XRP Update: SEC Drops Lawsuit, What’s Next for Ripple? Hey traders! 👋

Big news today for XRP – the SEC has dropped its lawsuit against Ripple! After years of legal battles, this is a game-changer that could lead to huge gains for the token. With the legal uncertainty now cleared, Ripple is free to push forward with its vision. But the real question is: what’s next for XRP? 🤔

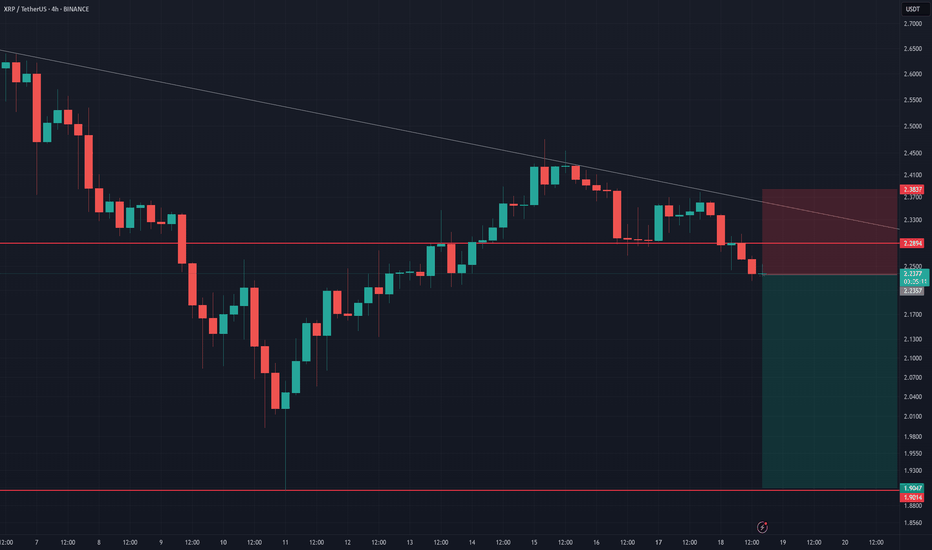

Looking at the chart, it’s clear that there’s a lot of potential here. We could see a surge in price, especially as the market reacts to this positive news. But here’s the big question: will we first fill the fair value gap or will we surge straight through to the supply box we’ve been eyeing for a while now? 📊

The market might want to fill that fair value gap before heading higher, but if Ripple continues to catch momentum, we might see a rapid push into that supply zone. If we break through that, we could be looking at new highs. 🚀

What’s your take? Will XRP start filling that gap, or will we go straight to the supply zone? Drop your thoughts in the comments!

Happy trading, and let’s see where XRP goes next! 💰📈

XRPBULLUSDT trade ideas

XRP BUY SETUPTrade Analysis of the Chart

1️⃣ Market Context

The chart displays a long trade setup with risk management in place.

The price is currently consolidating near the entry zone after a recent bullish move.

A gray supply zone at the top suggests potential resistance.

The risk/reward ratio looks favorable (green zone = profit target, red zone = stop-loss).

2️⃣ Trade Setup Breakdown

🔹 Entry Zone:

The price is currently at a demand/support level around $2.38 - $2.40.

The market might be testing this support before a potential upside move.

🔹 Stop Loss (SL):

Placed below the support zone, around $2.29.

This protects against invalidation of the bullish setup.

🔹 Take Profit (TP):

Set at $2.70 zone, which aligns with the previous resistance.

🔹 Confluence Factors:

✅ Bullish Structure: Higher highs & higher lows suggest an uptrend continuation.

✅ Support Zone: The price is reacting to a demand level, increasing the likelihood of a bounce.

✅ Fibonacci/Breakout Retest: The price may have retested a key breakout level.

3️⃣ Possible Scenarios

📈 Bullish Case:

If price holds $2.38 - $2.40 and forms bullish candles, it could rally toward $2.70 (profit target).

📉 Bearish Case (Invalidation):

If price breaks below $2.29, this trade setup may fail, leading to further downside.

📌 Conclusion

Current Bias: Bullish (long setup in play)

A strong break above $2.45 - $2.50 could confirm upside momentum.

Monitor lower timeframe reactions for confirmation before price moves.

XRP Price Outlook: Is a Deeper Correction on the Horizon?XRP remains in a descending channel, facing strong resistance levels. The price has recently rejected the moving average, signaling potential downside movement. Fibonacci retracement highlights key support at $2.31 (0.786 Fib) and $2.02.

