chart shows it all...expect more volatility this month, likely a retest of 61.8 fib level at 15k & 78.6 fib levels (based on lows from 2023) near 13k before we finally run to the highs again into 2026! tariffs have similar impact as rate hikes...overall will be digested by markets just fine & we'll head back to the highs as fed sees more freedom to cut given...

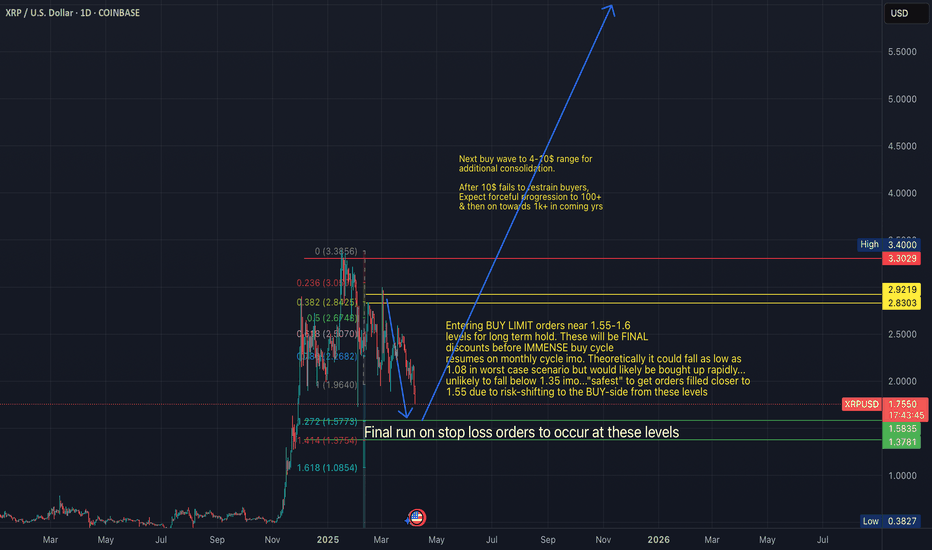

As indicated in prior posts, XRP is now approaching the liquidity target levels at 1.55-1.60 levels as part of a final liquidity run. Possibility exists for extended sell wave as low as 1.06 (worst case scenario imo) but most likely scenario is that 1.35-1.55 will be the zone in which the final low on the consolidation structure is formed. The next move is...

NQ futures aiming at 18900 level off these last highs. Now seeing developing weakness... expecting sellers to take it down for one more low as we approach the implementation of Trump's tariffs on 4/2. Look for renewed buyer strength after the next set of lows as we approach the next FOMC rate decision into first half of May 2025. This is a great swing trade...

looking for additional sell sequences to fill gap targets at 33.7 and 31.5 levels as we approach tariffs being implemented on 4/2/25. holding put options for 4/17 expiration

Make note of the following liquidity targets this wk Buy-side near term tp @ 21110-21160 (selling from there) Sell-side tp @ 20378 (scaling into long buy positions from there)

Final liquidity run rapidly approaching as we come off news of strategic reserve! Ensure LIMIT buy orders are placed at .50 area or just below to ensure they get filled. Just below the last big wick on daily/4hr tf. This news will be manipulated once again to trap over-leveraged bulls & then bears imo. Perfect opportunity to enter cheap once again & then ride...

As indicated in prior post (see: ) we have now reached the near term liquidity target at 2.8-2.9 zone; this news of a strategic reserve is highly likely to be sold off to trap both bulls & bears who are over-leveraged. They rarely waste a good PR for such price action. Expecting one more liquidity sweep below 1.70 for a final discount buy opportunity!! Looking...

looking for next buy wave to take price to 13.4-13.6 levels. strong buy rates, increasing buying pressure among tech stocks & indices amidst volatility. buyers returning & ready to take us higher once more. holding long equity & call option positions.

Expecting to see sellers resume control at 135-136 levels near term, to take price back to 118-120$ gap fill target for liquidity purposes. After that, looking for price advancement to 158-165 buy-side target levels for final high on weekly buy cycle.

Wonderful opportunity to extract profits from the markets on current Nasdaq futures setup. Pay close attention to those buy-side & sell-side liquidity zones relative to the doji candle established on the 15min tf. Expect that range to be tested once again into London/NY sessions. Sell-side liquidity target expected to be reached at 21075-21090 levels,...

Be prepared for strong sell sequence back down to 149$ handle as Yen resumes strengthening cycle. SL placed at 155

My time-wave cycles analysis (among other components) indicating we will have a final sell wave to 1.45-1.7 zone over coming days (before FOMC meeting in March imo). Granted I was a little off on exact timing to reach the buy-side targets back in December but nonetheless accurate on projected price levels..See prior analysis at attached link for the projected...

Buying now at discount levels near structural support. Expecting bullish thesis to be solidified once we recover above 1.9-2.2 levels. Expecting fairly rapid progression to gap fill targets by 2026. Strongly likely we see 6$ before summer 2025 & 10-12$ levels by end of yr Planning to scale out of buy positions primarily at 10-12$ range. Will leave remainder...

Solid base built over last several weeks. Consolidation now complete. Ready to run to 12.8$ target likely into March timeframe given today’s breakout above 6.20 Will likely consolidate a bit more after 12.8 is reached, before continuation to 20-22$ buy-side targets later in 2025. Great longer term swing trade from here!

Looking for current buy sequence to reach 0.85-0.92 by early March timeframe. To be followed by one final sell wave as low as .45 area before continuation back to the highs. Next buy-side targets will be TP1 @ 3.00 TP2 @ 7.00

Expecting quick progression to 118$ level as final buy-side wave near term. Looking for renewed significant selling action from that level to retrace price back to pre-earnings levels near 80-85$ Possibility exists (imho) that we fully retrace back to 63-64$ levels by April timeframe, depending on sentiment as we head into next FOMC meeting in...

APLD has reached within the 61.8 & 78.6 fibonacci retracement levels of current buy structure on 4 hr cycle. Based upon the strong buy rates & recent bullish activity, as well as the buy rates building on Nasdaq index, I see this retracement as a perfect discount for a long call options trade setup for 30 DTE contracts. Long equity positions are being held...

Strong buy rates indicating we have another solid bounce approaching into end of Jan 2025/ next FOMC meeting, to take price to 302$ target level. Great setup for a long call options trade for 30-45 DTE duration. Expecting additional volatility after peaking above 300 so will look for discounts once again before seeking entry on calls for Sept. Weekly and monthly...