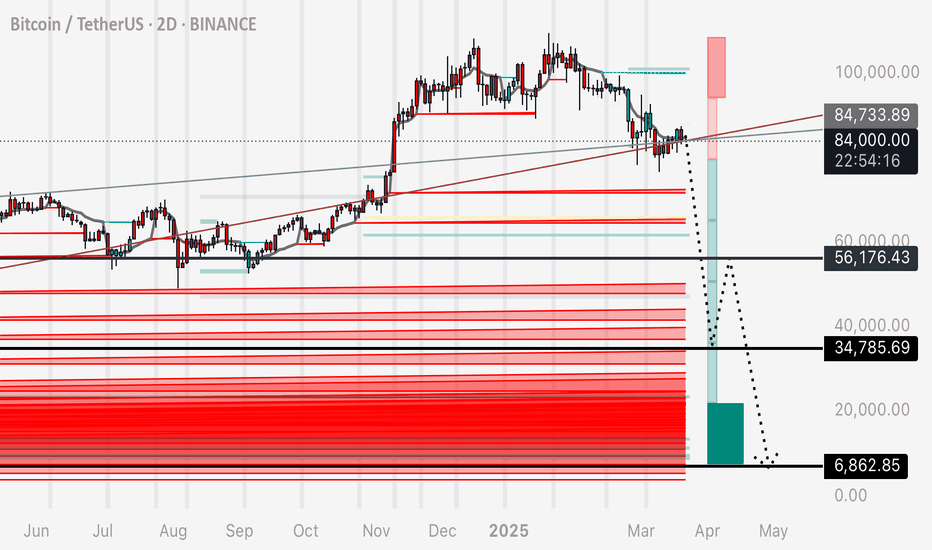

As a part II to my previous post on “Bull Market OR Bearish Retest?” - Here is a 2 day liquidity map on BTC’s chart. I’m anticipating a sharp drop to 7,000 - why is this number significant? There is a mass amount of liquidity in the chart down towards 7,000-10,000. This liquidity is in the form of long stop loss orders. In layman’s terms - the sell orders...

Bitcoins excessive rise for the previous two years brings concern for the mechanics of this market. Moving only up for so long leaves much liquidity in the form of long position stop losses below the current price. These stop loss orders, or leveraged sell orders, are an explosive chain reaction ready to set off. Observe these two trendlines and copy them to...

Bitcoin is back underneath these two intersecting bearish trendlines. I have laid out two potential paths Bitcoin could take to play this out. When an asset in crypto goes only up for so long, it leaves behind a trail of leveraged liquidity in the form of stop losses. These wide open gaps filled with long stop losses, is the fuel that would make such a move...

Further to my previous recent post, I wanted to highlight two indicators that accurately present us with liquidity on the BTC chart. Connecting the pieces of the puzzle of this prediction - this ABC correction pattern allows the market to absorb the Long position liquidity left in tact on the chart. Since these long positions leave a trail of leveraged sell...

