ChrisCryptoBear

Trump DeFi Force (TDF) has issued your orders. You have 1 year to comply. All your technical analysis are belong to us. #PulseChain

Ooohhh, maybe one day $ADA or $ETH will be a completed product. Have fun waiting years and years and yearsyears and years and yearsyears and years and yearsyears and years and yearsyears and years and yearsyears and years and yearsyears and years and years

I'm not short but i'm definitely not touching this. Most of the tokens #altcoins look really sad. Gains have already been made. Prepare for bear market. The only thing worth being in besides maybe a stable coin is a $HEX stake! #HEX

Making this chart to look at 2 years later and see how it played out. Will the Hexicans be the last to laugh? 15 years

Do you think a 15 year stake from today will see a HEX price of 100,000 satoshi's? Valuation of HEX is mostly USDC on Uniswap, soon to be forked into PulseX

Expecting volitle ranging in the 19-30cent range and stake accumulation for long term, 5555, quandro cinco. Next candl-lighting at $1.00 PLS PulseChain launch will bring attention to the great tech of HEX.

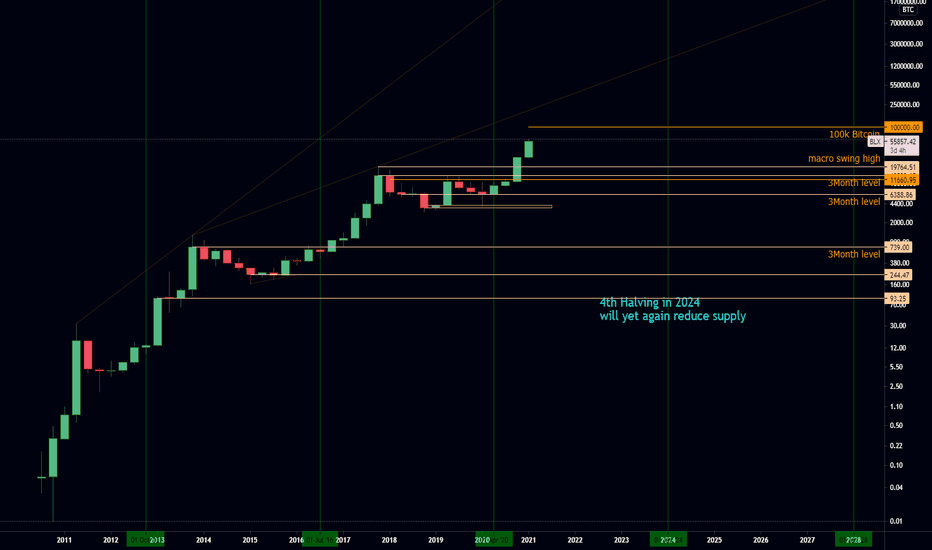

Technically speaking, and this is technical analysis, It would still be bullish to pull back high timeframe and trade in lower ranges before continueing the the great 100k. Probably a great idea, nfa, to have cash on teh sidelinez.

Not being impatient, waiting for Bitcoin to scare out weakhands a bit more before bullish volatility comes back. Long spot, no leverage.

when looking for a risk defined top and SFP opp.

Still going to use this until it doesn't work anymore

apparently central bank printing is good for #Bitcoin ?

Chart pretty much says it all. Built a strong position already, but still holding out for another dip even though that's probably not gonna happen.

Even if these exponential moving averages act as support, it could still break through hard in a couple weeks after some more consolidation. Bulls need to prove they are in control or the trend will continue to break further down. Target 6k's if Ribbon breaks.

Take notice how correlated the lending rate is to the rate of fiat dollars printed. All that money was printed at 0% interest. Now, rates are going up and the printing presses are cooling down.

September 2008 - The Fed started printing fiat in overdrive soon before the bank bailout of early 2009. Bitcoin's first block was also mined at the news of this in January 3-9th 2009. However monetary base has been in decline, retracing. What does this mean for the derivatives market and the Repos?