094 SL $3087

TP1: $3098

TP2: $3103

TP3: $3110

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

The Dollar’s Reign vs. Gold’s Rise: A New Reserve Champion?CAPITALCOM:GOLD TFEX:USD1! MIL:EURO

Central banks across the globe are stockpiling gold at a pace unseen in decades. Since 2022, this trend has gained momentum, with gold now outpacing the euro in global reserve portfolios while the U.S. dollar’s once-unshakable dominance shows signs of erosion. At the same time, gold futures have soared past $3,100, hitting all-time highs. This begs a pretty provocative question: Is gold poised to dethrone the dollar as the world’s go-to reserve asset?

What’s Fueling Gold’s Meteoric Climb?

Gold’s reputation as a "safe harbor" isn’t new-it shines brightest when economic storms brew. As markets grow choppy, investors flock to the metal, bypassing stocks and bonds in search of stability. Lately, a cocktail of geopolitical unrest, shaky financial markets, and whispers of a looming U.S. recession have supercharged this flight to safety.

The U.S. economy’s uncertain outlook is a big piece of the puzzle. With recession fears simmering, gold has become a trusted shield against risk. Add to that the monetary policy pivot among major central banks-lower interest rates are creeping into view, even if the timing remains debated. History shows that when rates drop, gold thrives, offering a compelling alternative to assets tied to yields. This dynamic is cementing gold’s status as a bulwark, propelling its price skyward.

A Dollar Decline-or Just a Diversification Moves?

Talk of gold unseating the dollar as the king of reserves might be jumping the gun. Yes, central banks are loading up on gold, but this looks more like a strategic pivot than a full-on replacement. The dollar’s allure is fading, not vanishing.

The Federal Reserve holds a key to this shift. When it dials down interest rates, the dollar loses some of its luster-lower yields make it less enticing to foreign investors who once flocked to it for returns. By contrast, high rates bolster the dollar’s strength; low rates nudge capital toward alternatives like gold.

Beyond U.S. policy, global trade is evolving. Nations are increasingly sidestepping the dollar, settling deals in currencies like the yuan or rupee. The World Gold Council highlights how countries such as China and India are amassing gold to loosen the dollar’s grip on their reserves. Today, gold accounts for about 10% of global central bank holdings, but some predict this could triple to 30% in the years ahead-a move that would keep gold prices climbing.

Still, let’s not write the dollar’s obituary just yet. It remains the backbone of international trade and finance. Gold may be gaining ground, but a total takeover feels like a distant dream.

Gold’s Next Chapter: How High Can It Go?

One thing is certain: gold’s current surge isn’t a fleeting spike-it’s a sign of deeper change. The $3,000 mark, once a lofty ceiling, is now a springboard for bigger gains. Analysts who pegged gold at $3,100 by year-end are already rethinking their targets. Goldman Sachs, for example, now sees $3,300 by the close of 2025.

Short-term dips and turbulence are par for the course, but the long-term picture points to enduring strength. Gold is stepping into a new era, one that could reshape the contours of global markets for years to come.

GOLD BEARS ARE STRONG HERE|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,132.31

Target Level: 3,059.08

Stop Loss: 3,180.97

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 5h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

[ TimeLine ] Gold 31 March - 1 April 2025Hello everyone,

Today is Thursday, March 27, 2025.

I will be using the high and low price levels formed on the following dates as entry points for my trades:

March 31, 2025 (Monday), or

March 31 & April 1, 2025 (Monday & Tuesday)

Trading Plan:

✅ Wait for the price range from these candles to form (indicated by the green lines).

✅ Trade entry will be triggered if the price breaks out of this range, with a 60-pip buffer.

✅ If the price moves against the initial position and hits the stop loss (SL), we will cut/switch the trade and double the position size to recover losses.

📉📈 Below is the chart with the estimated Hi-Lo range of March 31 & April 1, 2025.

You can copy the unique code and add it to the TradingView URL.

