Gold remains to hold the spotlight heading into this week with lots of upside projection as the bulls begin to attack. Mild data across the week including the US core PCE data and other USD and china related statements to be released. For any downside opportunity Gold needs a daily close beyond $1,976 per Oz. to defy the first monthly negative closing in previous...

Residual or more month end rebalancing could be a factor behind the renewed Greenback weakness, though the aforementioned Yen revival has certainly contributed to the Buck reversing further from Thursday’s post-Fed chair policy revelation recovery highs to lower lows. Indeed, the index is now roughly 100+ ticks down at 92.279 and the ytd trough looms (92.124)...

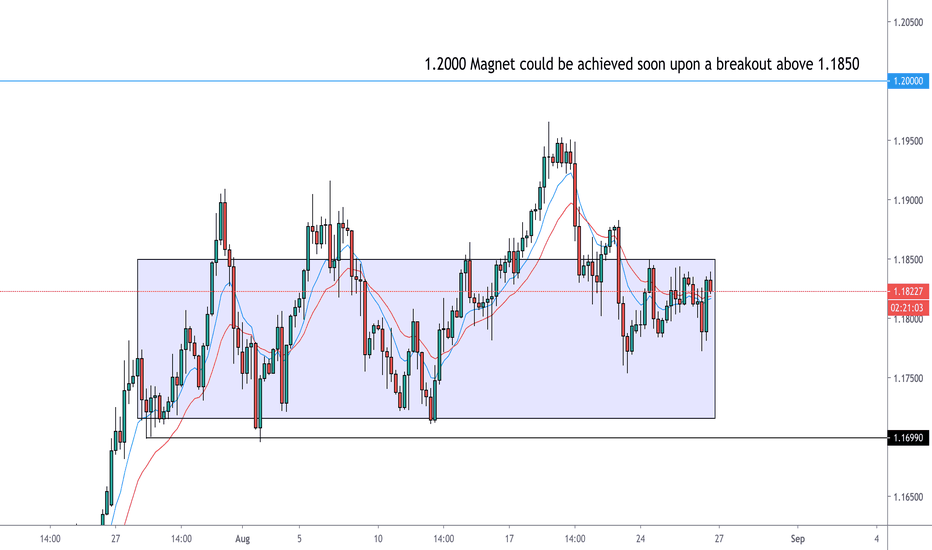

The DXY lacks conviction overnight which is slightly beneath the 93.00 after the prior day’s whipsawing in the aftermath of Fed Chair Powell’s announcement of a new policy framework to target 2% inflation "on average" and in which he noted the Fed will offset periods of weak inflation with inflation above 2% "for some period of time". The announcement initially...

The dollar saw choppy price action today amid the Fed’s Framework review announcement. The DXY initially weakened as Powell announced the Average Inflation Targeting (AIT), indicating more accommodation to ensure inflation averages 2%. The final target 1.3100 is insight for tomorrows session.

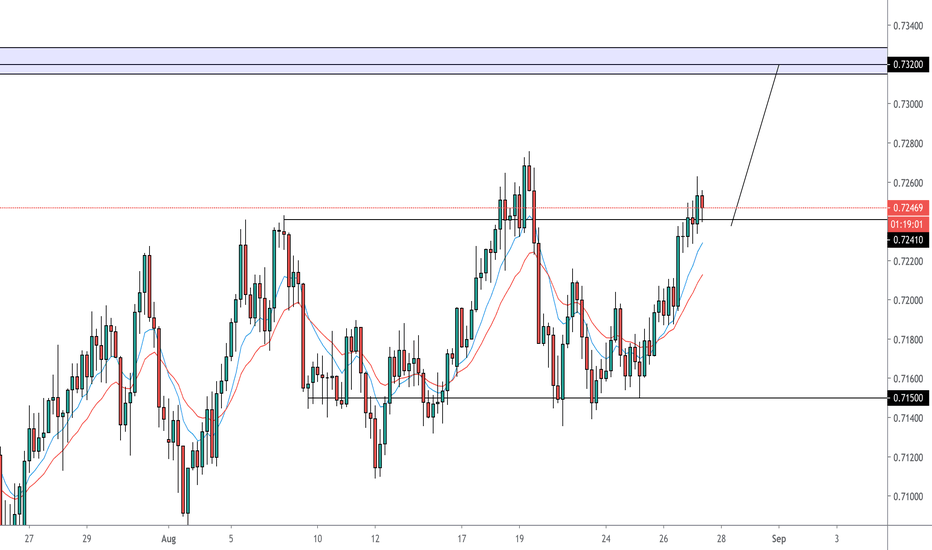

Following on from the recent success of the other USD pairs, we decided to add AUD/USD into the mix. Before: Still some more upside room on this along with the EURO. Hope everyone has had a great week in the markets! 📈📈

