After an aggressive selloff that pushed Japan 225 (Nikkei) into oversold territory, the index printed a solid bullish reaction off the 30,500 key zone. This area aligns with prior demand and offers a clean invalidation level for long positioning. With heavy bearish sentiment already priced in, I’m positioning long with TP near the premium zone around 40,000. The...

After an impressive rally, DAX has now returned to its previous highs. But this upward move looks more like an engineered push rather than a healthy breakout. From a technical and sentiment-based perspective, it feels overextended. That’s why I initiated a short position from this level. No need to predict the top—just follow the setup and manage risk. ...

WTI Oil has finally dipped into my long-watched buy zone, driven by macro fear and an aggressive tariff agenda. The current drop aligned perfectly with my long-term execution plan. I’ve placed this trade based on key historical demand levels with my stop-loss and take-profit clearly defined. I’m prepared for deeper drawdown, but this area remains high-conviction...

Copper just broke above its all-time high, triggering my short entry at 5.3010. While the macro trend is undeniably bullish, past price action has shown that each major high was followed by aggressive selloffs. This might not be the case this time – but that’s exactly why we have a stop-loss in place. This is a tactical counter-trade: not about fighting the trend...

I’ve entered a long trade on Silver (XAG/USD) after observing a deep retrace to the 0.7 Fibonacci level on the daily timeframe. The entry at $28.96 is positioned strategically based on historical support and the current technical setup. The stop loss is set at $26.54 to mitigate risk, while the take profit target is $36.00, aligning with a potential...

DAX returned to its major support zone around 22,000 after an extended decline through March. I’ve been triggered into a long position as we step into a fresh month and quarter. We’re sitting at strong historical demand with multiple macro events lined up this week—I’ll take what the market gives and manage it accordingly. No ego here, just flow with the setup....

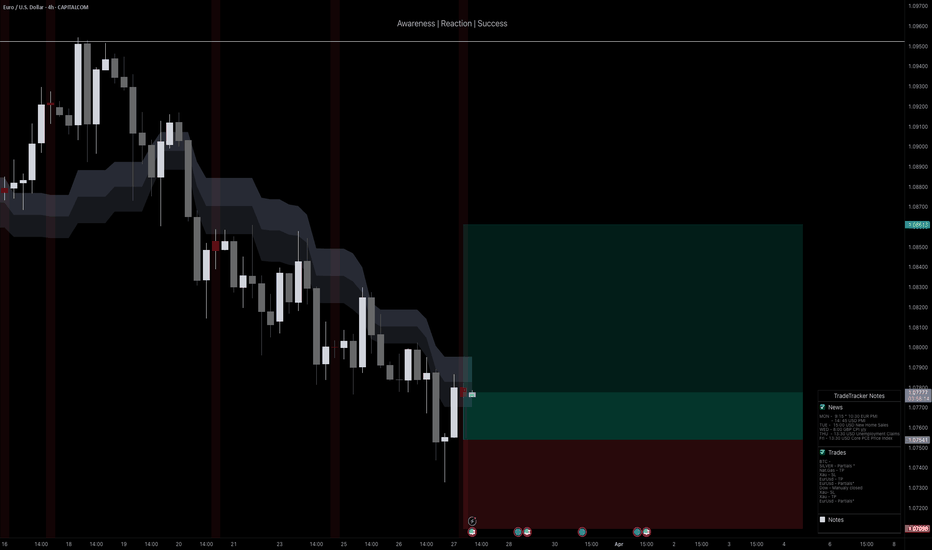

Euro reached an important zone for my setup, triggering a long position. Although it’s still trending below the fibcloud on the 4H timeframe, we’ve seen a solid 0.5% recovery from the recent low. I’m looking for this area to hold as support, with defined risk in case the setup invalidates. Technicals: • Price tapped into a major 4H support level where...

Ethereum has seen a steep 60% drop from its highs, but recent activity suggests it might be entering a key transition phase. I’ve entered a long position here with a wide target in place, waiting for clear signs of bullish momentum before adding more size. Technically, ETH is holding above a strong low on the daily and attempting to reclaim territory beneath a...

The German DAX index presents an opportunity for a long position, targeting the 23,300 price zone. The current price action suggests a retracement toward previous highs before confirming a continuation. With this in mind, I have executed a long position, monitoring key technical levels for potential reactions. On the fundamental side, the market remains sensitive...

Gold has finally reached the psychological $3,000 level, triggering the first round of sell-offs as traders take profit. The question now is whether this move can sustain itself or if we are set for a deeper pullback. Given the rapid move up, I remain cautious, ready to cut the trade quickly if I see signs of weakness in the continuation. Fundamentals:...

Bitcoin has successfully defended the $84K-$86K support zone, with the CME gap now fully closed. On the daily timeframe, BTC remains above the 200MA, signaling strong bullish momentum. With macroeconomic factors aligning in favor of crypto, this could be the start of another leg higher. Technical Analysis: • Support Zone: $84K - $86K held firm, preventing...

Since February 25, the DAX has surged by 7.24% without a meaningful pullback, suggesting potential overextension. Coupled with emerging bearish technical indicators and unfavorable economic fundamentals, this presents an opportunity for a short position. Fundamental Analysis: Germany’s economic landscape is currently facing several challenges: • Economic...

EUR/USD has been struggling to maintain momentum above the 1.0500 mark, facing renewed selling pressure as macroeconomic and geopolitical factors influence sentiment. With the US Dollar regaining strength and concerns about European economic stagnation growing, the pair remains vulnerable to further downside. Technical Analysis: Resistance Levels:...

Oil prices have surged impressively, fueled by recent fundamental-driven market moves. However, this swift upside has led WTI crude to my point of interest, offering a prime opportunity to short against the trend. My trade strategy includes taking partials at the $74 price zone. Here’s why this setup is supported by bearish fundamentals: 1. Rising U.S. Fuel...

Natural Gas (XNG/USD) has spiked to revisit the $4 price zone, activating my short trade. This marks the second time in two years that the price has reached this significant resistance area. The $4 level is pivotal, serving as a key psychological barrier and a historic zone of strong price action. With the position now live, I am leveraging the resistance for a...

Ethereum has pulled back significantly, experiencing a sharp 51% decline from its recent high. This steep correction presents a solid opportunity to go long. Currently, ETH is sitting at a critical support level, making it an ideal entry point for a potential recovery. Trade Setup: • Entry: Market price after the 51% drop • Target: $4,400 • Stop Loss:...

After a deep retrace on the daily timeframe, I’ve initiated a long position on the Nasdaq US100. The plan is to ride this wave back to its Higher High, capitalizing on the recovery momentum. Technical Insight: • Key Structure: The market has shown strong respect for the current retracement levels, providing a solid base for a bounce. • Trendline Support:...

Copper is showing signs of exhaustion after recent bullish momentum, prompting a short setup on the 15-minute timeframe. Price action aligns with a potential retracement toward the $4.17 zone, where a critical support level resides. Why This Trade? • The overextended rally suggests a short-term pullback. • Technical indicators point to weakening momentum,...