The market needs to pull back to Fibonacci zones. Look at the charts for details and let me know what you think. Counter Trend Setup: 1. Identify Liquidity, 200 EMA, and Market Hours 2. Mitigate Order Block 3. Strong Break of the Trendline 4. Retest Break at new Order Block 5/15 min 5. Rejection/Reversal at Break Retest on 5/15 min timeframe. 6. Enter

Price has finally made its way back to the demand zone previously showing strong support. I will be looking to go long in this area to avoid being stopped out by pullback if getting in too late.

Given the multitude of the wick rejection on the 4hr timeframe, the consistent downtrend on the weekly and how price is returning to the key area, I am still bearish on price. I will be looking for any significant signs of rejection off the key area on the 15min timeframe, in which I will be going short. Price is doing its "drop, base, drop" motion. Should...

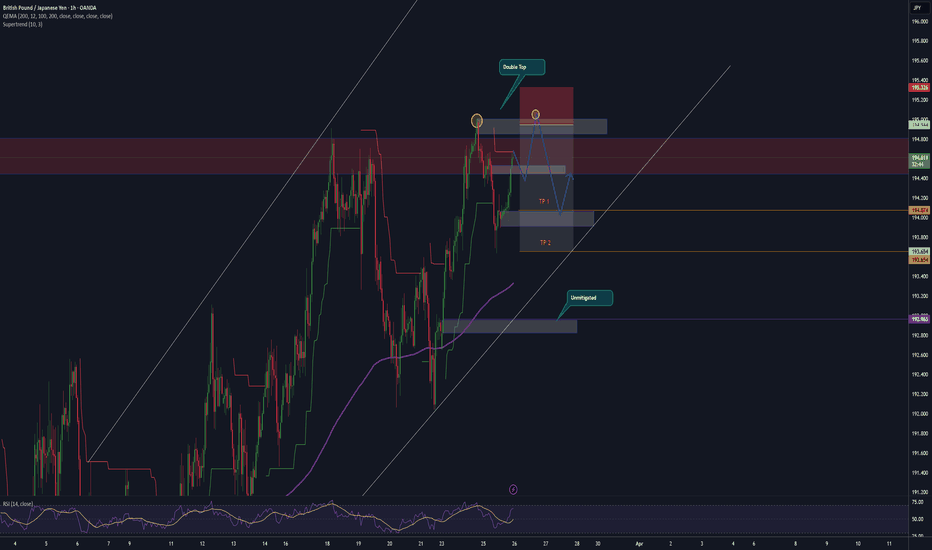

I'm looking to Short GJ as it retested and rejected off trendline break on 1hr and 4hr time frames. Additionally, its refused to close above the 200 ema on lower timeframes and didn't break above the previous HH on the 15-minute time frame, indicating selling pressure later on.

Conservative Entry Set Up: 1. Mitigate Swing Low 2. Sweep Liquidity just below swing low 3. Break of Structure/Market Shift 4. Short pull back to 1/5/15min D.Z. for conservative entry See Friday's Aggressive entry set up on chart.

Looks Bullish on the high-time frames. Worth it to take a buy at the trendline. Momentum is also slowing down, which is good as it approaches the trendline to hopefully reverse. For safety, you can move your stop-loss to B/E once the price hits around 194.792 in case it respects the descending squeeze and wants to break the trendline next week.

Currently running the 15 min Risk entry due to BOS and rejection/retesting of 200 EMA and double bottom off key area. Risk low with this one in case the market turns. Also included are entries I would have preferred, which are better entries. If it breaks below the unmitigated OB I will be looking to go short.

The pair has been respecting double tops and double bottoms very well. Liquidity needs to be swept before the market can push higher but understand it may be ready to mitigate price below if the market breaks the channel. Bullish on higher timeframes. AS always, bear in mind your entries and exits and be patient. Risk management.

Short-term sell to unmitigated order blocks before pushing higher. There is a Ton of liquidity below. Bullish on Higher Time frames so be cautious or wait for the but entry.

Respected double bottom off trendline. Needs to sweep liquidity and mitigate order block to push and break previous supply zone.

Double Top completed. Downward correction move to about 192.077 if Double Bottom is respected. If further pushed, TP2 is around 191.176 to the start of the move. Prediction is bullish on higher timeframe at TP2 zone.