Before: The Greenback has been mixed against major peers for the most part and the DXY rangebound between 92.500-000 parameters on the wide, awaiting further direction from FOMC minutes or remaining Fed speakers. However, the index is looking more prone to a downside break having failed to extend gains over 21 and 200 DMAs (92.304 and 92.380 respectively) or...

Cable met some underlying bids into 1.3770 and above a pivot point at 1.3760 that is guarding 1.3750 ahead of the April 1 base just below, and is back on the 1.3800 handle irrespective of minor downward tweaks to the final UK services and composite PMIs. Not necessarily the biggest G10 mover or even net loser, but the Pound has been in the spotlight again and...

Before: More pronounced resurgence in the Yen has dragged the DXY down through 92.500 to test chart support in the form of a Fib retracement. Market contacts note that buying in EUR/JPY started around 130.00 and continued all the way down to at least 130.40. Further bullish momentum anticipated. Note also, another Eurozone sentiment survey topped consensus...

Bucking the overall trend, as the Euro attempts to keep afloat of 1.1800 vs the Greenback. However, news that between 51.7-61% of the population in Germany, France and Italy may have been vaccinated by the end of H1 may also be helping the single currency resist Buck advances. The Dollar is on a firmer footing vs most G10 and EM counterparts having lost...

Prior chart: It remains to be seen whether the final throes of March, Q1 and FY 2020/21 give bulls more incentive to try and breach barriers that have held firm earlier, bears continue to reassert control and the Buck ends its winning streak. DXY slipped to a marginal new session low just under 93.000 in wake of US pending home sales plummeting around 4 times...

Prior chart: The Dollar’s almost relentless rally on the crest of rising US Treasury yields and curve steepening among other bullish factors stalled at the end of March when it failed to breach a few psychological barriers that remain beyond reach as the new month, quarter and financial year kicks off. It also reached a turning point on the Fibonacci D...

Prior chart: The Aussie is still underperforming, but some way off overnight lows vs the Pound within a 1.8150-1.8200 range in wake of trade data revealing a 1% fall in exports due mainly to iron ore, though the partial recovery is mainly down to another pull-back in its US counterpart rather than anything else. However, retail sales were not quite as weak...

The Pound remains propped near 1.3800 vs the Dollar and 0.8500 against the Euro, but unable to breach either psychological barrier on the back of an upgrade in UK manufacturing PMI, and aside from the obvious swathe of bids in Eur/Gbp just under the current 2021 low, Eur/Usd resilience on the 1.1700 handle is also keeping Sterling at bay. From a technical...

Prior chart: The pound gleaned more from LHS on Eur/Gbp action than upgrades to UK GDP or a narrower than anticipated current account shortfall. Cable popped over 1.3800 when the cross matched its recent 2021 low within a few pips of 0.8500. Possible further downside anticipated to 0.8450.

Although the Pound enjoys a greater share of the Dollar index, the sharp ascent of Gbp/Jpy and sheer magnitude of the rally has been instrumental if not quite responsible for its breach of 93.000. To recap, the Yen put up a pretty staunch defence of 140.00 and 150.00 before caving in at the end of last week when Treasury yields set off on their most recent ramp...

Euro looming and as noted before, Eur/Jpy appears poised to test the next half round number above rather than retreating to 130.00, and the Yen hardly got any chance to draw encouragement from better than expected Japanese retail sales and unemployment data overnight or remarks from BoJ Governor Kuroda who is seeing signs of the domestic and global economies...

Prior chart: 0.7550 which was anticipated. recently tapped. If 0.760 holds we could see upside for the remaining days of the week. The Aussie and Kiwi have both faded after receiving decent debt-related boosts to trade over 0.7660 and 0.7030 vs their US counterpart and will now look for further independent inspiration from building approvals, private sector...

Prior chart: Technically we are moving lower as expected. The Dollar index has finally attained 93.000+ status and is still bid between 92.882-93.176 parameters alongside US Treasury yields that have risen to new cycle highs along certain parts of the curve, but the DXY may have derived sufficient momentum to breach the psychological mark regardless given...

A typical mundane Monday for the Dollar and frustrating for both bulls and bears that might have been looking for more given that month end looms and Wednesday. Indeed, buyers were squeezed only a fraction short of 93.000 in DXY terms, but sellers did not get much mileage either as the index found a base at 91.71 and the Dollar attempted to break out of ranges in...

As many have requested through the comments, here is our GBP/USD update! :) Sterling is fending off an oil-fuelled Norwegian Krona for 3rd spot in the G10 ranks as Cable eyes 1.3900 and Eur/Gbp retests bids/support around 0.8550 due to risk back on impulses and hopes that the UK-EU vaccine stand-off will be resolved before too long. From a technical standpoint...

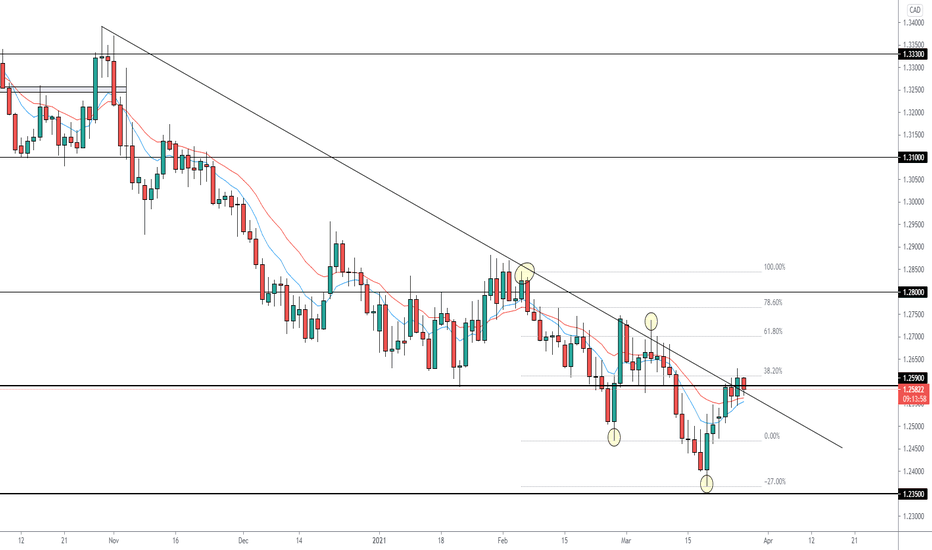

Usd/Cad has retreated through 1.2600 ahead of Canadian budget balances and Eur/Usd has pared declines from the low 1.1760 area. For the dollar, the pre-weekend position paring and general consolidation may be contributing to the Greenback’s loss of momentum, but a marked improvement in risk sentiment and the latest recovery in crude prices are also dampening...

Eur/Gbp is on top of tailwinds from under 0.8600 where the base of 1.7 bn expiries rolled off (stretching to 0.8615), Sterling could be drawing some encouragement from signs of a resolution to the UK-EU rift over COVID-19 vaccines. The drop is now under way.

GBP/AUD seems mainly dependent on chart support below 1.8000 as February 5’s circa low is the only level offering cover into the Fib retracements under the half round number. Further Upside is now anticipated over the remain days of the week. Antipodeans deriving some traction from a rebound in APAC bond yields, but the latter losing more of its recent bullish...