Price closed below the support-level on the 1D (red line) ----> price should come back to these lows. Price closed above the resistance-level on the 1D (green line) ----> price should SFP the lows ----------------------------------------- I expect (or should I say: hope?) price to do a MSB here, meaning: price coming below all that structure below the green...

BTC Possible HTF Creation 3 Inversed chart again... (to minimise full breakdown to 48k fear which messes with my analysis). Price did a MSB which definitely weakens this downtrend (yellow). But what happens now? ------------------------- Three possibilities: 1 Price gets capped here at outstanding 95k level and goes back to 74k level, breaks through it and...

How low-risk do you want your chart to be? - No breakdown PA at top; - Clear SFP level supported by big structure; - Lack of horizontality + big verticality making the SFP-level even stronger.

Invalidation = 15min candle close above wick. bwrooooooooooooooo

BTC Short setup. Not much to say. 15min Engulfing candle for the LH. Invalidation = SL = 1R. Entry = entering ASAP after two 15min downcandles after another below level (so not a specific level) Hopefully I'm right, would be great R:R as the TP is the lowest low around 74k and I don't want to lose 1R.

BTC Possible HTF Creation 2 (update from first post): Chart inverted; analysis below as if it weren't an inverted chart: 1) Weak highs as there isn't an SFP or some kind of big wick candle; 2) Price did break below a significant part of the HL structure but not the full structure (last HL hasn't been broken): - The part it broke down below isn't outstanding...

We are however still in a downtrend and current area is the place for the new LH. We already have the SFP at the highs (thus, good for the LH formation) but this hasn't provided any downward move + MSB isn't possible anymore as it has taken too long. We could get a LH SFP though which I think will still create the downmove. The question I ask myself now: what if...

No Breakdown PA at the highs as there's no SFP and no MSB (for there to be a MSB price shouldn't have come up this high in 2024). Will we get the SFP at $226.01 or will we be left out?

SFP = HTF HL = altcoin uptrend? = investing in altcoins +EV as this charts hints at more money being put into the market soon (as TA suggests a HTF HL is likely?)?

Again: breaking down without a valid reason: this time you can speak of a mini-MSB but if it was a relevant one price shouldn't have consolidated at the highs that long. This makes the breakdown now weak. Also: price falling down against previous structure without having some breakdown PA at the highs makes the breakdown even weaker (previous structure 'washes'...

Have you ever seen a level as outstanding as this one? Yes, but this one's great too. But will we ever get there though? Maybe with some tariffs action we do. Outstanding level = strong level We do have breakdown PA at the top (SFP) but the lack of structure in the downmove (2022) makes this less relevant as the lack of structure meant that price could easily...

Safe chart as there's no breakdown PA at the top: - No SFP at the highs; - No MSB possible as there's no relevant HL structure because price never significantly pushed out of any structure. Basically: 2021-2025 PA is still one big structure; ---------------------------- $124.17 is the only clean level for an SFP: it's the most outstanding out of all the PA,...

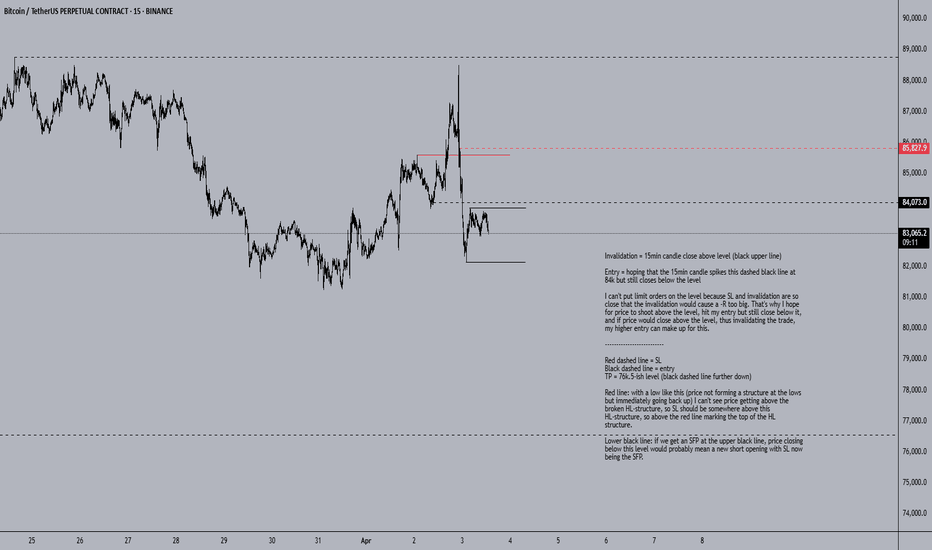

Invalidation = 15min candle close above level (black upper line) Entry = hoping that the 15min candle spikes this dashed black line at 84k but still closes below the level I can't put limit orders on the level because SL and invalidation are so close that the invalidation would cause a -R too big. That's why I hope for price to shoot above the level, hit my...

According to my 1D TF Theory, a 1D candle close above this level has a high likelyhood of thereafter producing a 1D SFP at the 78k lows level, which would produce the HTF HL for HTF bull trend continuation. So we would look for 1D CC above this level > short opportunity above this level > exit at 78k level. No 1D candle close above this level would cause a...

Possible 4H deviation setup for HTF trend continuation, or breakdown to probably 48k level. Look how price once closed below never closed back above on the 4H with clean retests: this means that this is a respected level (and the retest also meant the short entry). Might be obvious why this is a relevant level as this low caused the HH and therefore is the new...

What more can I say? Look at that 15min SFP candle of the relevant level.

Today, suddenly the thought came to me that there actually has been a bullish example with a 1D Candle Close below the relevant level: August 2023. So this shifts my bias more to a neutral level (but still more to the short side). ---------------------- The last two weeks have been parculiar: a two week consolidation?... That makes me think a big move is...