The Euro has lost 1.2050+ status vs the Dollar after testing 1.2100, but failing to breach the psychological level or derive much traction from broadly better than expected Eurozone manufacturing PMIs and firmer German state CPIs. Perhaps the EUR/USD is conscious about more dovish guidance from the ECB pre-comments via several GC members including President...

The Pound has unwound more gains vs the Greenback and Euro, or vice-versa, as global bonds yields finally show some sign of topping out after extended rallies to even loftier pinnacles above and beyond psychological levels. Currency markets are also consolidating after extended moves bordering on extreme in certain cases, such as Cable’s spike through 1.4200. This...

Commodities sold off, again, but more viciously, particularly in the belly, as a dismal 7-year note auction put the cherry on the cake in exhibiting the market's current aversion for rates. Fed's Bostic (voter) said faster recovery in GDP vs jobs may reflect business hesitation to hire for fear of having to be laid off again and stated the Fed will be very...

The Euro marginally pipped the Aussie to the post in round number terms, but it was much more even between the single currency and both Antipodean Dollars when it came to percentage gains vs the Greenback before the former accelerated beyond 1.2225. All 3 are gleaning leverage from yield differentials, while EUR/USD is also benefiting from supportive month end...

The dollar softened in Asia trade, and that continued into the European hours ahead of testimony from Fed Chair Powell; but the buck regained poise, moving into positive territory; Powell didn't push back against higher yields, perhaps due to these higher yields coming hand-in-hand with brighter prospects for H2 2021 (though that still doesn't explain why the Fed...

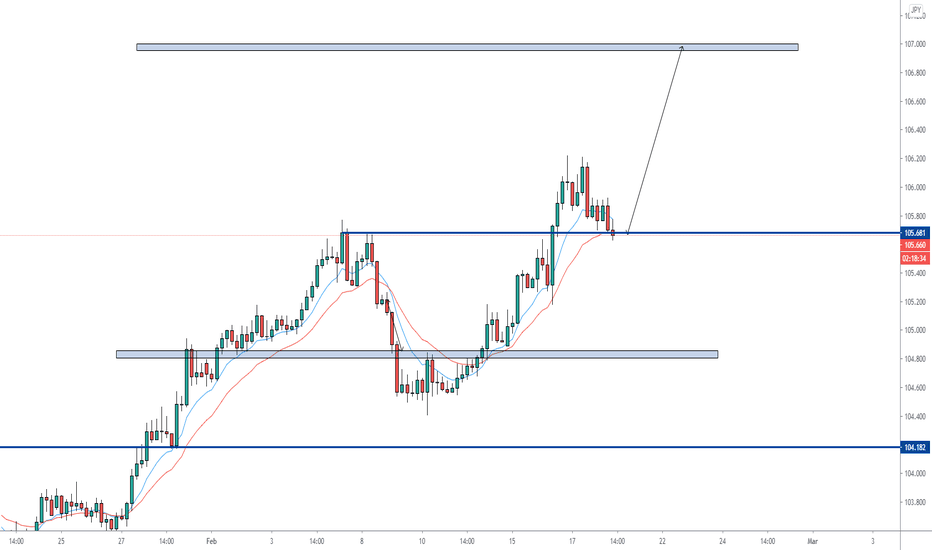

Prior Chart from December: Japanese Yen pressured around 10.0900 vs the Euro, sub-0.9050 against the Dollar/under 1.1000 vs the Euro and towards the north of 128.50-70 extremes in EUR/JPY respectively. Previous analysis showing another 300 pips to the upside potential has played out well from previous supportive levels and we may see signs of potential...

