The technical analysis points to a neutral to slightly bullish outlook for EUR/JPY over the next few days. The pair is expected to either:Continue trading within its current range of 162.00–168.00, orMake a modest upward move, potentially testing the resistance at 168.00.

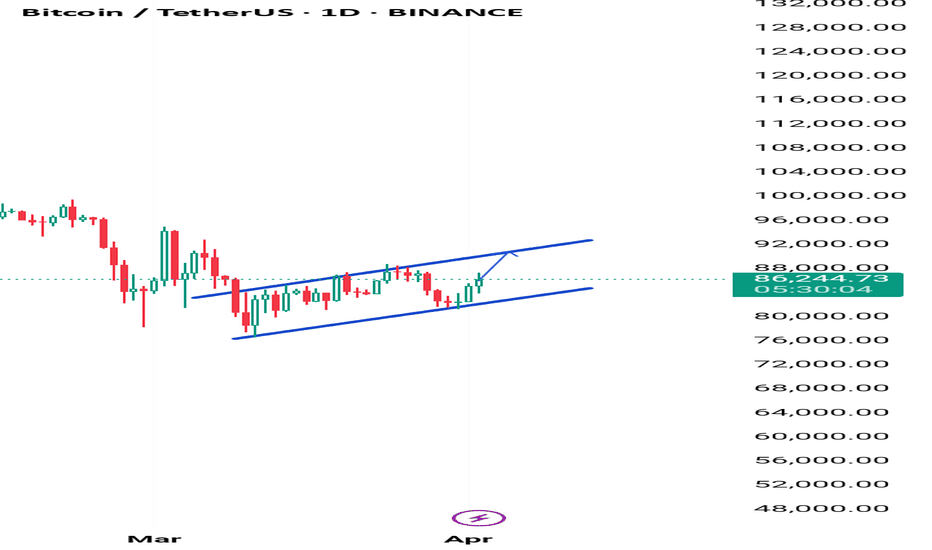

Given the technical and market factors, Bitcoin is poised for an upward move in the next few days, potentially reaching between $85,000 and $90,000. However, keep an eye on the key levels mentioned, as any loss of momentum could shift the trend.

the technical analysis suggests a neutral to slightly bearish outlook for NZD/USD over the next few weeks. The pair is likely to either continue trading within its current range of 0.5660–0.5760 or experience a modest decline, driven by its position below key moving averages and pressure from a stronger US dollar. Traders should monitor the support at 0.5660 and...

technical analysis points to an upward direction for silver prices over the next few weeks, with potential targets between $35.00 and $36.00. The rising trend channel, breakout above resistance, supportive moving averages, balanced RSI, strong volume, and favorable market conditions all align to suggest continued gains.

Given that forex prices often reflect all known information, the technical bearish trend appears to outweigh the mixed fundamental signals and unclear sentiment in the short term. Absent major news or data releases in the next few days (which are unknown here), the recent momentum suggests USD/CAD will continue its downward trajectory from its current range...

Bitcoin is likely to face short-term downward pressure in the next few days, primarily due to bearish technical signals and mixed sentiment. The price may test lower levels, such as around $71,000, as indicated by technical resistance. However, fundamental factors like the recent halving and potential interest rate cuts could provide underlying support, possibly...

Both the USD and CHF are safe-haven currencies, but their behavior depends on global conditions. If uncertainties (e.g., trade issues or economic slowdowns) rise, demand for the CHF could increase, lowering the pair. On the flip side, strong U.S. economic data could lift the USD and the pair For now let's wait for data to be released

Based on today's data from ForexFactory for the USD, the USD/CHF pair is likely to experience a short-term upward movement in the days ahead. Here's why: Flash Manufacturing PMI: Reported at 52.5, slightly above the forecast of 52.3, indicating stronger-than-expected manufacturing activity. Flash Services PMI: Came in at 55.3, exceeding the expected 54.8, showing...

