CanIGetARoar

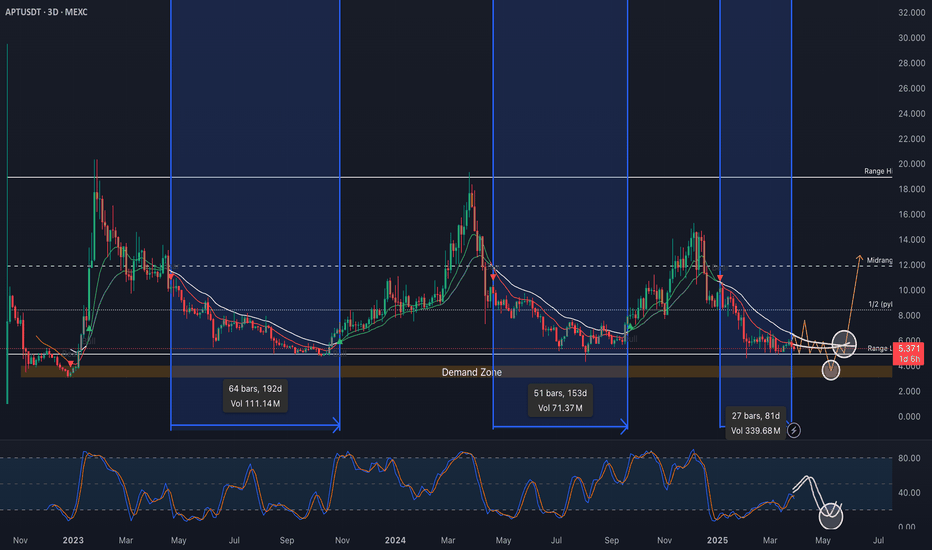

Essential3D Timeframe Update: APTUSDT – Structural and Trend Analysis March 27, 2025 This update focuses on the structural and trending environments of APTUSDT on the 3D timeframe, laying the foundation for deeper correlations (volatility, volume, momentum) as the bottoming process evolves. The goal is to provide a clear, actionable framework while maintaining a...

Buyers need to show up fast, or Sonic is sliding straight into the next liquidity zone. While the bands are tightening and price is hovering below them, momentum is fading. Stoch and Stoch RSI suggest a short-term bounce is possible, but RSI dipping below 50 signals weakening strength. Bulls either step in here, or this breaks down further and I'm eager to add...

BTC still holding above the new midrange, but price action looks heavy. Selling pressure remains strong, and inflows into exchanges are rising — whether that’s for spot selling or using BTC as margin for coin futures remains to be seen. For now, anything below the midrange is a short zone for me. A lower high before further downside wouldn't surprise me, but as I...

If this entire range is a distribution phase, then a push into 125k before a proper correction in Q2/Q3 would fit my expectations. That move would trap breakout buyers before a deeper retrace unfolds. Very important also, BTC hasn’t closed below 93K on a weekly yet, so there’s still a case for strength if we hold the December lows as support.

This chart highlights a key observation: SOL has spent multiple days testing the $260 resistance level without successfully breaking above it. This prolonged stagnation at a critical resistance level is typically a bearish signal, as it suggests an exhaustion of buying momentum. Plus, we are trading below Nov high. Key Points: Repeated Resistance Rejections: The...

lmao, 30 min timeframe, short term perspective for a scalp. will update if i don't forhet

Because everyone is talking about SOL at $500 and dissing ETH, for the past weeks, I’ve been steadily accumulating spot positions below the $3,200 level, confident that ETH will soon break out of its lackluster performance this bull run and deliver the explosive move it owes us. Buying into the bearish CT sentiment regarding ETH has been a good strategy so...

The BTC chart is in a phase where clarity is elusive, and predicting the next move with confidence feels like guessing between an accumulation or a distribution phase. On one side, some see a Wyckoff pattern corroborated with volume at the highs - signaling a potential top, while others are already drawing lines aiming for 200k. The market is filled with noise and...

Solana has proven itself to be one of the strongest performers this bull market, maintaining a continuous "bull signal" (12 EMA fast / 25 EMA slow) since October 2023, when it was trading around $20. Remarkably, the EMAs have not had a bearish cross since then on weekly timeframe, signaling persistent strength. Current Outlook: The price is currently trading well...

BTC Long Trigger Update () If you took the long from the demand zone highlighted in the previous posts (), this 100k level serves as an ideal first take profit and looking for a re entry lower. Entry Setup: I am currently focusing on a potential entry between 95k–96.5k, setting a tight stop-loss at 94.2k to manage risk effectively. If the price dips below this...

The recent price action has played out beautifully, taking out last week’s low and last month’s low, only to reclaim firmly the yearly open () & (). Today's update illustrates the ranges I’ve added for better clarity on the current structure, but the original ideas are still in play Monday’s Range (pdL - pdH): This defines our local range, providing immediate...

Update of 9 Jan Post: Demand Zone Interaction: Price briefly dipped into the demand zone, validating our structural expectations ✔ Current Structure: Consolidation above the yO has maintained the bullish framework. Near-Term Outlook: A breakout above the 4H 200EMA ($96k) could drive a test of the local supply zone. However, a rejection from the psychological...

3D Chart Analysis of FTM/USDT Overall Market Context Support Box (Highlighted Zone): This demand zone is anchored at the 0.786 Fibonacci retracement ($0.45), drawn from the mid-October swing low. It also aligns with the higher range of the May 2022 - Feb 2024 consolidation, serving historically as a pivotal zone for support during accumulation, resistance...

The SOL/USDT 30-minute chart shows price consolidating around $219, after a breakout from a previous accumulation zone near $211.52 ("March highs"). A potential pullback to the Fibonacci 0.618–0.786 retracement levels ($215.50–$217) could provide a strong buy zone before a bullish continuation to higher resistance levels near $230. Volume analysis suggests strong...

Short-Term Bullishness driven by the 12h Stochastic Indicator The Stoch crossover below 20 indicates short-term bullish momentum is building. This typically suggests a relief rally or bounce. Price could rally toward $95–96k, with potential extensions to $99k (the supply zone) if the momentum sustains. 12H 200 EMA and Yearly Open Retest: The 200 EMA aligns...

Supply Zone Rejection: As expected, price has rejected from a visible Supply Zone (100k - 101.5k) The rejection aligns with liquidity collection at resistance, indicating potential distribution at higher levels. Demand Zone Bounce: Below lies a clearly marked Demand Zone (~$92,000–$88,000), where buyers are expected to step in. A projected liquidity sweep...

Price is sitting just above the Point of Control (POC) within the highlighted Dynamic Liquidity Zone. VAL (The Value Area Low) of this zone is marked around $0.6530, which aligns with a potential key buy zone, being our first midrange high. RSI is trending bearish but nearing oversold levels, suggesting that a liquidity sweep into the $0.65–$0.70 zone could...

EMA Levels: EMA 50 ($205.83): This is the immediate support level. Price is extended above it and this EMA will likely act as a bounce zone during any short term pullback. EMA 12 & 25 Confluence ($210.97): Hidden but implied by the "Bullish" signal. This range overlaps with the EMA 50, creating a confluence zone around $205–$211, which is a high-probability entry...