GDX Gold miner ETF looking promising right now Similar to other precious metal price action right now

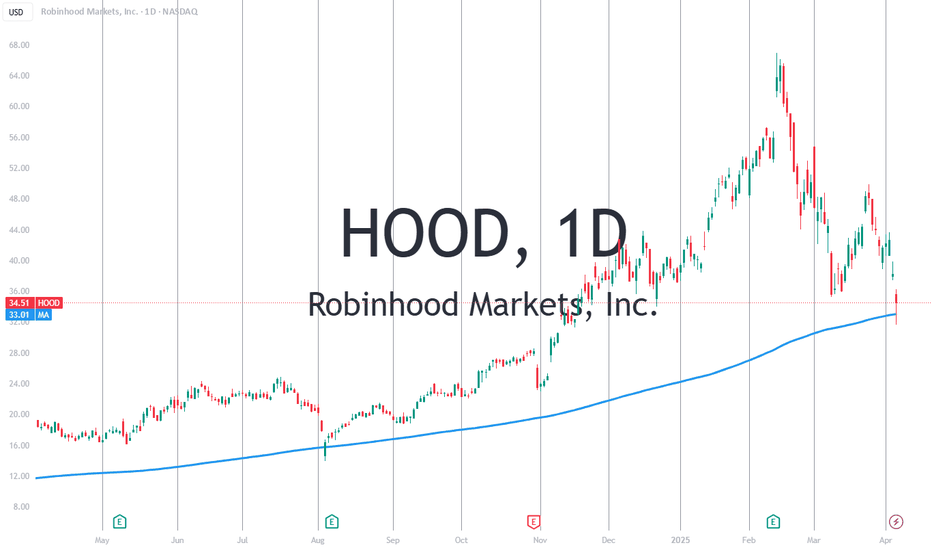

Analyst Upgrades : Robinhood has received positive upgrades from analysts, with a target price suggesting a significant upside. The company's growth in digital wealth management, AI-powered investing, and new banking features contributes to these bullish forecasts. Strategic Investments : High-profile investors, such as Cathie Wood’s ARK Invest, have increased...

ENPH Another upward trending, adding this to watch list

Albmerale adding this to watch list again play on material

looking at some of the Consumer discretionary names in headlines, some of these names are getting lot of publicity for right or wrong reason.

XME Worth watching, though not as strong as energy

CRAK Refiners ETF showing momentum Adding this to watch list

BOTZ Riding the AI Trends, looks like heading higher in weeks ahead, 30 is the next level to watch

NASDAQ:SOFI earnings Tuesday morning! 4 straight quarters of profitability is inbound and bears won’t be able to see @SoFi as an unprofitable company anymore. 180m shares that have been sold short are now officially underwater. Q3 Estimate Members: 715,000k Products: 1.1m Revenue: $650m EPS: $0.05

Adding this to watchlist given price action, earnings and cash flow looks good, but price action post earning is really bad

GDX Gold miners are finally showing some short term momentum, still range bound, looks promising for a long term if convincingly break the range

XLE Uptrend intact? Energy ETF is showing a clear uptrend for the last few months. let's see how this trend evolves

Most probably with $btc price correction, its a leveraged play on BTC Price action

XLE/SPY Relative ratio long term, now at 2008 levels, still looks good on short term daily charts

XLI relatively week not a good indicator for cyclical names

EWZ looking good looks like Brazil is finally bottomed out

Looks like Oil and Gas Equipment ETF is about to Run

EWZ Brazil looking relatively strong, worth watching for a potential long