Prior analysis: Bitcoin still has the bit literally between its teeth and is on the cusp of Usd 50k. $52,000 should be achieved by the end of this week. Possible pullback may occur from 52k.

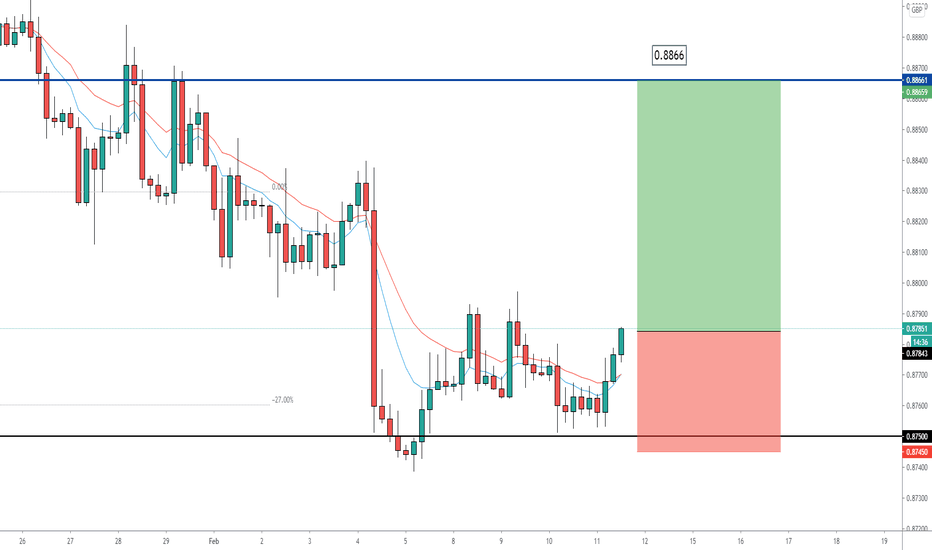

Cable is cresting 1.3900 with upside target at 1.4... and Eur/Gbp is back below 0.8750 partly due to another downturn in the Dollar and relative Euro lethargy between key technical levels. However, Sterling is also bid in its own right and benefiting from the UK’s ongoing advanced progress in terms of vaccinating the population against COVID-19 that is keeping the...

Also firmer vs the Greenback as the DXY meanders between 90.465-266 having failed to sustain Friday’s recovery momentum beyond the 21 DMA or 90.500 on a closing basis. The Euro has reverted to a 1.2100-50 range after Friday’s false downside break, and from a chart perspective eyeing 21 and 50 DMAs yet again (1.2102 and 1.2158 respectively today). If bullish...

GBP/JPY 145.50 complete! Yen has finally slipped beneath 105.00 on USD/JPY following successful defences of the round number, but could yet glean traction from hefty option expiry interest at the strike (2.8 bn). Downside expected heading into next week...

Gold set for a drive back into $1875 per Oz. This move will likl;ey occur now heading into next week. The Dollar looks set to end a tough week with a final flourish and the rationale for its latest recovery is not crystal clear in terms of a new or definitive factor.

All narrowly mixed against their US counterpart, as the Loonie hovers above 1.2700 within a 1.2660-1.2711 band, the Euro straddles 1.2130, Franc stays tethered to 0.8900, Sterling keeps afloat between 1.3811-59 parameters and Yen treads a fine line from 104.55 to 104.79 in holiday-thinned trade (Japanese National Day, but also Spring Festival in China and HK, plus...

Despite bitcoin’s 20% crash on Monday, I can see a continued price rally in the next coming weeks to push BTC closer to a six-figure price tag. At present price is $35,420, bitcoin (BTC, -1.6%) is up nearly 16% from the low of $30,305 observed on Monday. Even so, the number one cryptocurrency by market value is still well short of the weekend highs above...

Aussie is forming a firm platform above 0.7700 on AUDUSD and consolidating gains Antipodean counterpart in wake of a rather bullish update on economic developments from Treasury Secretary Kennedy overnight. Pound is seeming to hover. GBP/AUD is ready to print a downside leg. This could provide a nice opportunity to snag a hundred pips or so this week.

Japan reports that the BoJ could reinforce the message that rates have not reached the lower bound in conjunction with next month’s policy review appear to have halted the Yen’s rapid resurgence. Technicals are showing final D extension targets are coming up at 145.50 with the potential to reverse once final stops have been taken out.

Aussie retesting resistance into 0.7750 in wake of a rise in Westpac’s measure of consumer confidence and strong PBoC setting for the onshore YUAN on the eve of China’s Lunar New Year break. Potential further upside to come. Meanwhile the Dollar softer than forecast US inflation data has undermined the Greenback in more ways than one as bear-steepening along the...

Euro has managed to sustain momentum through 1.2050 and 1.2100 to surpass the 21 DMA just beyond the round number to expose 1.2150 and the 50 DMA around 1.2156. Further upside excepted. The Dollar has fallen further from best levels, and almost across the board on a mixture of fundamental and technical factors, including more retracement and reconvergence in...

EUR/JPY set for more upside movements to come over the remaining part of this week. It’s a close call, but in terms of magnitude and sheer speed of movement, the USD/JPY resurgence from 105.77 at one stage last Friday to circa 104.54 (and counting) so far today is perhaps most eye-catching, especially when set against the Nikkei’s potenital ongoing rally and close...

Sterling succumbs to the Buck in the run up to the BoE policy announcement where eyes will be fixated on commentary on the feasibility of NIRP for the banking sector if required, although the immediacy of such policy is likely to be downplayed by the MPC. Meanwhile, markets currently pencil in incremental negative rates for August. Cable has descended from its...

A game of two halves for the Dollar, and by default its peers in major circles and beyond. However, the turning point or catalyst seemed to come via the resurgence in Bitcoin after reports that Tesla has invested Usd 1.5 bn in the crypto currency. Indeed, BTC and others spiked with the former almost reaching Usd 44.9k before topping out around the same time that...

In keeping with the norm, higher UST yields and by inference wider divergence to JGBs, have undermined the Yen more than most, while Usd/Jpy is also eyeing the 200 DMA after what proved to be a false break above last Friday. To recap, the pair spiked to 105.77, but closed just shy of the aforementioned technical level, which incidentally remains at 105.57 today,...

The Greenback is grinding higher after extending its post-NFP retreat to 90.966 in index terms, and it seems like an even more pronounced reversal in US Treasuries and several more specific technical factors have helped the Buck to stop the rot. 10 year cash has touched 1.2% again, while the 30 yield is probing the psychological 2% level to lift the Dollar off...

Prior Downside targets have been met on this pair. The Euro recovers from a slightly deeper pullback from 1.2000 where 1.1 bn option expiry interest resides, the Kiwi bounces from under 0.7150 and Yen through 105.50 after hitting a sub-105.60 trough. Eur/Gbp under 0.8750 even though the Euro is trying to claw back losses against the Buck and other peers. Note,...

The Loonie remains anchored around 1.2800 with one eye on crude prices and the other on the upcoming Canadian labour report which could push up price. And as for the dollar it could purely be a case of consolidation ahead of the monthly BLS update, but also a function of external factors and perhaps some technical impulses given the fact that the DXY failed to...