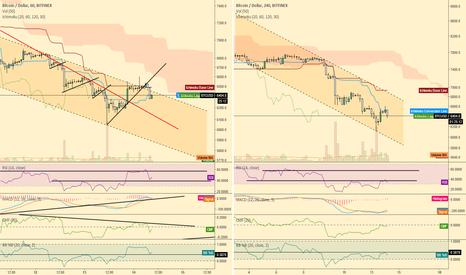

This daily chart shows us the real work that needs to be done on the larger time frame. As a reminder, we have two large patterns covering the past four months of price action -- 1) the triangle in red, which if valid then shows we fell bearishly through the bottom but a reversal and subsequent breach of the descending red resistance line would validate a...

Good morning, traders. As we discussed during the live stream last night, Bitcoin's price continued to rise as it targeted the ~$6500 area where it is now finding resistance. This has pulled daily RSI out of oversold territory at times, but currently sees it sitting on the cusp. I am still not convinced of the power of this upward movement yet. I want to see the...

Good morning, traders. The despair is growing as price hovers around $6400 which tells me we are near time for a reversal, if only for a few thousand dollars at this time. The daily RSI is oversold which usually indicates a reversal. BTCUSD shorts are still very high within an ascending braodening wedge, which is bearish (bearish for shorts is bullish for price)....

As mentioned, the BTCUSD Shorts continue to build ridiculously. We can see the pattern playing out as the previous two times we have had the same indicators at the same point -- the build up, the small drop, then the large drop. All three times have created ascending broadening wedges before falling out of them. The upper is the daily chart while the lower is the...

The daily chart shows the same thing as the 4 hour chart, as well as the potential path out of this consolidation that I've been mentioning for a few weeks now. If price does happen to follow the same pattern then, as the fibs show, we should see it top out at just above the 61.8% level which, again, pits it against the descending resistance line. The question...

The 4 hour chart shows what I have been watching for a while now -- potential repetition of the March downward movement. We have talked about it before but decided it wasn't happening when the previous consolidation did not create the triangle and price didn't continue up. However, taking a look once more suggests that maybe I was a bit hurried in finding that...

Good morning, traders. Bitcoin price held up throughout the night but this morning has seen it drop right back into the support zone it was hovering above. As mentioned on yesterday's live stream, there are currently three possibilities for a bounce -- a push up from this support, a short squeeze, and a potential oversold daily. The latter, I believe, may require...

BTCUSD Shorts are about to enter overbought territory in RSI and %B, as mentioned above. The arrows show us that when it happens in tandem a strong short squeeze usually results. This short squeeze could be just a few days away, especially since price did not print oversold RSI on the daily chart nor bullish divergence. One more move down may be in the works this...

Weekly OBV is showing slight bullish divergence between the weeks of May 21st and June 4th. On Balance Volume (OBV) gives us an idea of what's going on with the "smart money" -- the theory is that volume precedes price and, if so, then an increase in volume as we are beginning to show would suggest that smart money is entering the market and, as a result, price...

The daily RSI is sitting on the cusp of oversold at 30.3362 and %B has not been this far oversold since the September 2018 correction. MACD is currently printing a potential bullish divergence on its negative histogram. Price appreciation would solidy a reversal. I am watching the noted descending resistance lines in RSI and %B to gauge buyside momentum. We need...

Tradingview is erroring out when I attempt to publish the 1 hour chart, so here's the description followed by the 4 hour chart description as well: Good morning, traders. Bitcoin had a heck of a weekend and showed us exactly why we wait for confirmations and never trade based solely on our opinions, and that the weekends have low liquidity and therefore require...

The BTCUSD shorts are doing exactly what I said was likely to happen last night -- liquidating due to being so significantly overbought. One of the most significant things I notice on this daily chart is that the MACD high on April 11th is significantly higher than price's current high, however shorts are significantly lower and, while RSI is not as low as MACD,...

When it comes to the daily time frame, the ascending triangle in MACD remains compelling, as it began in January while prices were falling. Since then we've seen higher lows consolidating toward that resistance area. Because MACD is a momentum oscillator, and it is showing us that bullish momentum has been building for the past 5 months toward a resistance point,...

The 8 hour chart shows us much of the same as the 4 hour chart with the addition that the BB is squeezing as it trends upward. This would tend to signal a bullish squeeze on the horizon. With the weekend upon us, liquidity is drying up, and shorts are growing, so it wouldn't take much to give price the pop it needs to ignite stronger bullish momentum. Price...

The 4 hour chart shows us that price has remained within the ascending yellow channel. Price has also managed to remain on the topside of the large descending grey channel. Remember, the horizontal orange channel denotes where most of the price action has occured for the past two weeks and slightly smaller horizontal blue channel shows the same (but for just over...

Good Friday morning, traders. Bitcoin has fallen from the potential double top on the short go, but remains within the ascending triangle. For those paying attention during last night's short downward movement, the %B indicator again told traders when to get ready for the bounce. Nothing that happened over night should be a surprise for anyone who tuned into our...

The daily chart continue to look decent, but we would like to see less of a wick at the top of the candle. A close above the close of $7718 on June 3 would be bullish, however price really needs to see a close above that same day's high of $7779 to ignite continued bullish passion from the crowd. I have adjusted the pitchfork slightly to better accommodate price...

A look at the 8 hour chart shows much of the same once more. Price remains above the moving average of the Bollinger Bands and continues toward the top band. That upper band is also nearing the Kijun line, which as we mentioned before, is likely to provide resistance at around $7840. The Bollinger Bands are squeezing tighter as price continues upward within the...