If bearish momentum persists, a retest of the lower trendline is likely. The daily chart shows significant supply zones around 2.3265-3.4106 and 2.5032-2.6487, with additional selling pressure expected between 2.6487 and 3.0153. If the RSI remains below 60-65 within these ranges, XRP could roll over, initiating another bearish impulse wave. Monitoring lower timeframes for signs of trend reversals or uptrend violations can help confirm short entries and long exits.

Should sellers regain control, daily demand zones are identified at 1.5414-1.2843 and 1.1222-1.0033, with Fibonacci retracements reinforcing these levels. Given XRP’s explosive rally in 2024, the monthly and weekly charts feature "tradeable voids" due to expanded-range candlesticks. While these large candles suggest momentum, they also indicate gaps in order flow, which could lead to rapid price movements if a correction occurs.

If XRP sells off, price may decline quickly due to the lack of unfilled orders to absorb movement. Traders should remain cautious and use micro-timeframes to spot early signs of trend shifts and potential entry opportunities.

Navigating XRP Regulatory Winds and Technical TidesThe crypto sphere remains fixated on XRP, a digital asset perpetually caught between regulatory scrutiny and promising technological advancements. Recent developments, including the delayed decision on a potential XRP ETF, the nearing conclusion of the SEC vs. Ripple lawsuit, and the launch of CFTC-regulated XRP futures, have injected fresh volatility and speculation into XRP's price trajectory.

ETF Delay and SEC Lawsuit: A Tale of Two Catalysts

The anticipation surrounding a potential XRP Exchange-Traded Fund (ETF) has been palpable. However, the recent delay in the SEC's decision has tempered immediate expectations. While a positive verdict would undoubtedly trigger a massive price surge, the postponement underscores the regulatory hurdles still facing the cryptocurrency market.

Conversely, the long-standing legal battle between Ripple and the SEC is seemingly approaching its denouement. Reports suggest the SEC is considering dropping the case against Ripple, a development that has already spurred significant price appreciation. The dismissal of the lawsuit, even if partial, would provide much-needed regulatory clarity, significantly boosting investor confidence. This potential resolution drove XRP up 12+% to $2.50, indicating the market's sensitivity to legal outcomes.

Technical Analysis: Charting a Course to New Highs

From a technical standpoint, XRP's price action displays a complex interplay of support and resistance levels. A critical resistance zone lies between $2.60 and $2.89. Overcoming this barrier is crucial for XRP to unlock its full potential and embark on a sustained upward trend. However, XRP has shown resilience, maintaining support above the $2.0 mark, which suggests underlying strength.

Analyzing the Elliott Wave theory, some analysts suggest XRP is currently in a corrective Wave 4. Within this framework, the $2.66 level emerges as a pivotal point. Breaking above this level would signal the completion of Wave 4 and the initiation of Wave 5, potentially leading to new all-time highs. This wave count, while speculative, provides a valuable framework for understanding potential price movements.

Conversely, trading below the 100-day moving average (MA) presents a significant setback for XRP buyers. This would signal a potential shift in momentum and could lead to further downward pressure. Investors should closely monitor this MA as a key indicator of short-term price direction.

Bitnomial's XRP Futures: Bridging Traditional and Crypto Markets

The launch of Bitnomial's CFTC-regulated XRP futures marks a significant milestone for the asset. This development provides institutional investors with a regulated avenue to gain exposure to XRP, potentially increasing liquidity and market depth. This regulated futures market may also provide more price stability, while also providing a tool for shorting XRP.

How High Can XRP Price Go After a Ripple Victory?

The question on everyone's mind is: how high can XRP soar if Ripple secures a decisive victory against the SEC? Predicting exact price targets is inherently challenging, but several factors suggest a bullish outlook.

Firstly, regulatory clarity would remove a major overhang that has suppressed XRP's price for years. This newfound certainty would attract a wave of institutional and retail investors who have previously been hesitant to invest due to legal uncertainties.

Secondly, Ripple's continued expansion and adoption of its technology, particularly in the cross-border payments sector, positions XRP for long-term growth. The increasing demand for efficient and cost-effective payment solutions could further fuel XRP's price appreciation.

Thirdly, the psychological impact of a legal victory should not be underestimated. It would validate XRP's legitimacy as a digital asset and potentially trigger a FOMO (fear of missing out) rally.

