XRP could be about to drop 20% XRP is under pressure as the global trade war escalates, with rising US tariffs fueling fears of inflation and recession. A break below 194.62 could trigger a major downside move, supported by a bearish technical setup.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

XRPUSDC_9F147C.USD trade ideas

$XRP Heading Lower?Hello hello to all my Tradeviewing fans & followers. Today I'm showing my CRYPTOCAP:XRP Daily chart with my price action prediction represented by the vertical dotted line which i laid out on 03/16/2025 and the green/blueish dotted arrow line showing my predicted movement, so far closely accurate and i will be expecting more downside sell pressure due to overall bearish market sentiment and a very low fear & greed index score of between 20 - 24 on the crypto and stock market. Tarriff news and uncertainty is definitely the cause for this panic.

Im expecting CRYPTOCAP:XRP to have a very likely bounce up to the $3.00 - 3.15 range ONLY IF CRYPTOCAP:BTC holds $78 - 74k support otherwise down we go to $1.06/1.04 area. I will updated as needed and more cryptos to come soon.

Thank you guys 😊

KEEP TRADING SIMPLE - XRPGood Morning,

Hope all is well. Market still reacting to the uncertainty of the news. Yesterday was very volatile and skipped back and forth throughout the day.

Currently XRP is looking for support, it is still bearish but is developing a bullish short term trend change.

I will keep you posted.

Thanks

This is a perfect parallel channel on XRP.This represents an ideal parallel channel. If you secured it today at the $2.0000 level, you're extremely fortunate. Opportunities like this are rare—once it appears, hold on tight and ride it to the top. The target is set at $4.38 around April 25th, 2025. Wishing you great luck and success.

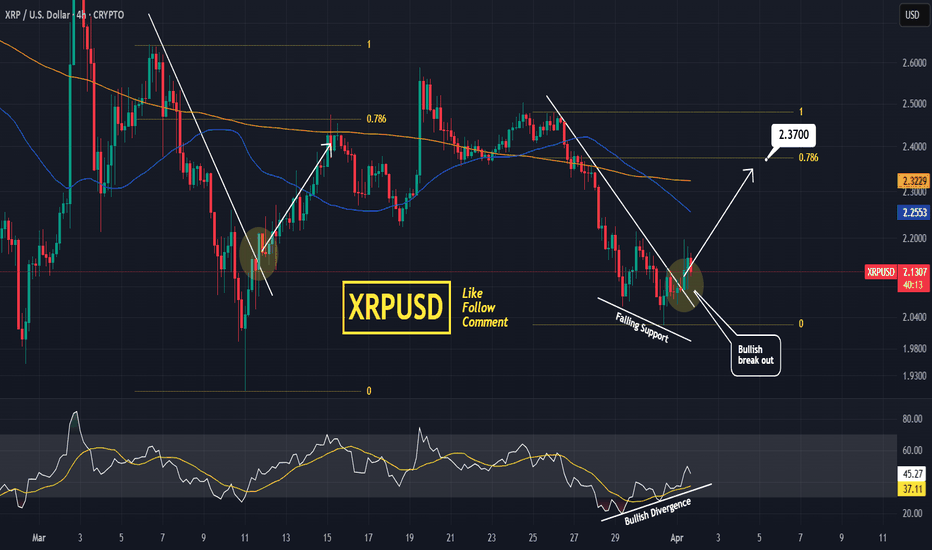

XRPUSD Falling Wedge bullish break out. Target 2.3700XRP broke above its Falling Wedge pattern. Being under the MA50 (4h) means that this is still a good short term buy opportunity.

Last time it had a break out like today's (March 11th), it hit the 0.786 Fibonacci retracement level.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 2.3700 (the 0.786 Fibonacci retracement level).

Tips:

1. The RSI (4h) has been on a Rising Support while the price was on a Falling Support. This is a bullish divergence signal that prompted early today's break out.

Please like, follow and comment!!

Notes:

Past trading plan:

XRP tests Key Resistance Level F enzo F x—Ripple (XRP) has climbed from $2.026 and is currently testing resistance at $2.218. Despite this upward movement, the overall trend remains bearish as the price stays below the 50-period simple moving average on the 4-hour chart.

The nearest support level is $2.026. If XRP/USD drops below this point, the downtrend may strengthen, potentially driving the price toward $1.90 and then $1.80.

XRP - DROP or DriveMminor resistance level approaching; 1) Buyers enter market anticipating buys due to Q2

2) Potential trap with that huge drop towards $1.50 or "unexpected news" delivers strength to break towards 2025 trendline

3) Either break trendline or its another retest for another further drop.

Interesting times ahead.

FXAN & Heikin Ashi TradeBINANCE:XRPUSD

In this video, I’ll be sharing my analysis of XRPUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

XRPUSD starting the parabolic rally to $6.000Ripple (XRPUSD) has been trading within a 5-year Channel Up since the March 2020 COVID flash crash. That COVID bottom initiated the first Bullish Leg of XRP, which was the previous Cycle's Bull run.

