Fomenka

Latest observations on the SP500: Despite recent upward movements, I continue to view both SP500 and Oil as being within broader correlated downtrends. The recent price action likely represents a corrective phase rather than a reversal.

🛢️☕ #OilNotCoffee | 📐 #TECHANALYSIS 📉 Oil appears to have formed a triangle in wave 4 and is poised for a major gap down on Monday, driven by OPEC+’s decision to accelerate production increases beyond initial plans. Position: ▫️ Entered the weekend with short positions near peak exposure. ▫️ Critical level marked by the 100% red line. ▫️ Scenario suggests WTI...

🔥 #GasHasNoMercy 📉 Gas is again following the main scenario closely. We stayed out of the market most of the time, as the movement was a correction within the primary downtrend, which remains intact. The wave is nearing completion. Historically, gas rarely reverses after weekends—it typically continues the previous week’s trend until Tuesday-Wednesday. However,...

▫️ Context Amid ceasefire news 🕊️ and my dissatisfaction 😤 with the previous wave count, I spent 3 hours ⏳ searching for options with a sharp drop on Monday ⬇️. ▫️ What I Found 1️⃣ Complex Wave Count 🧩: To understand the wave logic, zoom in 📊. 2️⃣ Elliott Wave Rules 🧠⚡: Interpreting them correctly is like soldering a circuit board without instructions 🔧. 3️⃣ Why...

I don’t track SP500 closely since I trade on the Russian exchange, where SP500 liquidity is thin 💧. But @Fewhale asked, so here’s my take: 📉 SP500 appears to have completed its consolidation and is now poised for a Wave 5 collapse. Note that despite the sprawling Wave 4, it doesn’t overlap with Wave 1 — aligning perfectly with Elliott Wave rules ✅. Oil’s Looming...

🛢️☕ #OilisMyCoffee | 📐 #TechnicalAnalysis The most frustrating thing is when the market follows the script, but your account is in a drawdown 😭 Corrections are sneaky 🐍 Mid-week, I leaned toward the red scenario 🔴 (see last week’s chart), but the market suddenly shifted to black ⚫️. Now the uncertainty: How and when will the diagonal end? I see at least 3...

🔥 #GasHasNoMercy | 📉📈 #TechnicalAnalysis 📉 Well, the era of predictable gas trends in recent weeks seems over. Ironically, the downtrend has confirmed across all timeframes, but our wave count 🌊 and decline structure had to be revised. 🚫📉 Gas failed to show the expected impulsive downward waves. Moves were choppy—corrective triples, diagonals. Yet, we adapted and...

So far, there have been no deviations from the expected scenario. The price appears to be forming a corrective pattern around a critical trendline. Last week, we anticipated movement under the "red scenario," but the "black scenario" now seems more likely. However, post-Iran news developments might still push us toward the red path. The delayed ultimatum in Iran...

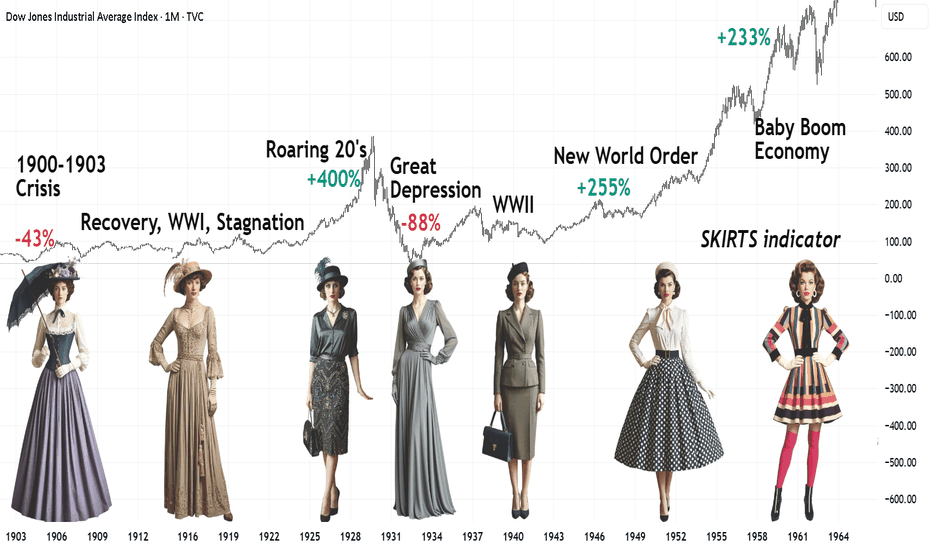

Part of the #Socionomics series. How fashion and societal moods shifted in the first half of the 20th century. 1900–1910 Economy: The rise of industrialization in the U.S. — Ford’s assembly line (1908), booming cities, and a growing wealth gap between the elite and the working class. In Europe, colonial powers raced for survival, fueling military spending (sound...

I had to slightly rework the NatGas chart. The price appears to have formed and confirmed the Order Block, and is now retesting it to allow smart money to pull out of shorts that were previously opened to trigger the sell-off and collect stop orders underneath.

#Natgas seems to have completed the wave down and is ready to explode. I can label the last wave as a diagonal and it seems that we have small 1-2-3-4 sequence completed. So I flipped my stance from bearish to bullish.

I've noticed that Friday and Monday rarely bring a change in gas prices (unlike Bitcoin). Usually, the price follows the previous week's trend, which is currently downward. It's possible that wave (5) of should be extended because waves and appear to be the same length. The chart shows weekly cycles that last one week, from Friday to Friday.

Oil has been a tough one. No clear patterns makes me keep the idea that we are in wxy double zigzag formation. I think we need to retest this huge Order Block area indicated in green box. A possible way to label it is to expect that (x) will be an expanded ABC flat with A being a combination. Not my ideal choice but do not have a better count now. The red...

That's how I see it. It has been difficult in the past month to count BTC waves and no wonder, considering the complex wxy waves. However, it is getting a bit more clearer now. Wave of y might have just finished, but the base case is going lower very soon. A complete wxy might also mean the end of the correction and the road to ATH.

Determining trend for intra week trading. I use 1h timeframe and 300/400/500 moving averages (grey). If they are stacked and do not entangle too much the trend is defined and trading on 1h and lower timeframes should be done in the direction of the trend. Otherwise it is better to stay away.

I suspect we are already on an upward trend. The diagonal we just finished can be referred to as wave A. Sadly, this means that we missed it and even stayed short for a significant portion of it. The new low is still possible, as indicated in black, but I am increasingly leaning toward the red scenario. Wave b could be almost any shape, making trading...

Bitcoin remains firmly in a downtrend, and I believe we have only completed waves 1 and 2 of a five-wave sequence. The projection on the chart is for illustration only and should not be used as targets. Wave was a diagonal (not sure if it was expanding or contracting), so I expect wave to manifest as an impulse.

A few possibilities to complement the previous update. Wave B can take many shapes and forms and an expanded flat (black) is relatively frequent but bot the only one. A triangle (green) is not less probable and WXY combination is also possible.