🔗 TV/x/IaLLLLcp/

XAUUSD (Gold) is bearish scenario on Daily until 2,940.00 quote Hello guys and welcome one more time to my detailed yet simple strategies to make profit out of any situation in forex,

So, another month, another strategy, in fact, a modified strategy which I hope works better than my other previous 2 trades with simplified strategy. Maybe, it was too simple.

Let's go to the chart though. Daily chart is bearish, as I can see so we go to 15 min chart and seek for opportunity to sell.

So, from now on the next level to touch is a resistence point from March 25, 2025 which became a sort of support which is 3,070.00 and the next one stronger is 3,058.00.

So, let's see what happenes next.

You, what do you think?

XAU / USD 2 Hour ChartHello traders. Just a quick post on a the 2 hour chart. Gold is on a tear up. I am not trying to short gold but I have marked the area where we may see a pullback. For me, I would rather a big pullback to get in on a good , scalp Long position. Let's see how the next few hours play out. It is only Tuesday and I am in no hurry to rush or force a trade. Be well and trade the trend. All my thanks goes to Big G.

Gold selling plan!XAUUSD- GOLD Selling Setup - Since Gold has reached to its highs and based on Double top reversal pattern and RSI showing Bearish Diveregence , it is expected that market is expected to begin moving in downward direction. despite the fact that market is closing . still we expect to get our TP1 hit and may Tp2 as well.

Gold is reversing before reaching the round $3,000 mark.Gold is reversing before reaching the round $3,000 mark.

As you can see on the chart, we’ve hit the 227% Fibonacci level.

— Back in 2008, after testing this level, we went into a correction.

— I think we might see a similar scenario play out from here.

Dollar Index:

SP500/SPY:

GOLD PoV - SHORT 3.125$The price of gold has recently reached a historic high, surpassing the $3,100 per ounce mark, driven by uncertainty stemming from U.S. tariff policies under President Donald Trump and concerns about potential geopolitical conflicts.

This increase underscores gold’s role as a safe haven asset, with investors seeking stability amid growing economic and political instability.

Trade tensions, particularly the tariff policies proposed by the Trump administration, have contributed to economic uncertainty, prompting investors to seek security in gold.

Additionally, concerns about potential conflicts, such as recent escalations in the Middle East, have further strengthened demand for gold as protection against geopolitical risks.

Central banks have played a significant role in this scenario, increasing their gold reserves. In the third quarter of 2023, reserves increased by 337 tons, bringing the total for the first nine months of the year to 800 tons, about a third of the global mine production for the same period.

This accumulation by central banks has helped sustain the price of gold, highlighting its status as a safe asset.

Regarding investment strategies, some analysts suggest that gold's price may undergo a correction after its recent rally. For example, technical analysis indicates a potential short entry at $3,125 per ounce, with a profit target of $2,925, anticipating a retracement of about $200.

However, it is important to consider that gold price forecasts can be influenced by various unpredictable factors, such as economic policies, geopolitical developments, and market dynamics.

In summary, gold has benefited from a significant increase in value due to the uncertainty arising from trade policies and concerns about geopolitical conflicts. Its nature as a safe-haven asset has attracted investments from both institutional investors and central banks. However, trading strategies, such as short positions, should be evaluated cautiously, considering the volatility and uncertainty that characterize the gold market.

Gold can continue moving up inside the upward channelHello traders, I want share with you my opinion about Gold. At the beginning of the chart, the price started to grow from the buyer zone between 2865–2880 points, entering the first upward channel, where it formed higher highs and higher lows. After multiple rejections from the resistance line, the price made a correction and exited the channel, but the overall bullish impulse remained intact. Following a brief consolidation in the support area between 3000–3015 points, GOLD launched another strong move upward, securing a position above the current support level at 3000. This zone has proven to be strong support and marked the beginning of a new upward channel. Currently, the price is trading confidently inside this second upward channel. After a minor correction to the midline, GOLD continued its upward trajectory. I expect a short-term pullback, but as long as the support holds, the bullish trend is likely to continue. My main scenario assumes that GOLD will stay within the channel and move toward TP1, which is set at 3135 points. Given the bullish structure, solid reaction from support, and clear upward momentum, I remain bullish and anticipate further growth. Please share this idea with your friends and click Boost 🚀