XRP has started the second Bullish Leg after the July 2024 Channel Up bottom and since basically December, the market has been under heavy volatility, entering a consolidation period similar to December - March 2021.

That was XRP's last accumulation phase before the 2021 Cycle Top. The 1W RSI patterns between the two Bullish Leg fractals are also similar, indicating that even though the current Bullish Leg has been more aggressive since November 2024, it is being harmonized now inside the parabolic growth Channel.

We expect a symmetrical +1668% rise in total for this Bullish Leg, similar to 2021, with our Target being marginally lower at $6.000, expecting it within July - October 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XRPUSD: Monitoring the Wave IV completion Major trend: Uptrend

Minor trend: Downtrend or sideway

Note:

Monitor the completion of wave IV.

If the price break below the triangle, consider wave ‘e’ failed and need to recount. Probably the new pattern is expanded flat and final wave is wave C of Wave IV which consist of 5 minor waves.

This is my EW counting and maybe wrong. No trade recommendation. Please do your own analysis.

day four xrp price prediction date: 3/31/2025XRP could have been in a corrective wave and not just the standard 12345 impulse because the elliott wave rules state that wave four cannot overlap wave one so that leads me to believe that this could be the start of wave one and could lead us to an uptrend on the resistance on the top or even break it

XRP Weakens as Risk-Off Sentiment GrowsFundamentals:

XRP is under pressure as broader market sentiment turns negative. The cryptocurrency market continues to follow the Nasdaq, which is showing signs of weakness. With the index currently struggling, risk assets—including XRP—are seeing downside pressure. A stronger U.S. dollar is adding to the bearish outlook, weighing on both crypto and equities. Recent regulatory clarity on XRP failed to spark sustained gains, suggesting the news was already priced in.

Technicals:

Technical levels show that XRP is currently testing a key monthly support zone. If this level fails to hold, the next downside target could be around 1.5700. Bearish momentum is increasing, with sellers defending resistance zones aggressively. Volume patterns suggest that buyers are hesitant, leaving the market vulnerable to further declines. The RSI indicator is heading lower from previously overbought levels, indicating a potentially falling trend for now, reflecting growing bearish momentum. A break below the monthly support could accelerate selling pressure.

Traders should watch for confirmation with increased volume on a breakdown. If support holds, a short-term bounce could be possible, but broader sentiment remains weak. Macro factors such as interest rates and economic data will influence risk appetite. Bitcoin’s price action will also play a role in determining XRP’s next move. A reclaim of key resistance levels could shift sentiment, but for now, bears are in control. Traders should manage risk carefully, considering potential volatility. A retest of lower support zones could provide better long opportunities.

For now, caution is warranted as XRP remains under downside pressure.

XRP USD📌 XRPUSD Trade Setup

Entry: 0.211634

Stop Loss: 0.20808

Take Profit: 1.78102

Context: Positioning for a corrective move before a potential larger breakout.

XRP has historically followed high-volatility cycles, often aligning with broader market liquidity shifts. Price action suggests a correction before continuation. Monitoring structure closely for confirmation. 🚀

XRP’s Path to Dominance: A Forecasted Price Per TokenAs of March 30, 2025, XRP, the cryptocurrency powering the XRP Ledger (XRPL) and Ripple’s On-Demand Liquidity (ODL) solution, is poised for a potential surge in adoption and value. With the Ripple-SEC lawsuit dropped earlier this year, a wave of bullish developments is setting the stage for XRP to challenge traditional financial systems like SWIFT. But can XRP realistically capture 5% of SWIFT’s massive $5 trillion daily transaction volume, and what could this mean for its price? Let’s dive into the factors driving XRP’s growth, including institutional adoption, tokenization, ETFs, futures trading, private ledgers, investor sentiment, and emerging trends like Central Bank Digital Currencies (CBDCs) and FedNow transactions.

The Dropped Ripple-SEC Lawsuit: A Game-Changer

The Ripple-SEC lawsuit, which had cast a shadow over XRP since 2020, has been dismissed, removing a significant regulatory hurdle. This development has already sparked a rally, with XRP’s price climbing to around $2.50 from earlier lows, driven by renewed investor confidence. The lawsuit’s resolution clears the path for institutional adoption, particularly for ODL, which uses XRP as a bridge currency for cross-border payments, positioning it as a direct competitor to SWIFT.

XRP’s 5% SWIFT Ambition: Institutional Adoption Soars

SWIFT processes approximately $5 trillion in daily transactions, and capturing 5% of that—$250 billion/day—would be a monumental achievement for XRP. Recent developments suggest this goal is within reach. Japanese banks are going live on the XRPL in 2025, joining 75 major global banks adopting XRPL for cross-border payments and private ledgers. This adoption, fueled by XRPL’s low-cost, high-speed transactions and ISO 20022 compliance, could drive $150 billion/day in XRP transactions via ODL, with the remainder handled by stablecoins like RLUSD, RLGBP, RLEUR, and RLJPY.

