ChartMage

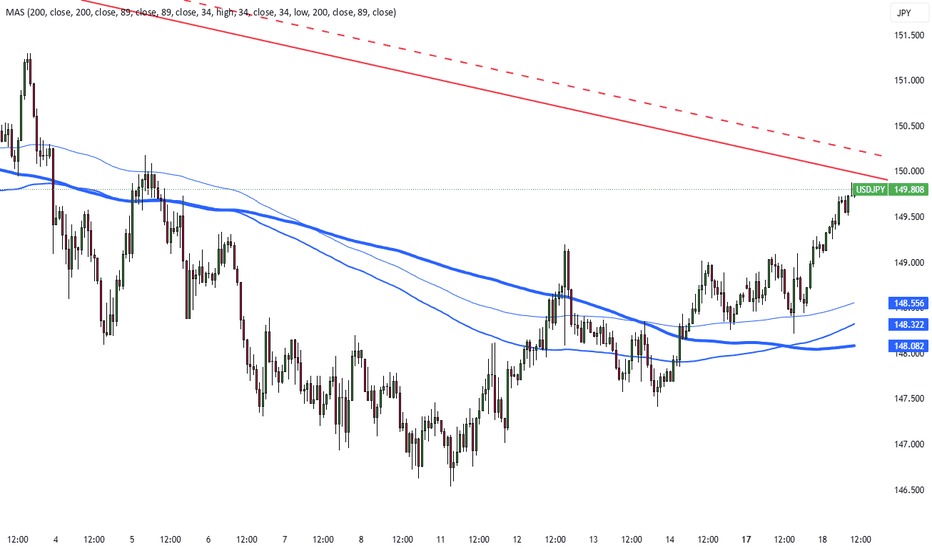

EssentialThe yen fell to around 149 per dollar on Friday, ending a two-day rally, after Japan’s core inflation eased to 3% in February from 3.2% in January, still above expectations of 2.9%. This marked the second month of stronger inflation, reinforcing the case for future rate hikes. Earlier, the BoJ held rates at 0.5% and maintained a cautious stance, citing global...

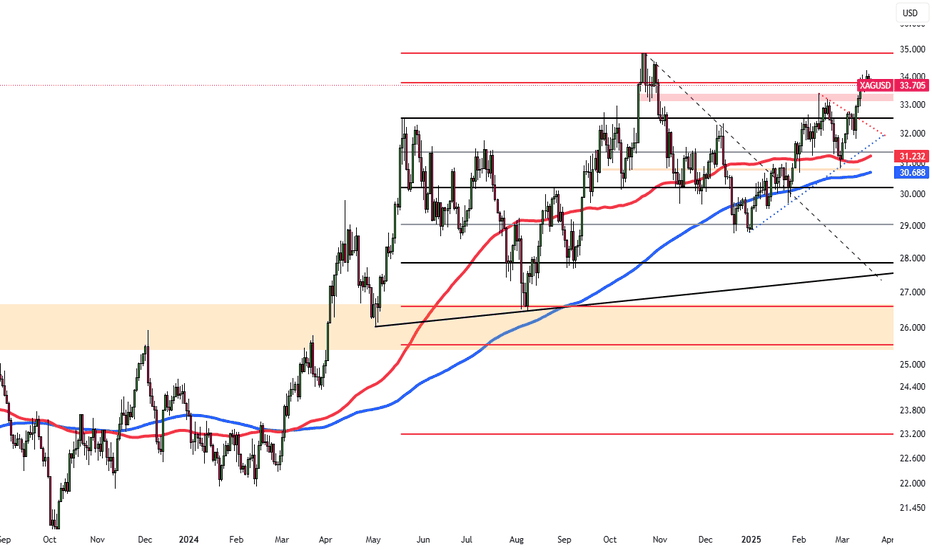

Silver hovered near $33.60 after the Fed held rates at 4.25%-4.5%, signaling 50 bps cuts by 2025. Despite trade-war fears and Trump’s policies, silver remains near a five-month high. Lease rates surged as stockpiles shrank, especially in London, with silver flowing to the US for higher prices, widening market price gaps. Spot silver is up 17% this year,...

Gold hovered near a record $3,050, supported by Fed rate cut expectations and safe-haven demand. The Fed reaffirmed plans for 50 bps cuts this year amid rising economic uncertainty, driving gold. Middle East tensions escalated as Israel resumed ground operations in Gaza after an airstrike ended a two-month ceasefire. The US continued strikes on Houthi targets,...

GBP/USD held near 1.3000 as sentiment stayed upbeat after the Fed reaffirmed 2025 rate cuts, though delayed. Markets still expect a 25 bps cut in June, with Powell highlighting strong US growth and a healthy labor market. The Fed lowered its 2025 GDP forecast to 1.7% from 2.1% and acknowledged trade policy risks but sees inflationary effects as...

