The Buck is off best levels after the DXY extended gains just beyond Tuesday’s peak to 93.617 largely at the expense of the aforementioned ailing Pound, with the index acknowledging a partial recovery in risk appetite ahead of weekly MBA mortgage applications, Redbook sales and JOLTS. All narrowly mixed vs the Greenback, as the Loonie pares some declines in line...

Notwithstanding the Yen’s aforementioned greater allure as a safe destination, the Greenback and index have also appreciated further with the latter registering a new post-NFP best at 93.483 amidst broad gains for the Buck. However, the US Treasury curve has returned to pretty pronounced bull-flattening mode and could keep the Dollar capped on pure yield...

UK PM Johnson is to tell the EU that the Withdrawal Agreement never made sense as it is contradictory on Northern Ireland and must be written, according to Telegraph. Furthermore, PM Johnson believes the WA is legally ambiguous and would leave Northern Ireland isolated from the rest of the UK, while this contradicts earlier comments from a UK PM spokesperson that...

Yen Both relatively flat and moving in tandem with the Dollar amidst a lack of fresh fundamental newsflow and the US market holiday. USD/JPY holds its head above 106.00 (106.14-38 range), with the NY eyeing USD 1.2bln in option expires at strikes 106.00-15. Meanwhile, USD/CHF retains a 0.9100+ status in a 20-or-so pip parameter at the time of writing, whilst...

$1880 downside target still remains anticipated... further updates to come.

Sterling stands as the G10 laggard in early trade in light of a slew of Brexit developments over the weekend which added to the pessimism on an agreement reached with the EU ahead of the October deadline. First, PM Johnson brough forward the touted deadline to October 15th from the prior October 31st in order for a deal to be effective by year-end (a change EU...

The Dollar looks laboured ahead of NFP and Monday’s US market holiday, or simply fatigued after its recovery exertions that culminated in the DXY reaching 93.074 before petering out. Pre-NFP caution and consolidation has curtailed price action with major pairings restrained within narrow ranges, exemplified by the index sticking to tight confines just below the...

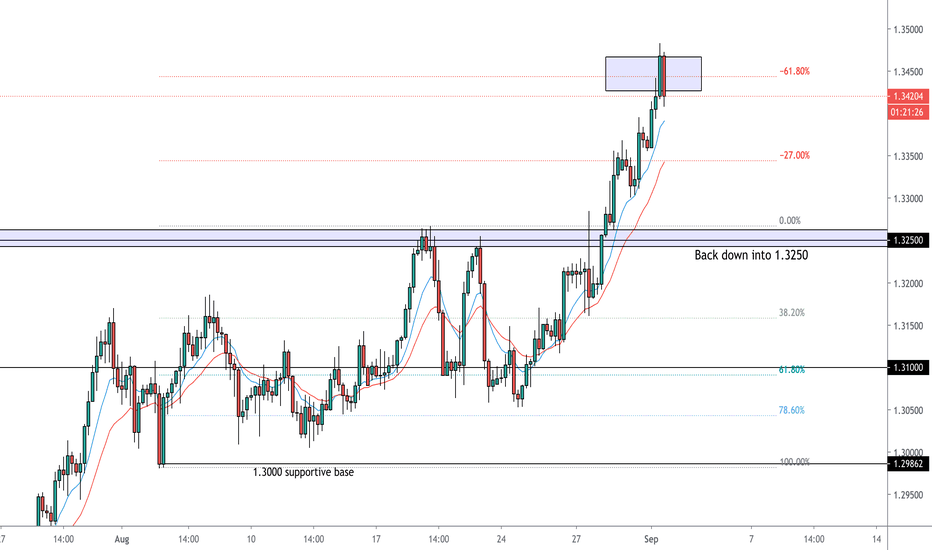

The Pound finds some support near a half round number to revisit the 1.3300 handle irrespective of a slowdown in the UK construction PMI or dovish sounding comments from BoE’s Saunders. Further data will be coming out on this pair today so trade safe.

It would be easy and perhaps convenient to say that recovery momentum has simply run out of steam given the scale and relative speed of the Buck’s rebound, but the index has been toppy above 93.000 on each occasion it has attempted to vault the big figure, and the DXY has already clawed back an impressive 133 or so ticks from 91.737 y-t-d trough to 93.074 top in...

Sterling has slipped towards the bottom of the G10 ranks, with Cable struggling to keep sight of 1.3300 and Eur/Gbp eyeing 0.8900 after downward revisions to UK services and composite PMIs, but also amidst some re-pricing for zero or negative rates along the Short Sterling strip. However, BoE Governor Bailey may reiterate that NIRP is unlikely to happen anytime...

As noted above, a weaker than forecast ADP payrolls survey threw a spanner in the Buck’s recovery works, but the Greenback has subsequently regrouped and regained momentum with the index now over 100 ticks above yesterday’s 2020 low and aiming for the 200 DMA (92.920) ahead of 93.000, assuming it stays above interim resistance at 92.850 vs the 92.872 high, thus...

The Yen is back under 106.00 amidst a pronounced upturn in risk sentiment, dovish rhetoric from the BoJ and LDP leadership challengers. This morning has consisted of weak Eurozone data and dovish/downbeat ECB commentary.

Tests and ultimate rejections of big figure and psychological levels in several Dollar/major pairs have also contributed to the revival, as the DXY reclaims 92.500+ status ahead of ADP, factory orders and more Fed speak, with Williams and Mester scheduled to orate. Whilst it may well be too premature to suggest that the rot has stopped, but the Buck is bouncing...

It may well be too premature to suggest that the rot has stopped, but the Buck is bouncing further from Tuesday’s 2020 low (91.737) and seemingly gleaning more traction from the US manufacturing ISM, with considerable assistance via independent weakness in rival currencies. Eur/Usd may yet find support around 1.1850 and be drawn towards decent option expiry...

All off best levels, but not before registering fresh and significant gains vs the increasingly weak Greenback as the Pound inched closer to 1.3500, the Kiwi forms a firmer base around 0.6750 awaiting NZ terms of trade tonight and Euro breached barrier defences at 1.2000, albeit briefly. However, the DXY is striving to draw a line in the sand and stay within sight...

The Dollar is suffering from a post-month end hangover as the DXY slips to a new 2020 low of 91.741 amidst broad losses vs G10 peers and most EM currencies. Confirmation of a firm US manufacturing PMI via the final release and ISM matching expectations for a pick-up in headline activity could conceivably provide the Greenback some respite, but the index remains...

The index continues to decline after more fleeting dead cat bounces and just fell to a new y-t-d low at 91.989 despite more pronounced weakness in the Yen as jitters about the end of Abenomics in Japan are assuaged by the fact that at least 2 PM candidates appear content to keep the ideology going. Indeed, the DXY remains vulnerable and could come under renewed...

The next weak major link, and perhaps the Pound is taking note of Brexit news and media speculation suggesting that the UK is prepared to walk away from negotiations with the EU if Brussels does not back down on its demand for alignment with state aid rules. Cable is struggling to keep hold of 1.3300, albeit with volumes lighter than normal due to the August Bank...