The latest COT data reveals a net long position among speculative traders for the British Pound, indicating bullish sentiment. Concurrently, technical analyses from multiple reputable sources suggest a buying opportunity for GBP/NZD. Therefore, based on the current data, the direction for GBP/NZD in the days ahead appears to be upward to the resistance TL

The news from Forex Factory today, assuming positive US economic data and negative Swiss data, strengthens the USD relative to the CHF, pushing the USD/CHF pair higher. Combined with a technical breakout and favorable sentiment, the pair’s direction for the days ahead is likely upward

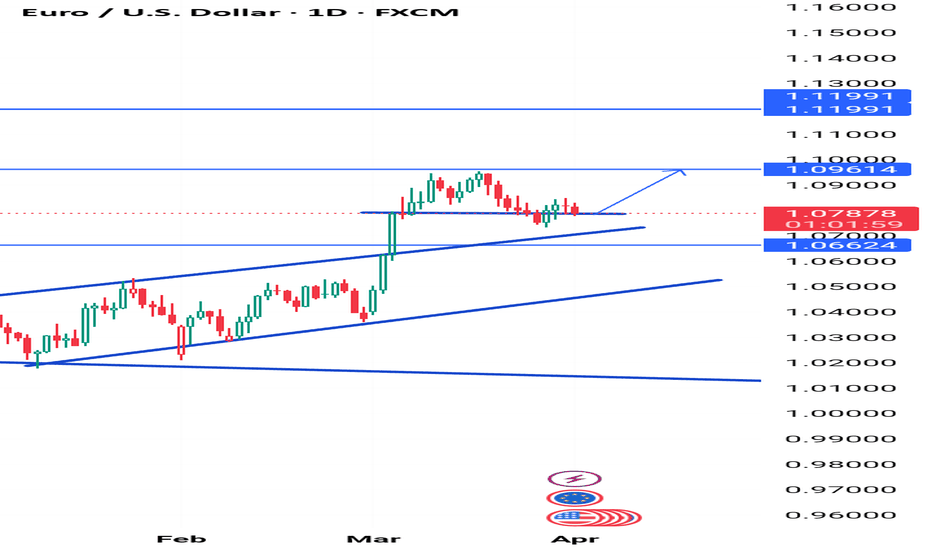

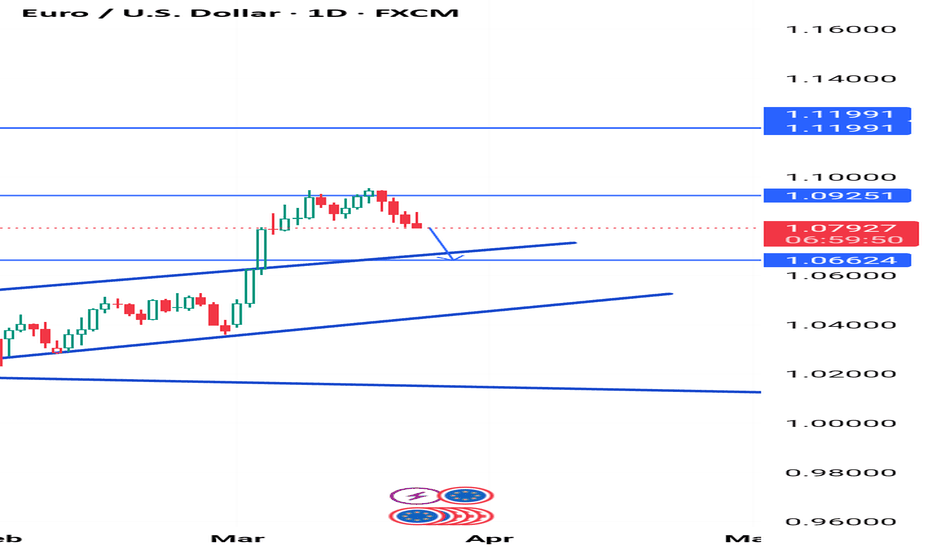

For the days ahead, starting March 24, 2025, the direction of EUR/USD is likely to be downward. The fundamental drivers—monetary policy divergence—provide a robust case for continued USD strength and Euro weakness. The COT report’s indication of increased net-short positions by commercial traders supports this bearish trend. While the reduction in large...

Based on today's fundamental news from Forex Factory, the euro appears to be showing modestly positive fundamentals. In other words, the latest economic releases and sentiment for the EUR are supporting a slight bullish bias. When you combine this with the technical picture for EUR/USD (which is pulling back but still sitting above key moving averages), it...

Every detail on direction on previous post In summary, while the net-short positioning by speculators reinforces a cautious or bearish view on EUR in the short term, the gradual reduction in their short exposure may also be viewed as a subtle signal of potential stabilization or even a contrarian setup if market sentiment were to shift.