Asian Session Update: The AUDNZD has found support at the multi year channel as noted yesterday near the 1.0650 level. Now the pair is in a descending wedge, which is typically a reversal pattern (bullish) so a breakout of the 1.0710 level would suggest a move back towards the 1.0800 level.

Intraday Update: The USDCAD slipped to bear flag support following the interest rate decision. The market was trading short CAD in hopes of a cut, and was disappointed. A break of the 1.3830 level would open up channel support at 1.3760. The BOC presser is ongoing at time of writing.

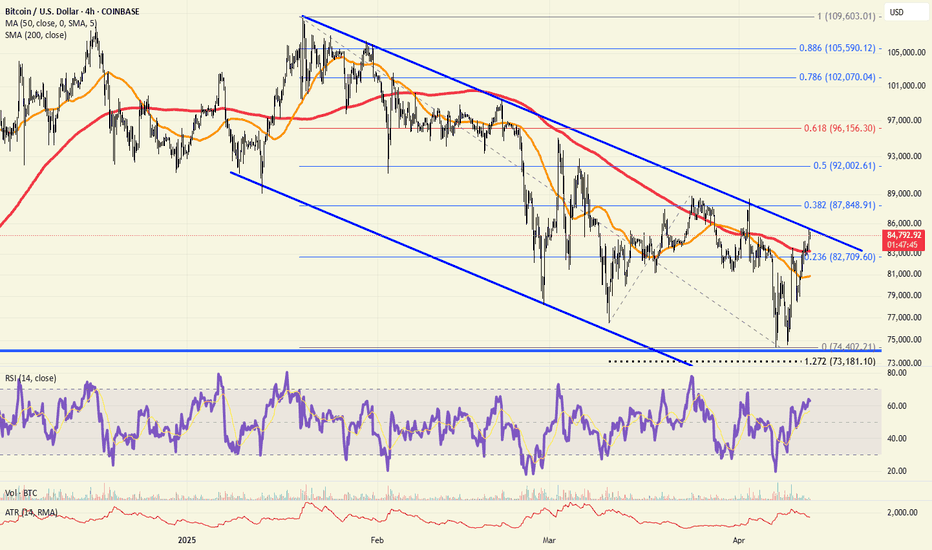

Intraday Update: Bitcoin over the weekend is challenging the descending channel trend line and above the channel is the 38% retracement at 87848. This level is being tested as headlines over the weekend suggest that tariffs will not be applied to phones, computer and chips. This should allow for risk assets like Bitcoin to continue to rise higher over the weekend.

Intraday Update: Long term, the USDCHF is testing the key support that has held since the end of 2024. A break of the .8300 level would put the .8127 level in play (longer term). This is not uncharted territory, see 2011

Intraday Update: The SPX stalled at previous (flag) support at the 5500 level as noted in the end of day analysis. The "line in the sand" has been drawn intraday for the session now. A break above this level would continue yesterday's epic squeeze

Intraday Update: The EURAUD pullbacks have been shallow and the risk still remains higher when headlines like this keep popping up: CHINA IMPOSES 84% TARIFF ON US . A move back below the 1.8200 level may allow for a deeper pullback now.:

Intraday Update: Crude oil broke the 161% extension (lower) of the March 5th lows to April 2 lows, this is also below the support of the May 2021 lows and major horizontal support. ONLY a break back above the 61.70 level would take the downside pressure off.

Intraday Update: Bitcoin has hit major support at the 74000 level (today's lows at 74420) which should allow for a move back above the 80K level. A move below 74K level could put the 68848 level in view,

This is a strong reversal pattern which points to below the 1.7900 level. This is a complex H&S pattern, but targets the 1.7840 level in the days ahead. We'd need to see some bounce in the equity market to assist a move lower here.

Intraday Update: The EURAUD has completed the bull flag pattern. However, with the headlines today out of China, the risk is we could continue to squeeze, and target is a guess at this point. Some traders will fade this, I would wait till after US stocks markets reopen

Intraday Update: The AUDUSD has broken flag support following the headline from China that they are going to impose a 34% retaliatory tariff. The AUDUSD just surpassed the 127% extension and now may target the .6118 level intraday. Long term targets the post covid lockdown lows.

Intraday Update: The EURUSD has hit the 1.1100 level, going as high as 1.1146 and surpassing the long term trend line of 18yrs near 1.6000. This is a big resistance, expect two way price action around these levels.

Intraday Update: The EURUSD is nearing the 1.0871 level as Europe announced that they are looking at measures to guard the economy from Trump Tariffs. That is the 61.8% retracement of the 1.0959 level to 1.0730.

Intraday Update: Despite the weaker Australian CPI overnight the EURAUD slipped below 1.7085 which may allow for a move to the 1.7020 level, which is the 38% retracement. A bullish pennant may be developing.

Intraday Update: With the weaker CPI, the GBPJPY slipped from resistance and the budget statement will be out a little later in the session. The GBPJPY has forged key resistance at the 195.00 level as noted all week. While below the risk is for a move back to the 192.00 level now.

Intraday Update: The S&P futures are up today following possible tariff news being factored in from some weekend headlines about "targeted reciprocal tariffs" for April 2nd, which is allowing for the S&P to near the 38% retracement which would be the top of the beer flag pattern and setup.

Intraday Update: Another strong rejection of the 68.50 level. Since it is the end of the week, the risk is building for a big move either back to the 65.20 support or perhaps a break of the key 68.50 level.

The SPX is bouncing from pennant support this morning. So in other words, the overnight lows in futures MUST hold or w may attack trend lows.