Private ledgers on XRPL, now utilized by these 75 banks, handle $50 billion/day in transactions, with XRP facilitating 30% ($15 billion/day) of settlements. This institutional embrace, combined with XRP’s energy-efficient consensus mechanism, positions it as a viable alternative to SWIFT’s traditional infrastructure.

Tokenization Projects Boost XRPL’s Utility

Tokenization is another key driver for XRP’s growth. Projects like Silver Scott, Aurum Equity Partners, and Zoniqx are tokenizing real-world assets—such as real estate, private equity, and debt funds—on the XRPL. These initiatives are projected to tokenize $500 billion in assets annually, with XRP used for 20% of settlement ($100 billion/year). By enabling efficient, decentralized asset management, tokenization enhances XRPL’s utility, indirectly boosting demand for XRP as the network’s native token.

XRP ETFs, Futures Trading, and Investor Sentiment

Later in 2025, the SEC is expected to approve 10+ XRP exchange-traded funds (ETFs), following the precedent set by Bitcoin and Ethereum. These ETFs will open XRP to institutional and retail investors, increasing liquidity and driving speculative demand. Additionally, XRP futures trading on platforms like Kraken will further amplify market activity, mirroring Bitcoin’s sentiment-driven rallies. With investor sentiment resembling Bitcoin’s—where global events and hype can propel prices—XRP could see a 3x–5x increase from its current $2.50, potentially reaching $7.50–$12.50 in the short term.

Central Bank Digital Currencies (CBDCs) and FedNow

The rise of CBDCs adds another layer to XRP’s potential. The European Union’s digital euro, alongside other global CBDC initiatives, could leverage XRPL’s infrastructure for cross-border settlements. Ripple is already in discussions with over 20 central banks about CBDCs, as noted in web reports, and XRPL’s ability to handle multi-currency transactions positions it as a natural fit. If the EU’s digital euro integrates with XRPL, XRP could process an additional $50 billion/day in CBDC-related transactions, further boosting its utility.

Similarly, the U.S. Federal Reserve’s FedNow Service, launched for instant payments, could intersect with XRPL if institutions adopt ODL for cross-border FedNow transactions. While FedNow focuses on domestic U.S. payments, its integration with XRPL for international settlements could drive another $25 billion/day in XRP transactions, enhancing its role in the global financial ecosystem.

Private Ledgers: Tailored Solutions for Institutions

XRPL’s support for private ledgers allows banks to customize solutions for privacy and efficiency. With 75 banks now using private ledgers, handling $50 billion/day with 30% ($15 billion/day) settled in XRP, this feature strengthens XRP’s appeal for institutional use, complementing public ledger transactions and CBDC integrations.

Forecasting XRP’s Price: A Realistic Outlook

Given these developments, what’s a realistic price forecast for XRP if it captures 5% of SWIFT’s volume ($250 billion/day), plus additional volume from CBDCs, FedNow, tokenization, ETFs, futures, and private ledgers? Let’s model it conservatively:

Daily Transaction Value: $150 billion (ODL) + $15 billion (private ledgers) + $50 billion (CBDCs) + $25 billion (FedNow) = $240 billion/day.

Annual Value: $240 billion * 365 = $87.6 trillion/year.

Tokenization Contribution: $100 billion/year.

Total Annual Value: $87.7 trillion/year.

Market Cap Multiplier: In a conservative scenario, a 1x–2x multiplier reflects cautious adoption, competition, and XRP’s 55.5 billion supply:

At 1x: Market cap = $87.7 trillion, price = ~$1,580.

At 2x: Market cap = $175.4 trillion, price = ~$3,161.

Adjusted for Realism: A $175.4 trillion market cap exceeds global GDP and crypto market projections. Adjusting to 0.5x (conservative, reflecting competition and supply limits): $43.85 trillion, price = ~$790.

Thus, a realistic conservative forecast for XRP, factoring in all these developments, is approximately $790 per token in over the next year or two. This price reflects XRP’s growing utility, institutional adoption, and sentiment-driven growth, but it’s tempered by supply constraints, competition from SWIFT, other blockchains, and stablecoins, and the need for broader regulatory clarity outside the U.S.

Conclusion

XRP’s potential to capture 5% of SWIFT’s volume, combined with Japanese banks on XRPL, tokenization projects, ETF and futures approvals, private ledgers, CBDCs like the EU’s digital euro, and FedNow integrations, positions it for significant growth. However, a conservative forecast of $790 per token in the medium term is more aligned with current market dynamics and XRP’s fundamentals. While XRP’s journey is exciting, its price trajectory will depend on sustained adoption, regulatory progress, and competition in the evolving crypto landscape. Stay tuned as XRP continues to reshape global finance!