In this video, I break down the smaller-degree waves near the recent highs and explore the possibility that a minor Wave 2 has completed. If that's the case, we could see a reversal from here, provided price stays below 88,876. Wave E has been unusually complex and aggressive, but I believe I now have a clear understanding of where we are in the overall...

We're watching for a break below 87,000 to confirm the start of Wave (C), with a target of 74,517. If price drops below 87,000 without making a new high, it confirms 88,894 as key resistance and an ideal stop level. For a full breakdown, check out the video linked below in Related Ideas.

Bitcoin appears to be encountering resistance on several fronts: recent highs, the 200-day moving average, and the extended length now required for Wave (C) to complete the larger Wave B Zig-Zag pattern. A break below the 87,000 level would likely signal the completion of Wave E. Price action remains choppy at the highs due to ongoing uncertainty, but I expect...

Price has been rejected at the 200-period moving average on the daily time frame. This presents an opportunity to short back toward the recent lows, completing the complex Zig-Zag structure I mentioned earlier. A strong resistance level remains above at 88,486, with a downside target set at 74,517. I’ll be posting a video update shortly.

So far, there's been no actual gain or loss from my current idea that we could reach 90K. However, I’d like to propose a new perspective — that we may have been navigating a complex, expanded Wave B Zig-Zag this entire time. With a deeper understanding of AriasWave, I can now make certain assumptions more confidently. I had considered this scenario before but...

Recent rejections at the highs have prompted a deeper analysis, and the findings are quite intriguing. Based on a detailed wave review, there's a possibility we're currently trading within an expanded Wave B zig-zag pattern that has yet to find a bottom. If this scenario holds and we see a break below the 83,000 support level, price could potentially decline...

In this video, not only do I walk you through the small degree long trade (based on the chart linked below), but I also break down the entire pattern, explain the corrective process, and share what I expect to happen next. As long as 83,015 holds, all signs point toward a potential 6%+ move up to 90K. This is a solid opportunity—price tends to move slowly during...

We appear to be in the midst of an expanded zig-zag correction. A small push toward 90K—without breaking the support at 83,015—would confirm the pattern. So far, the break above the recent high, along with the expanded correction, supports this outlook. As long as the 83,015 level holds, price may reject any prolonged move below the 1000-period moving average.

Could this count actually be valid? It might seem like a stretch given the sharp drop we just saw—but what if Wave D still needs to play out? Is it possible we see the RUNE token hit $11 again in this cycle? It doesn’t sound so far-fetched if you’ve been following the Bitcoin pattern I mentioned in my recent post about AVAX (linked below). At the end of the day,...

After decoding what I believe is the most accurate interpretation of the larger Bitcoin pattern—and how it mirrors across Altcoins—I can now break down what this means for Avalanche. A setup is forming for Wave (C) of Wave D, and it’s looking promising. Once Wave (B) wraps up, I’ll be closely tracking and trading this expected move higher. Stay tuned.

What if I told you that the stock market’s pattern could actually reveal what’s coming next for Bitcoin—would you stick around and watch the entire video? That’s exactly what I’m diving into here. I didn’t force this analysis to fit; somehow, over the past week, it just lined up this way. In this video, I break down exactly why the next market move could be more...

According to AriasWave, the reason we haven’t seen the market roll over yet is because Wave D has been in play since 2022. I’m watching the 1.17747 level closely—once we hit that zone, I’m expecting a sharp reversal to the downside. There’s also a chance we push up to 1.22570 to retest the 1000-period moving average on the weekly. Either way, the setup’s almost...

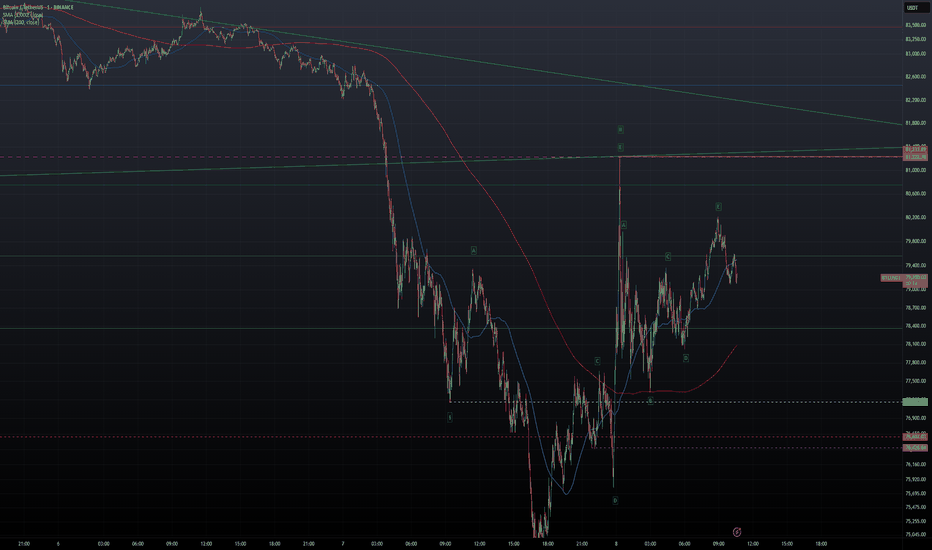

The video idea for this chart is linked below. The current thesis is that minor wave ii has recently completed, confirmed by a retest and rejection of the previous key level at 81,222. Additionally, a brief touch of the 0.618 retracement level supports this view, along with the overall wave structure, suggesting that wave ii is complete and we are now in the early...

In this video, I break down what I woke up to this morning regarding the wave structure. With wave ii appearing to be complete, I’m looking to add to my short position and adjust my stop level down to 81,223—creating another potential entry point for the short trade. Recognizing and understanding these developing patterns is essential if you want to stay in the game.

This idea is explained in the video linked below. The price action speaks for itself, and it’s hard to ignore what looks like the end of the recent correction. A break below $81,222 would confirm this view. Short Entry: $81,222 Stop Level: $84,715 Target: $61,000

After multiple rejections at higher price levels, the most recent major rejection—followed by a break of the lows—suggests that the corrective move we've seen since the end of February may have concluded. In this video, I outline the key reasons why a larger upside move no longer appears likely. With the potential end of the corrective wave combinations now in...

In this video, I break down the latest price action while incorporating some AriasWave analysis along the way. There's nothing unusual happening—just psychological reactions testing your patience. Welcome to the world of trading lol, where you can be riding high one moment and facing losses the next, shifting between excitement and frustration. Today, I dive...

In this video, I share an update on the developments I've observed since yesterday as we prepare for a move higher in a third-of-a-third wave. As price movements become smaller and sharper at lower degrees, identifying the correct count becomes more challenging. That’s why I always consider bearish alternatives and play devil’s advocate. However, at the...