Sterling reversed in excess of 100 pips after setting a fresh ytd peak at 1.3283. Further bullish momentum to come. Target complete. 📈

First post on AUD/USD on our page... hopefully a profitable one... The Aussie and Kiwi are outpacing G10 peers, with the former probing resistance around 0.7250 vs its US counterpart in wake of Q2 Capex data showing a less steep decline than anticipated, while Aud/Usd is also deriving more upward momentum from the ongoing incremental strength in the YUAN that is...

The broad Dollar and index have unwound more of Wednesday’s pre and post US durable goods gains after another solid Treasury auction indicated a retreat in yields alongside some curve realignment from pronounced steepening, which in turn helped Gold and other precious metals to rebound sharply (Xau currently back up around Usd 1950/oz compared to just above Usd...

Gold nurses some of yesterday’s losses as it rebounds from support near the 1920.00 level but with upside limited in the aftermath of disappointing Consumer Confidence data and amid month-end factors at play with Citi suggesting FX hedge rebalancing flows point to a bias for net USD selling next Monday as this month’s relative outperformance of US equities has...

DXY It remains to be seen whether the dollar index can maintain or even firmly regain 93.000+ status after several unsuccessful attempts and short-lived recoveries, but a new high was forged on the back of an unexpected acceleration in headline US durable goods orders at 93.368 and the data is capping Treasury futures ahead of the 2nd leg of this week’s auctions....

Sterling has scaled ascending peaks from Monday and Tuesday to cross 1.3200 for the first time since August 21, while Eur/Gbp tripped stops circa 0.8975 on the way down to just below 0.8950 having breached the psychological 0.9000 level. We are nearing our weekly upside target already!

Loonie rebounded further from sub-1.3200 troughs to 1.3140+ peaks following a relatively in depth update on the BoC’s monetary policy review from assistant Governor Wilkins. In short, alternative frameworks under consideration include average inflation targeting (AIT), price level targeting, an employment mandate and nominal GDP targeting, while the Bank is also...

USD The Dollar is holding up relatively well ahead of durable goods, spot month end and the start of this year’s global Central Bank ‘gathering’ in Wyoming, albeit with assistance from certain currency rivals and a fade in broad risk sentiment after the recent bull run. The index has tightened its grip around 93.000 following several false breaks below, but is...

Flanking the G10 ranks, Sterling shrugged off considerably weaker than forecast CBI distributive sales on the way to setting fresh 1.3100+ peaks vs the Dollar and re-testing offers around 0.9000 against the Euro. However, the Yen has extended losses across the board as US Treasury yields rebound further from recent lows and the curve continues to re-steepen ahead...

The DXY is looking precarious again on the 93.000 handle after recovering late yesterday, but fading at 93.347 and only fractionally eclipsing that high (at 93.351) before declining to 92.965. The aforementioned portfolio positioning for next Monday (or this Thursday in spot terms) could be keeping the Buck capped, but an unexpected deterioration in US consumer...

As the DXY hovers just above the 93.000 level within a confined 93.012-351 band, major Dollar counterparts are also sitting close to big figures awaiting firm breaks or clearer direction, like the Euro in wake of an encouraging German Ifo survey on balance. To recap, 2 out of the 3 metrics exceeded expectations, but the more forward looking outlook reading missed...

Not quite role reversal, but a marked change of fortunes as the Dollar loses post-US PMI momentum and the DXY struggles to maintain 93.000+ status within a 93.016-266 range. Accordingly, the Euro has pared losses and is back above 1.1800, albeit tentatively as 2nd waves of the coronavirus spread across the Eurozone. Here on dollar-cad, we are still looking for...

EUR - AUD Highlights Both off best levels, but retaining an underlying bid following tests of half round number and big figure resistance at 1.1850 and 0.7200 respectively. The Euro is holding around 1.1800 and Aussie more assuredly near the middle of a 0.7204-0.7153 range, but the latter has eroded gains relative to the Kiwi after 1.4 bn Aud/NZD option expiry...