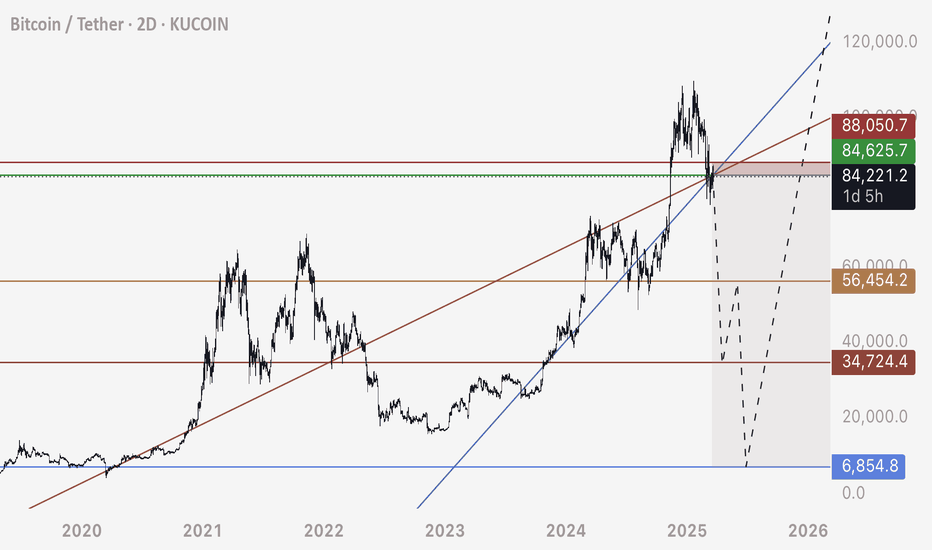

I encourage you guys to draw these trendlines on your chart and experiment by doing some exercises. 1. Draw the main two trendlines. 2. Spend time on each by duplicating it, keeping the angle the same, and moving it to different spots on the chart. Notice how Bitcoin works on this ascending diagonal support resistance structure. You’ll find that the correct...

The FOMC data this week could be a conduit that sticks the price to play down these two trend lines. We can see the mass liquidity on the chart in these low zones. Bitcoins consistent rise since late 2022 has been leaving a train of long stop loss orders (leveraged sell orders) underneath - think of the mechanics of “why it’s possible” as a massive chain...

Bitcoin is back underneath these trendlines. Showing confluence with liquidity in the chart on higher time frames. Be mindful of this correction pattern.

Expanding on my last idea focusing on the first move in this sequence, here is a bigger picture of this idea and I will explain in detail how I arrive to this. 1. The market is always going to absorb liquidity. We know this. We also know that since Dec 2022 Bitcoin has been on a steady climb up allowing for lots of long positions to open and stay open. What...

I’ve drawn the main trendline and marked the contact points in red circles if you’d like to replicate this on your own chart I’ve also demonstrated that when the correct trendline is identified, it can be duplicated and placed at different points on the chart that price seems to follow - IE support / resistance works on a diagonal grid I’ve marked my personal...

It’s of my opinion that Bitcoin has a lot of interest in recollecting this long position liquidity. Per my previous posts we have some trendlines to support these zones being hit. Likely? Who am I to have an opinion on that. The facts are that there is a mass amount of liquidity here and technical analysis patterns that support price reaching those zones....

Sure it’s just two lines but they are lines that are repeatable and respected very well. Bitcoin dropping to these lows makes sense, the market wants it to happen, Entry is perfect currently at 104,000

Perfect entry for a short on this BTC trade. Not financial advice. This is what I am trading per this bearish trendline pre-Trump week. You won’t be disappointed

In this video I detail out why I believe we will see a significant crash on Bitcoin, dig into the mechanics of how a drop to $10,000 is possible, talk about the US Dollar and macro ideas for Bitcoin, and summarize my trading ideas and why I am anticipating its a good trading opportunity. Any questions or comments, please feel free to ask or leave your own input....

Short Bitcoin per trendline: Entry - 60,200 to 60,500 Stop Loss - 61,200 Targets: 1) 46,000 2) 39,500 3) 35,000 Clear trendline breakdown with respected areas circled in red! When in doubt zoom out! Happy trading

Bitcoin is still respecting and not breaking this resistance line marked in RED. Unless we break above 62,000 - I consider this upwards momentum to be a bearish retest and bull trap scenario. It’s possible that we see a flash crash and tap that level around 35,000

I anticipate Bitcoin to drop a correction sequence - 34,500 level as a first low From here, we should watch for a major resistance to hold around 43,000 - this indicates a further drop to the 10,000 level If Bitcoin drops at speed we know why - DXY is seeing a major breakdown and bearish retest. This indicates an extended 1-2 year bull market - prior to which...

This is the same chart I’ve been presenting for a few months now. Bitcoin has been showing interest in correlating with DXY’s major breakdown to sweep these Uber low zones. So long as we are respecting these trendlines, I’m convinced that Bitcoin will form a pattern approximate to these levels: 58,700 to 34,500 34,500 retrace up to 42,000 to 45,000 Rejection...

Bitcoin is currently at an ideal entry for a high R/R short based on the trendline shown - targeting 34,200 to 35,000. From that level, I will look for a retrace up to 43-46k. Rejection at this zone can indicate a much more substantial drop to sub 20,000 zones. All details on the chart - will update with a new idea if Bitcoin follows through on this expected drop.