Based on these factors, some analysts speculate that XRP could potentially retest and surpass its previous all-time high, potentially reaching double-digit valuations. However, the timing and magnitude of such a surge remain subject to market dynamics and regulatory developments.

Why Is XRP Surging? The Convergence of Catalysts

The recent surge in XRP's price can be attributed to a convergence of positive catalysts. The nearing conclusion of the SEC lawsuit, coupled with the launch of CFTC-regulated XRP futures, has created a perfect storm of bullish sentiment.

Furthermore, general market sentiment towards cryptocurrencies has been improving, with increasing institutional adoption and growing awareness of the technology's potential.

Navigating the Volatility: A Word of Caution

While the outlook for XRP appears promising, investors should remain cognizant of the inherent volatility of the cryptocurrency market. Regulatory developments, market sentiment, and technical factors can all significantly impact price movements.

Therefore, investors should conduct thorough research, manage their risk prudently, and avoid making impulsive decisions based on short-term price fluctuations.

In conclusion, XRP is navigating a complex landscape of regulatory headwinds and technological tailwinds. The nearing conclusion of the SEC lawsuit, coupled with the launch of regulated futures, presents a compelling case for a bullish outlook. However, investors should remain vigilant and exercise caution as they navigate the volatile crypto market. The interplay of legal outcomes, technical analysis, and market sentiment will ultimately determine XRP's future trajectory.

RIPPLE (#XRPUSDT): Bullish Reversal Confirmed?!Ripple's price saw a positive shift following the SEC officially dropping the lawsuit against XRP.

The price broke through a key daily resistance level, indicating a bullish trend reversal. A cup and handle pattern was formed with a broken horizontal neckline, suggesting a confirmed bullish reversal.

I anticipate further growth in the market, with potential targets at 2.69 and 2.94 levels in the near future.

XRP/USDT 1H: Bullish Breakout Holding – Can $2.80 Be Reached?XRP/USDT 1H: Bullish Breakout Holding – Can $2.80 Be Reached?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 8/10):

Price at $2.51, confirming strong bullish breakout.

RSI at 68.91, approaching overbought territory but still has room for continuation.

Clear order block formation at $2.35, reinforcing demand.

No significant bearish divergences present, supporting further upside.

LONG Trade Setup:

Entry: $2.48 - $2.52 zone.

Targets:

T1: $2.65 (initial resistance).

T2: $2.80 (extended target).

Stop Loss: $2.35 (below recent support).

Risk Score:

7/10 – Favorable risk-to-reward, but watch for profit-taking near resistance zones.

Market Maker Activity:

Accumulation is evident at higher levels, with minimal selling pressure.

Strong break above $2.40 suggests continued bullish momentum.

Key resistance ahead at $2.60, with previous resistance at $2.35 now acting as support.

Recommendation:

Long positions remain favorable within the $2.48 - $2.52 entry range.

Monitor price action near $2.60, as this level may provide temporary resistance.

Volume confirmation needed for a potential move beyond $2.80.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

XRP/USDT (1H Chart) - Trade Strategy & Market InsightsBased on the analysis of the chart and considering the market patterns and liquidity behaviors I previously mentioned, here’s how I would approach this situation.

1. Observing Key Market Movements

✅ Liquidity Grab Before Expansion:

Price swept the downside liquidity (below 2.2677 USDT) before making a sharp move up.

Break of Structure (BOS) confirmed a bullish trend shift.

✅ Fair Value Gap (FVG) Retest in Progress:

A large FVG has formed between 2.3788 and 2.4512 USDT, which price is now testing.

If price fills this FVG and shows a bullish reaction, the next move is likely upwards.

✅ Order Block (OB) Near 2.2225 USDT Acting as Strong Support:

If price drops further, the next major liquidity zone sits around 2.2225 USDT.

This zone is critical for bounce confirmation.

✅ RSI Showing Overbought Conditions & Possible Cooldown:

RSI at 68.49, indicating it was previously overbought and may need a correction.

If RSI drops to 50–55 range while price stays stable, it confirms bullish momentum is still intact.

2. Trade Setup & Recommendations

✅ Ideal Buy Entry (Long Position)

First Entry Zone: Around 2.38 - 2.41 USDT (Inside FVG) → Conservative buy.

Second Entry Zone: Around 2.27 - 2.30 USDT (Deeper retracement to liquidity grab) → High-risk buy.

