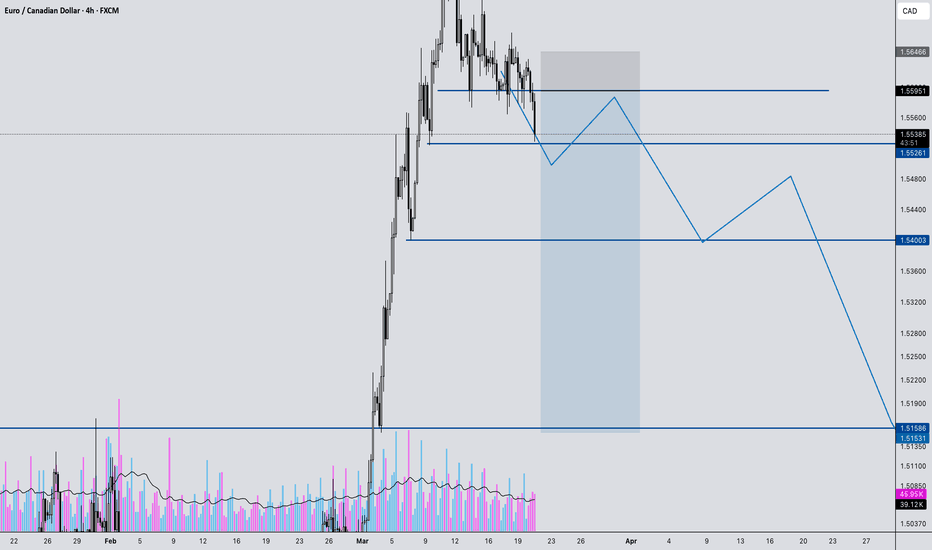

In this video, we analyze a high-probability trade setup on EURCAD, breaking down key market structure shifts and potential reversal zones. 📊 🔹 Massive impulse move into key resistance – Is a pullback coming? 🔹 Breakdown of bullish structure – Signs of a trend shift? 🔹 Key entry & exit points mapped out – Waiting for confirmation at 1.5595 🔹 Targeting major...

Market Structure Breakdown: 🔸 Daily Timeframe: • We initially identified a double-bottom formation, signaling a bullish push to grab liquidity above previous highs. • However, buyers failed to sustain momentum, leading to a structural shift. 🔸 H4 Timeframe: • Strong impulse move downward, breaking key structure. • Formed a lower high, indicating seller...

AUD/USD – Bullish Momentum or Liquidity Grab? Technical Breakdown: The Australian Dollar vs. US Dollar (AUD/USD) is showing an interesting setup, with price action hinting at potential continuation to the upside. Let’s dive into the analysis across multiple timeframes to see if buyers are in control or if we’re facing another liquidity trap. Weekly...

📊 USOIL (Crude Oil) Analysis – February 17 What’s up, traders? Mr. Blue Ocean FX here with another deep dive into the markets, and today, we’re breaking down US Oil (Crude Oil) and the major opportunities setting up. Let’s get straight into it. 📉 Weekly Time Frame Insight • Last week’s candle closed with exhaustion, printing a low at 70.30 but losing...

Welcome back, traders! Mr. Blue Ocean FX here, breaking down the latest price action on gold (XAUUSD) . Let’s dive straight into the technicals and see what the market is telling us. Market Overview Gold has been on a strong bullish run since December 30th, surging from the 2620 area all the way to 2942, marking an aggressive impulse move. However, last week,...

Yesterday, we were focused on GBP/JPY selling off after a major support break, but today’s price action is revealing a potential shift in momentum. While the larger structure still suggests a bearish outlook, recent price behavior is showing signs of a liquidity grab before any major move. On the H4 and H1 timeframes, we’re seeing slow but steady higher highs...

Overview: GBP/JPY has been a strong focus, and for those following along, we’ve been anticipating short opportunities as the market structure continues to favor downside momentum. Recent price action has set up another potential short entry, aligning with our long-term bearish bias. Weekly Timeframe: Major Rejection & Momentum Shift • Double Top Formation:...

Gold has been on an incredible 49-day bullish run, but signs are emerging that the momentum is fading. Is the reversal finally here? In this analysis, I break down why I believe gold is setting up for a potential short opportunity and how I plan to execute it. Starting from the weekly timeframe, we identify a key rejection at $2943, signaling potential exhaustion...

In this analysis, I break down my short trade setup on Silver (XAG/USD) using a multi-timeframe approach to identify key levels, structure shifts, and liquidity targets. • Monthly Outlook: Strong bullish close in January, but price is trading within a range between 32.67 - 28.77. • Weekly Structure: Consecutive bullish candles since December with no real...

What’s great, everyone! We’re back with another GBPJPY update, and it’s January 24, 2025. The market has been playing out exactly as we anticipated, and we’ve been capitalizing on every move with precision. If you’ve been following our breakdowns, you’ll remember that on January 17, we entered a long position at the 192.97 level. Some asked if this level would...

What’s great everyone!? Mr. Blue Ocean FX here, breaking down EUR/GBP with an in-depth analysis you don’t want to miss. Starting from the higher timeframes, we’ve identified a major trendline resistance dating back to January 2023, which has been tested multiple times and is now being challenged again. After a massive impulse move from the 0.8275 area in late...

What’s great everyone? Mr. Blue Ocean FX here with an in-depth breakdown of GBP/USD. We’re currently in a trade, having entered at 1.2297, with stops set at 1.2550. Let’s dive into the key levels and what we’re looking for moving forward. On Friday, we identified a significant lower high around the 1.2297 level, which led to a strong impulse move down to 1.2104....

We’re back with an update on our GBPJPY trade on January 20th, Martin Luther King Day. If you haven’t seen our previous breakdown, be sure to check it out to see how everything unfolded step by step. We’re still holding strong at the 190.02 level, and despite a wick on the weekly candle, there’s a lot of selling pressure within that move. Scaling down to the...

I am back and live on January 18th with a crucial Ethereum (ETH) breakdown! 🚀 In this video, we dive into potential bullish momentum for Ethereum, identifying key levels for buying opportunities and explaining the recent market reaction to altcoin rotations, including the hype around Trump’s meme coin. We start on the weekly time frame, reviewing the inverted...

What’s up, traders! We’re back with an update on GBPJPY as of January 17, 2025. The pound-yen pair continues to keep us on our toes with its range-bound behavior, but we’re breaking down exactly where we believe the market is headed next. In this video, we’re dissecting the levels that are holding strong, the possible upside plays, and the crucial areas where...

What’s going on, everyone? It’s January 16, 2025, and we’re back with an update on GBP/JPY. Let’s dive right into the action. In this update, we’re reviewing the trade we entered midweek and breaking down why we’re still bearish on the pound versus the yen. We’re seeing lower highs consistently forming on the higher timeframes, and volume suggests that the bears...

We’re back with an update on GBPJPY, breaking down our lessons learned from a stopped-out trade and how we re-entered smarter and stronger. See how we use precise risk management, volume analysis, and Fibonacci tools to set up a 3:1 reward-to-risk ratio trade. This update covers everything from identifying key levels to avoiding common pitfalls. Watch now to...

Welcome back! It’s January 14, and this is Mr. Blue Ocean FX diving into EUR/CHF, a pair that’s been hammered relentlessly over the past months. But today, we see a potential scalping opportunity amidst the chaos. On the monthly timeframe, EUR/CHF shows repeated sweeps of key liquidity levels, with a recent bullish close in December 2023. Scaling down to the...