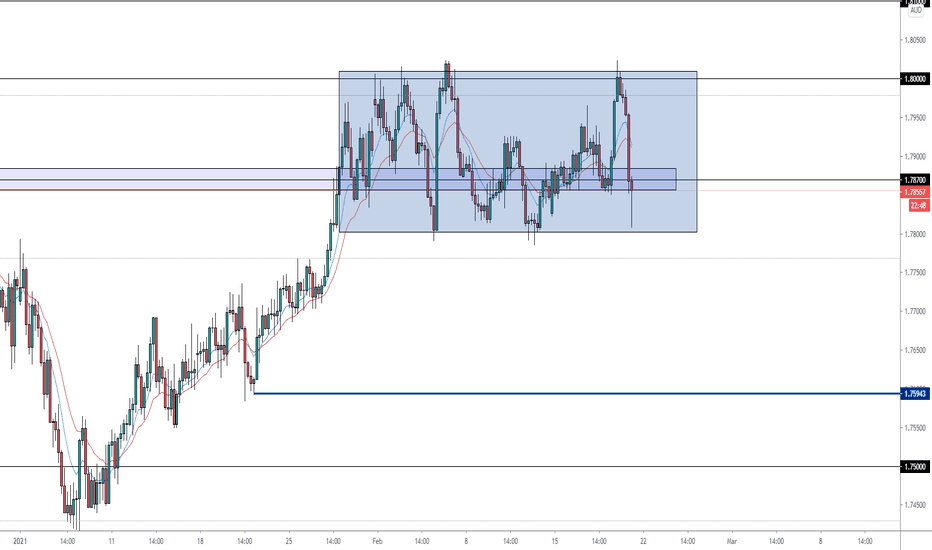

The Aussie is treading water in the run up to construction work completed and wages for Q4. Note, however, month end rebalancing flows are strongest on GBP and tomorrow is spot February 26. I am keeping close eyes on the support around highlighted region. However overall anticipating a break below.

AUD/USD is holding firmer in relation to 0.7900 before construction work done, wages, RBNZ policy meeting and press conference. The Dollar has lost a bit more of its yield advantage, but not all attraction as a safe-haven it seems given that the index has regained some composure after a more pronounced pull-back from recent recovery highs. The DXY is holding...

The Euro has benefited to an extent from an upbeat German Ifo survey as all key metrics beat expectations and the institute noted that travel companies have turned a tad more optimistic for the first time in more than 12 months. We arte now looking at the 1.2180 D extension level as a point of impact for this pair to rebound from shorterm. Although US Treasury...

The next best majors, as the Pound extends through 1.4065 vs the Dollar and claws back loss against the Euro from the midday fix to trade over 0.8650 assessing UK PM Johnson’s parliamentary address on the staggered easing of COVID-19 restrictions before he delivers details of his plan to the nation from 19.00GMT. Be careful for any whipsaws back down into 1.3900....

UK Flash Services PMI (Feb) 49.7 vs. Exp. 41 (Prev. 39.5); Manufacturing PMI (Feb) 54.9 vs. Exp. 53.2 (Prev. 54.1) Composite PMI (Feb) 49.8 vs. Exp. 42.2 (Prev. 41.2) UK Retail Sales YY (Jan) -5.9% vs. Exp. -1.3% (Prev. 2.9%) UK Retail Sales MM (Jan) -8.2% vs. Exp. -2.5% (Prev. 0.3%) UK GfK Consumer Confidence (Feb) -23 vs. Exp. -27.0 (Prev. -28.0); highest...

Precious metals are mixed with spot gold resuming its real-yield-driven downside after yesterday testing support at around USD 1,764/oz, whilst the technical “death cross” confirmation earlier in the weak flagged a bearish signal. Spot silver meanwhile is firmer as a function of the softer Dollar. Looking for minor pullback to upside before one last leg down over...

Prior analysis: A strong end to the week for the Antipodean Dollars and considerably firmer rebounds from lows vs their US counterpart, as AUD/USD takes a firmer grasp of the 0.7800 handle and NZD/USD tags along. The Aussie has shrugged aside somewhat disappointing preliminary consumption figures for January amidst a spike in bond yields, partly in catch up...

Also firmer vs the Buck, as the , Loonie hovers around 1.2650 awaiting Canadian retail sales and Pound probes barrier defences at 1.4000 following significant beats in UK PMIs, including services that were so ravaged by the return to lockdown last time. On that note, ONS retail sales data was extremely weak in contrast to public finances, but neither impacted that...

It remains largely a long term rates and reflation rather than general risk sentiment story in terms of Dollar direction and corresponding moves in other currencies by default, but global stocks are beginning to get twitchy about the implications of soaring yields and steeper curves to keep the Greenback underpinned on safe haven grounds even when US Treasuries...

Prior analysis: The Yen is rebounding further from under 106.00 to probe 105.70 and away from 106.00-105.95 (1 bn) option expiries at this stage, as we approach some fundamental's on Friday. Further upside to our target of 107.00 is likely over the rest of this week and next. As long as we remain above the bounce at highlighted support bullish bias continues...

Eur/Gbp resumes its relentless decline after a tame bounce to 0.8700 and is now sub-0.8670. Elsewhere, the Aussie is back over 0.7750 vs its US counterpart and edging nearer 1.0800 against its Antipodean rival in wake of a somewhat mixed labour report in terms of outward appearance, but with internals better than the headline and jobless rate encouraging. Sterling...

Possible break to $1860 if $1780 breaks... I am cuurently observing the $1785-$1790 level. Breaking here should put more pressure on the price to decline. Support here and we could go back up to test the 1800-1808 level. Im not in any positions at the moment. I've emphasised on remaining short in this market unless momentum suggests otherwise, yesterday was...