Confirmation Needed: Look for a bullish engulfing candle or pin bar before entering.

❌ Stop Loss (SL)

Below 2.22 USDT, since breaking this would invalidate the bullish structure.

🎯 Take Profit (TP) Targets

TP1: 2.48 USDT (Previous Resistance)

TP2: 2.64 USDT (Major Resistance Level)

TP3: 2.75+ USDT (Potential breakout level)

XRP/USDT:BEST CHANCEhello friends

Due to the price correction, now is a good opportunity to buy in steps.

Note that the best way to buy a ladder is to not suffer a loss if the price changes.

We have specified price targets for you.

We have also specified an important resistance range for you, when the price reaches it, we will give you an update.

*Trade safely with us*

SEC Officially Drops Ripple $XRP Lawsuit XRP Up 13%In a shocking news today the US SEC officially drops Ripple CRYPTOCAP:XRP lawsuit a move that saw CRYPTOCAP:XRP surged nearly 15% today amidst the market dip to $2.54 pivot. in a similar events, CRYPTOCAP:ETH likewise reclaims the $2k pivot albeit CRYPTOCAP:BTC trading at FWB:83K point.

Garlinghouse called the move “a resounding victory for Ripple, for crypto, every way you look at it.” Moreover, the move was one in a string of similar actions taken by the revamped agency this year. The arrival of 2025 has come with a completely overhauled cryptocurrency policy embraced by the returning Trump administration.

The lawsuit was originally filed four years ago, under the previous Gary Gensler-led SEC. Ripple CEO Brad Garlinghouse called the lawsuit “doomed from the start” in a statement following the dropped appeal.

“In many ways, it was the first major shot fired in the war on crypto,” Garlinghouse added. “I truly felt that I knew then that Ripple was not only on the right side of the law, but I felt that we were also going to be proven to be on the right side of history.”

The landmark decision has proven Garlinghouse and the company right in the end.

Technical Outlook

As of the time of writing, CRYPTOCAP:XRP is up 11% trading within over bought territory with the RSI of 73. For the altcoin, the 65% Fibonacci retracement point is serving as a support point should CRYPTOCAP:XRP cool off. Similarly, a break above the $2.64 price pivot that connotes with the 38.2% Fibonacci level could spark a move to $5 as more buyers will feel convicted and step in.

XRP's Bullish Triangle: A Promising PatternXRP's Bullish Triangle: A Promising Pattern

XRP has recently completed a bullish triangle pattern, which appears to be a strong and reliable formation. The growing trading volume further supports this bullish outlook.

While Bitcoin's trajectory remains uncertain, many cryptocurrencies are showing signs of growth, potentially paving the way for Bitcoin to follow suit.

For XRP, I am targeting conservative price levels at 2.37, 2.45, and 2.56, based on the current market dynamics and technical indicators.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

XRP: Current SituationYou asked, and we delivered:

XRP is trading at $2.23, down from recent highs and caught in a choppy phase amid a broader crypto market dip (total market cap down 4.4% in the last 24 hours). Some traders point to a breakout from a descending channel, hinting at bullish potential, while others flag whale selling and weak volume, suggesting bearish risks. The breakout lacks strong volume, raising doubts about its staying power. External factors, like the ongoing SEC lawsuit and ETF rumors, add volatility but remain speculative. For now, XRP is testing immediate support at $2.20-$2.23, with the market awaiting a decisive move.

Technical Indicators and Key Levels

Short-Term (1-Hour Chart):

Support: $2.20-$2.23 (current test), $2.00

Resistance: $2.33, $2.50

Indicators: RSI at 49 (neutral), MACD bearish. The breakout needs volume to confirm; otherwise, a retest could push XRP back to $2.00.

Long-Term (Weekly Chart):

Support: $1.90 (critical), $1.50

Resistance: $2.50, $3.00

The 200-day MA is falling, reflecting long-term pressure, but holding $1.90 is key for bulls.

Potential Scenarios

Bullish Case: Hold $2.20, break $2.33 with volume → target $2.50. Long-term, clear $2.50 → aim for $3.00.

Bearish Case: Drop below $2.20 → test $2.00; below $1.90 risks $1.50.

Volume is critical—watch for spikes to validate moves.

Broader Context and Tips

XRP’s utility in cross-border payments and ETF whispers keep long-term optimism alive, but regulatory uncertainty looms. Traders should focus on $2.20, a hold keeps bulls in play, a break signals caution. Use tight stops (e.g., below $2.20 for longs) and stay alert for news on the SEC case or ETF developments. Long-term, $1.90 is the line to watch for bullish continuation.