EUR/USD fell for a second day, nearing 1.0900 in the Asian session. The pair found support as the dollar weakened on falling Treasury yields after the Fed reaffirmed plans for two rate cuts. However, uncertainty over Trump’s tariff policies kept sentiment cautious. In Europe, German lawmakers approved a debt plan by likely Chancellor Friedrich Merz to increase...

The yen strengthened past 148.5 per dollar, rising for a second session as the dollar weakened after the Fed reaffirmed two rate cuts this year. Fed Chair Powell downplayed Trump’s tariffs as short-lived. The BoJ kept rates at 0.5% on Wednesday, adopting a cautious stance amid global risks, especially US tariffs. It also emphasized monitoring forex markets and...

Silver surged to $33.90, its highest since October 2024, driven by a weaker dollar, geopolitical tensions, and strong industrial demand. Recession fears and trade disputes have supported safe-haven buying, with Trump planning new tariffs on China, steel, and aluminum starting April 2. Middle East tensions added support, as Netanyahu confirmed intensified military...

Gold surged past $3,000, hitting a record high as safe-haven demand grew ahead of the Fed's rate decision. While rates are expected to remain unchanged, investors await economic projections and Powell’s remarks for policy clues amid trade tensions. Market jitters also rose after Trump warned Iran over Houthi rebel attacks and planned talks with Putin on ending the...

The pound traded at $1.294, near a four-month low, as investors awaited the BoE's Thursday decision. The central bank is expected to hold rates at 4.5%, balancing weak growth and inflation risks. Despite forecasts for 2025 rate cuts, none are expected now. The UK labor market is weakening, with unemployment set to hit 4.5% and wage growth slowing. Markets also...

EUR/USD is slightly down, hovering near 1.0915 in early Asian trading. The Euro faces pressure from rising U.S.-EU trade tensions after Trump announced new tariffs on European goods. Washington imposed duties on steel and aluminum, prompting Brussels to prepare countermeasures, while Trump threatened a 200% tariff on European wine and spirits, adding downside...

The yen fell past 149.5 per dollar, a two-week low, ahead of the BoJ's policy decision. The central bank is expected to hold rates at 0.5% on Wednesday while assessing U.S. policy impacts. Despite a pause, rate hikes are anticipated later this year as rising wages and inflation support policy normalization. Major firms agreed to wage hikes for the third straight...

Silver surged toward $33.90 an ounce, its highest since late October with ongoing trade tensions and rising Fed rate cut expectations after weak U.S. inflation data. Trump threatened 200% tariffs on European wines in response to the EU’s 50% tariff on U.S. whiskey, further heightening market uncertainty. U.S. producer prices remained flat in February in the...

Gold surged above $2,980 per ounce, hitting a record and heading for a 2% weekly gain as risk aversion and Fed rate cut expectations grew. Trump escalated trade tensions, threatening a 200% tariff on European wines after the EU's 50% tax on U.S. whiskey. February's PPI and CPI data showed easing inflation, increasing Fed flexibility for rate cuts, and raising...

The British pound fell to $1.29 after UK GDP unexpectedly shrank by 0.1% in January, missing forecasts of 0.1% growth, mainly due to weakness in the production sector. The Bank of England recently cut its Q1 growth forecast to 0.1% from 0.4%, with rates expected to stay at 4.5% in next week’s policy decision. Markets also await Chancellor Rachel Reeves' fiscal...

The euro climbed toward $1.09, nearing its highest since early November, as Germany agreed on debt reform and increased spending. Chancellor-elect Friedrich Merz secured a deal with the Green and Social Democrat parties ahead of next week’s parliamentary vote. Markets await Fitch’s rating decision on France, which is due after Friday’s close. Meanwhile, trade...

The Japanese yen traded around 148.6 per dollar on Monday, near a five-month high, as expectations for BOJ rate hikes remained strong. However, the central bank is expected to keep its policy unchanged in this week’s meeting. Major Japanese firms approved wage hikes for the third year, boosting consumer spending and inflation, and potentially allowing future rate...

Silver edged lower to approximately $33.80 during early Asian trading on Friday, losing momentum. However, the downside may remain limited, as softer U.S. consumer and producer inflation data could provide room for the Federal Reserve to consider an interest rate cut in June, offering some support for the metal. Additionally, concerns over U.S. President Donald...

Gold surged above $2,980 per ounce on Friday, hitting a record high and poised for a 2% weekly gain amid risk aversion and rising Fed rate cut expectations. Trump escalated trade tensions, threatening a 200% tariff on European wines after the EU imposed a 50% tax on U.S. whiskey. February's PPI and CPI data signaled easing inflation, increasing Fed flexibility for...