NFP on Friday, 4 days from now and I suspect we range between 1.1040 to 1.1080 to fill up the volume area encircled.

Just basing it on a weekly trendline and high volume area.

Daily channel intact, downside move more likely than upside. Not selling, buying around the lower channel.

Bounced off monthly zone, we have a net long bias. Waiting for reversion to 1.1030 at the most. As this is the first time we turn slightly bullish in 2 years, we should see one last retracement before we take off to 1.17, if ever we are headed there. Next zone 1.1250.

Waiting for retracement to go long. Entries and exits may adjust depending on the 1h.

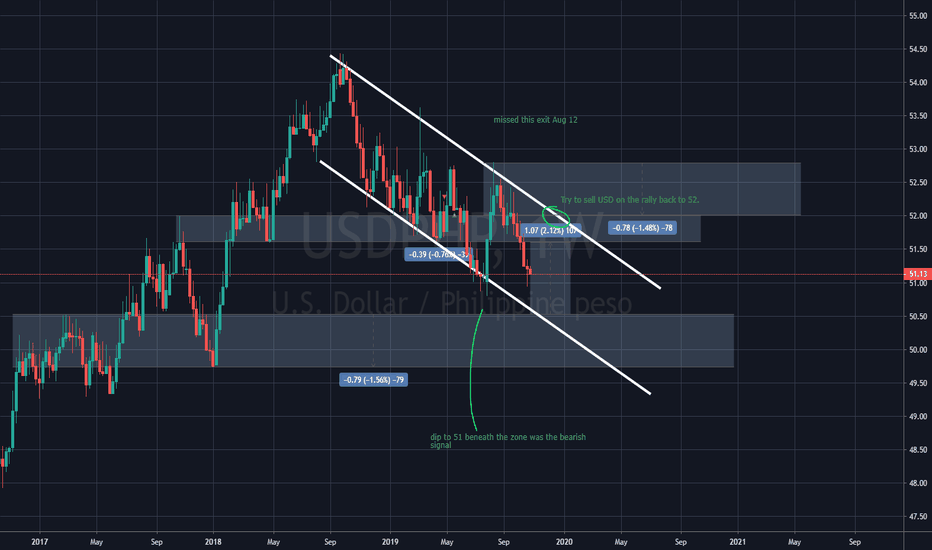

Try to sell USD on the rally back to 52.

BSP announces rate cut last May 9 and multiple RRR cuts thereafter. USDPHP has spoken it wants to go up. Possibly 56 if the previous 8% to 9% runups are any indication.

Short bias, playing around with my pos by going long around 1095, covering starting 1123 to 1130ies, adding new shorts 1130s to 1150s

Today's range expectation of 57p to 60p falls nicely in the demand zone, in confluence with fib50 from the past x days. Will play around with half my pos here and hopefully reload my shorts around 1.1140.

this was the perfect place to short after Saturday's Oct 19 Brexit vote scare as the market ran stops on Monday Oct 21 morning. Went back down in the afternoon, tested the morning range, failed, and a final retest of the afternoon range provided an entry.

Cautiously bullish, will go heavily short past 1.1060.

Price didn't immediately break down 3pm, it bounced and tested the EMALU before finally breaking down around 530pm. 3 pushes capitulated around 8pm where it would have been 6R if taken. 4R if taken at the 4h doji 1 day later, with drawdown experienced of course.

The dollar peaked and broke down on October 1, 2019 10pm as Fed Fund Futures indicate a jump in probability from 39% to 62%. This was a good signal to go long EUR and buy the pullbacks on an hourly timeframe. Probabilities of a 150-175 Target Rate on October 30,...