XRP/USDT 4h chart review Hello everyone, let's look at the 4H XRP chart to USDT, in this situation we can see how the price moves over the upward trend line, or rather on the upward trend line and fights to stay above the line.

However, let's start by defining goals for the near future the price must face:

T1 = $ 2.41

T2 = $ 2.49

Т3 = 2.56 $.

T4 = $ 2.63

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 2.30 $

SL2 = $ 2.25

SL3 = $ 2.22

SL4 = $ 2.17

Looking at the RSI indicator, you can see how it stays in the upper part of the range, however, you can see how there was a place for potentially re -growth.

#XRP/USDT#XRP

The price is moving in a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 2.25.

Entry price: 2.34

First target: 2.42

Second target: 2.47

Third target: 2.56

TradeCityPro | Deep Search: In-Depth Of XRP👋 Welcome to TradeCity Pro!

Today, we're diving deep into the Uniswap project with Deepresearch. First, we'll review the project information, and then I'll provide a technical analysis of the UNI coin.

🤑Overview of XRP & XRP Ledger (XRPL)

XRP Ledger (XRPL) is a decentralized blockchain launched in 2012 that functions as a currency exchange network, payment settlement system, and remittance platform. It is designed as an alternative to the SWIFT system for international money transfers, enabling instant and low-cost transactions. Of course, these services have not been officially launched yet.

🔹Key Features

Transaction Speed: 3-5 seconds

Scalability: 1,500 transactions per second

Low Fees: $0.0002 per transaction

Energy Efficiency: Carbon neutral and low energy consumption

🔹How XRP Works

XRP operates on an open-source, peer-to-peer, decentralized platform. Unlike Bitcoin and Ethereum, which use Proof-of-Work (PoW) and Proof-of-Stake (PoS), XRP uses the Ripple Protocol Consensus Algorithm (RPCA).

🔹Key Components of XRP Ledger

Consensus Mechanism:

-Transactions are verified by a group of bank-owned servers (validators).

-Users select trusted nodes (Unique Node List - UNL) for transaction validation.

-A transaction is validated if 80% of validators approve it.

-Instead of blocks, ledgers are used to store transactions.

🔹Gateways:

-Acts as a middleman for currency exchange between fiat and cryptocurrencies.

-Anyone can create a gateway to provide liquidity in XRP transactions.

🔹Transaction Fees:

Minimum transaction cost is 0.00001 XRP, significantly lower than bank fees for cross-border payments.

🔹XRP Tokenomics & Vesting Schedule

Total Supply: 100 Billion XRP (Pre-mined)

Current Circulating Supply: ~45 Billion XRP

Escrow System:

-80 Billion XRP was given to Ripple Labs at launch.

-55 Billion XRP was locked in escrow, with monthly releases of up to 1 Billion XRP.

-Unused XRP is returned to escrow to control supply inflation.

Inflation and Deflation Mechanism:

Every transaction burns a small amount of XRP, reducing total supply over time.

Unlike Bitcoin, which is capped at 21 million coins, XRP’s supply management prevents extreme price volatility.

🔹Ripple’s Funding & Investors

Total Raised: $294.5 Million

Current Valuation: $9.8 Billion

🔹Major Funding Rounds

🔹Key Investors & Partnerships

1- SBI Holdings – Major financial institution in Japan, strong supporter of XRP.

2- Santander & Accenture – Integrated XRP for remittance solutions.

3- Bank of America & American Express – Tested XRP for cross-border payments.

4- BlackRock – Exploring tokenization of U.S. Treasury bonds on XRP Ledger.

🔹Ripple and SEC Lawsuit

Background of the Legal Case

-The SEC filed a lawsuit against Ripple in December 2020, alleging that XRP is an unregistered security.

-Ripple argues that XRP is a digital asset, not a security, and operates similarly to Bitcoin and Ethereum.

Latest Developments

-July 2023 Court Ruling: U.S. District Judge Analisa Torres ruled that XRP is not inherently a security, particularly when traded on secondary markets. However, the court found that Ripple's direct sales of XRP to institutional investors constituted unregistered securities offerings.

-Ongoing Settlement Discussions: Recent reports indicate that the SEC is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs.

