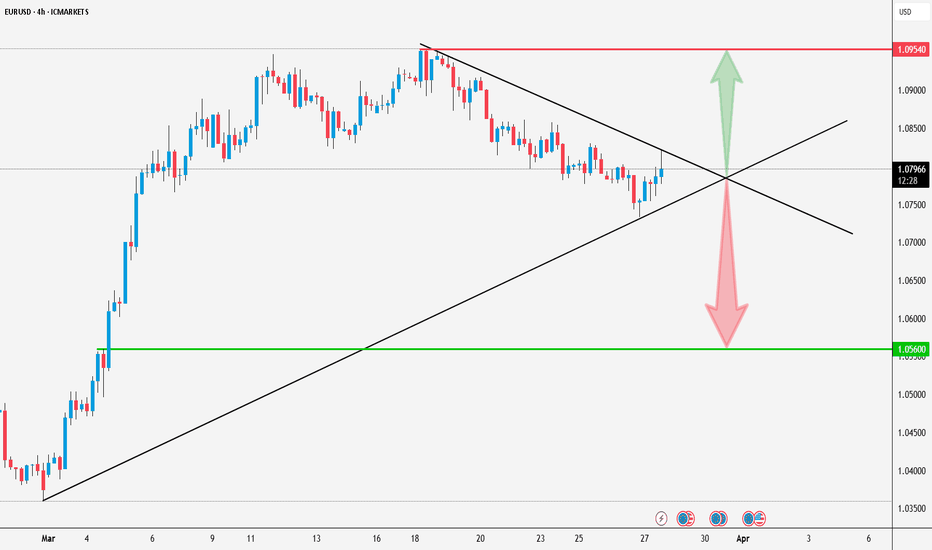

Dear Fellow Traders, This major pair has the potential for a "SHORT" - RSI Divergence. Upside is limited in the short term. A strong quality breakout is necessary, either way. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

Dear Fellow Traders, This major pair have the potential for a deep correction. A strong quality breakout is necessary, either way. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis.

I calibrated the analysis a little: It seems like stocks have some bullish strength. We'll have to wait and see if the imbalance will be filled in the short term. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis

I calibrated the analysis a little: It seems like stocks have some bullish strength. We'll have to wait and see if the imbalance will be filled in the short term. Feel free to ask if anything is unclear. Thank you for taking the time to study my analysis

How I see it in the shorter term: KEY LEVEL OF CONFLUENCE, NOW SUPPORT @ 19960.00 Potential "LONG" - TP 1 = 20490.00 TP 2 = 20834.00 Potential "SHORT" - To Fill Imbalance (Requires a break and hold below KEY SUPPORT) TP 1 = 19975.00 Keynote: Stocks had a GAP weekly open, which indicates potential bullish momentum. At some point the GAP needs to be...

How I see it in the shorter term: KEY LEVEL OF CONFLUENCE, NOW SUPPORT @ 41640.00 Potential "LONG" - TP 1 = 42355.00 TP 2 = 42890.00 Potential "SHORT" - (Requires a break and hold below KEY SUPPORT) TP 1 = 40652.00 Keynote: Stocks are still not showing the "reversal" type quality and energy. Upwards might only be a higher TF correction. On the 4HR TF there is...

How I see it in the shorter term: Potential "LONG" - Requires a break and hold above resistance @ 3026.00 TP 1 = 3047 Potential "SHORT" - Requires a break and hold below support @ 2999.50 TP 1 = 2978.55 TP 2 = 2956.29 Keynote: The 1W candle closed with a big fat green body. At some point price will attempt to chase the wick for sure. Monitor reaction of price...

How I see it: Can this major pair find support? Correction in progress, or just a dip? Bullish momentum stalling after FOMC... Potential Supports indicated Support 1 = 1.08000 Support 2 = 1.07700 Support 3 = 1.07290 (38.20% FIB retracement - Complete Rally) 1) Potential BULL Target @ 1.10010 In case of a deep correction - 2) Potential BEAR Target @...

How I see it: BIG PIVOT AREA FOR NASDAQ BETWEEN 19960.00 & 19112.00 Breakout Catalyst - Pending Interest Rate Decision: If there is any "WISPER" of further rate cuts this year, "IT WILL BE POSITIVE FOR STOCKS" Thank you for taking the time to study my analysis

How I see it: BIG PIVOT AREA - Key Confluence, Now Support @ 148.639 Pending Interest Rate Decision: 1) If key support holds - "LONG": Higher TF Correction towards 156.000 2) If key support is breached (1D body close below): "BIG SHORT" towards 140.000 Thank you for taking the time to study my analysis

How I see it: Bitcoin still needs to fill the imbalance as indicated. Strong daily resistance is holding price down thus far. The "Sweet Spot - Area" to accumulate "LONG" Inventory remains between 75000.00 & 70000.00. Thank you for taking the time to study my analysis

How I see it: Gold achieved new ATH. Potential re-test of previous confluence - now "SUPPORT" Wait for the Re-Test to find Support: "LONG" - TP 1 = 3000.00 TP 2 = 3038.00 Keynote - As once again GOLD finds itself in unfamiliar new territory: Very bullish, strong, green quality candles. Price can always just power on until a psychological resistance is...

How I see it: 3 x Rejections on Key resistance on 1D TF. Key resistance @ 148.639 "SHORT" Targets - TP 1 = 144.530 TP 2 = 140.247 Thank you for taking the time to study my analysis.

How I see it: US30 is testing a key confluence of resistance. A break and hold above key resistance- Potential "LONG" Targets: TP 1 = 41948.00 TP 2 = 42349.00 Rejections @ key resistance- Potential "SHORT" Targets: TP 1 = 40335.00 TP 2 = 39825.00 Thank you for taking the time to study my analysis.

How I see it: Nasdaq did break out of 4Hr trend. Convincingly enough, I'm not so sure? If you look at the bigger picture, there is a lot of traffic upwards. Now key resistance @ 19960.00 Potential " LONG" Target - TP 1 = 20305.00 (The 38.20% FIB retracement on the complete 4HR bearish trend) Potential " SHORT" Targets - TP 1 = 19112.00 TP 2 =...

How I see it: Nasdaq is respecting the 4HR trend resistance thus far. Potential " SHORT" Targets - TP 1 = 19112.00 TP 2 = 18700.00 TP 3 = 18350.00 In case of a bullish breakout @ 4Hr Trend: Potential " LONG" Targets - TP 1 = 19690.00 TP 2 = 20305.00 Keynote: The yellow zone is located above the bearish OB. Indicating the 71-78.60% FIB resistance. Thank...

How I see it: Just another perspective. Bullish breakout @ trend - TP = 20305.00 Bearish rejection @ trend - TP 1 = 19112.00 TP 2 = 18700.00 Thank you for taking the time to study my analysis.

How I see it: Very strong bullish pair - quality green continuation. Any red is only shallow corrections and/or deeper corrections. I'm specifically not recommending ANY short targets in this environment. Classic wait for the market to come to you. Potential bullish targets from confluences of support- "LONG" TP 1 = 1.09370 TP 2 = 1.10010 TP 3 = 1.11390 TP 4 =...