Potential Impact on Market

-If Ripple wins – Strengthens XRP’s legal standing, boosts institutional investment, and may set a precedent for other cryptocurrencies.

-If SEC wins – Increases regulatory scrutiny, could affect other blockchain projects, and may impact market liquidity.

🔹Future Roadmap & Developments (2025)

Regulatory Expansion and Compliance:

-Expanding into Dubai with regulatory approval, reducing dependency on the U.S.

-Seeking partnerships with Central Banks for CBDCs (Central Bank Digital Currencies).

Tokenization and Institutional Finance:

-BlackRock partnership to tokenize U.S. -Treasury Bonds on the XRP Ledger.

-Increased use of XRPL for real-world asset (RWA) tokenization.

Enhanced XRP Ledger Capabilities:

-Improvements in transaction speed and cost-efficiency.

-New developer tools for smart contracts and DeFi applications.

🔹TVL overview:

An analysis of the Total Value Locked (TVL) in XRPL reveals that after a significant drop in early November 2024, it has recently shown a modest upward trend. Since early February 2025, TVL has increased from approximately $31.5 million to $34.5 million. Despite this recovery, it remains about 380% below its peak recorded in November.

—

🔹Certik: 94.25

—

🔹Ripple Team and Key Figures Behind XRP

Founders (2012):

-David Schwartz (CTO): Architect of XRP Ledger, leads technical development.

-Jed McCaleb: Co-founder, later founded Stellar (XLM).

-Arthur Britto: Key cryptographic contributor, works on decentralization.

-Chris Larsen: Co-founder, now Executive Chairman.

🔹Current Leadership:

-Brad Garlinghouse (CEO): Drives global expansion, leads SEC legal battle.

-Monica Long (President): Manages Ripple’s growth strategy.

-Kristina Campbell (CFO): Oversees Ripple’s financial operations.

-Stuart Alderoty (Chief Legal Officer): Leads Ripple’s defense in the SEC lawsuit.

-Global Presence: Offices in San Francisco (HQ), London, Singapore, and Duba

🔹On-Chain Analysis of Ripple (XRP)

Following XRP’s all-time high (ATH) in January 2025, network activity has declined sharply, with the number of active addresses returning to levels seen four months ago.

In March, exchange inventories show an increase in inflows, possibly indicating selling pressure from individual holders.

Regarding supply distribution, wallets holding over 1 million XRP (primarily institutions and organizations) have reduced their holdings since the ATH. Meanwhile, the number of addresses holding over 1,000 XRP has increased, but this growth appears to be partly due to transfers from larger holders rather than new demand.

🔹Platforms for creating XRP liquidity pools

Uniswap

KLAYswap

Claimswap

Sologenic

Squadswap

—

🔹Some of the wallets that support XRP:

Atomic Wallet

Trust Wallet

Exodus

Guarda

Xaman

Safepal

MetaMask

Tangem Wallet

BitPay Wallet

Math wallet

Trezor

Now that we have reviewed the project, let’s move on to the chart to analyze it from a technical perspective.

📅 Weekly timeframe

As observed in the weekly timeframe, after breaking 0.6568, an upward leg started, and the price even broke through 1.5728, reaching 3.0590.

📊 Market volume was decreasing before the start of the upward movement but surged with the upward trend, although it is currently on the decline again.

✨ The SMA25 has reached the candles, and the price has pulled back to this area. This indicator might introduce new momentum into the market. If it breaks above 3.0590, we could witness the next upward leg.

💫 If this SMA is broken, the price could correct further down to 1.5728. SMA99 could also act as dynamic support.

🛒 For spot purchases, you can enter upon breaking 3.0590. However, if the price corrects further, new triggers will be formed.

📅 Daily Timeframe

In the daily timeframe, as you can see, the price has formed a range box between 2.0032 and 3.3117 and has managed to maintain itself well within this area.

✔️ The 2.0032 area overlaps with the 0.236 Fibonacci level, and if this area breaks, the price could move down to lower Fibonacci levels.

🎲 Market volume in the box is decreasing, which could bring the next price move closer as decreased volume reduces price volatility and allows more whales to influence the price significantly.

⚡️ If the RSI oscillator can stabilize above 50, it might introduce some upward momentum into the market, potentially driving the price up to the box's ceiling. The main trigger for a bullish market is breaking 3.3117.

🔽 For short positions, you can confirm a downward movement with the break of 2.0032, but be aware that this movement is a bearish correction against the main market trend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️