MSTR is likely going north. My buy view for Microstrategy with risk-reward ratios of 1:2 & 1:4.7 Trade 1: RR 1:2 Trade 2: RR 1:4.7 Trade with care

UBA on Nigeria Exchange may be heading to N35 - N34 Look at my analysis on the chart and you will see my sentiment for sell. The TL and horizontal lines have my eyes.

My buy for Access Holding Stock on NGX This is my entry target with RR of 1:34 for ACCESS BANK STOCK. I will wait for this asset to pullback to 21.95 zone as shown on the chart for buy limit. I have a trade entered on CMP. See you guys

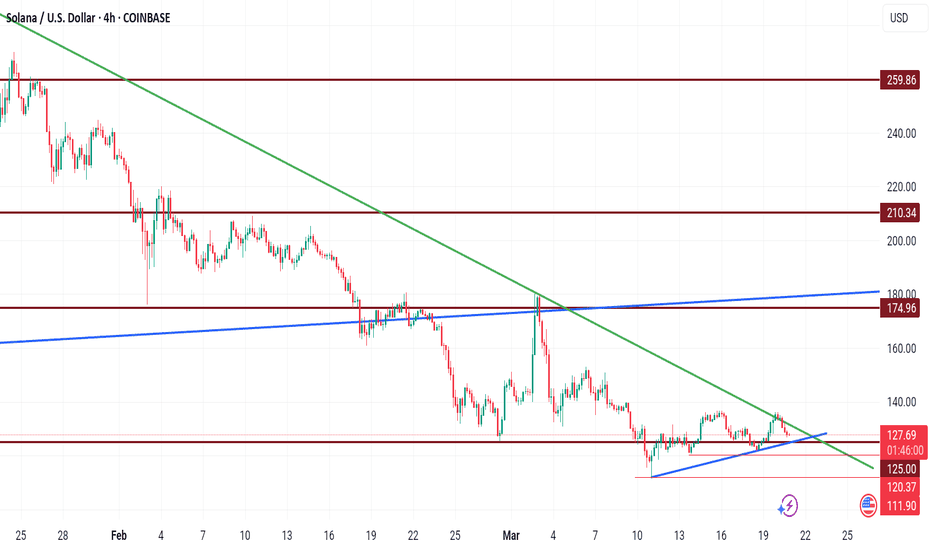

$125 buy target for Solana My previous analysis came to play. The green TL acted as resistance zone despite the false breakout. I see this baby coming down to kiss the blue TL as a support level before another push up. I have a buy entry for $125. Trade with caution as crypto market is a volatile one. Please share your thoughts, like and follow for more charts.

Pi coin: here are some key levels. After hitting TP for out last sell trade for Pi, Here are some levels I am looking at if the sell pressure continues. Trade with care

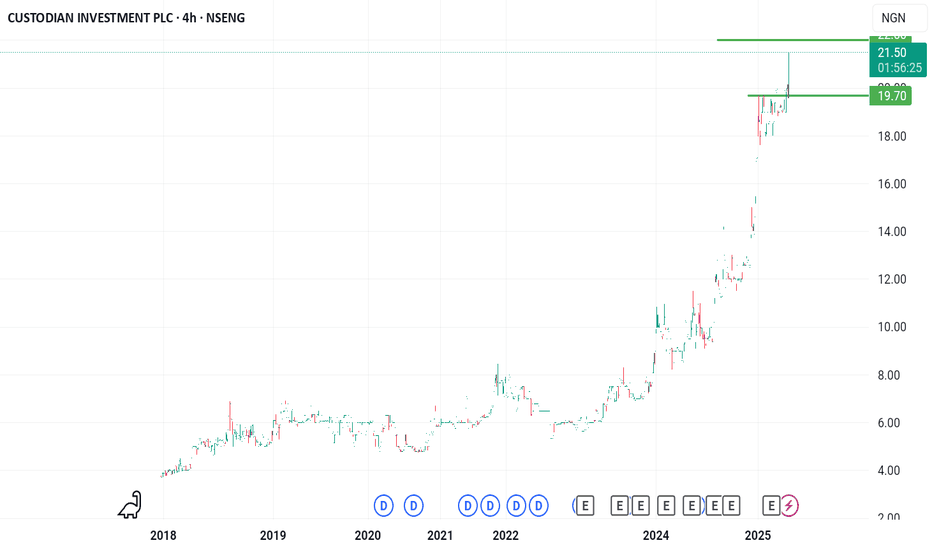

CUSTODIAN stock on Nigeria Exchange to likely hit N21 soon. This stock made it to the position of 3rd best performing stock on the NGX gainers table. The move from N19.6 to N21.5 was a rapid one. I will be looking at N22 as a likely resistance to the upward move.

MY 1:2.6 RR short for Dogecoin A short-term short for DOGECOIN with a Risk/ Reward ratio of 1: 2.6 Trade with caution

Technically, the sell is not over for BNB $600 is currently acting as a resistance zone. If this force continues resisting the movement towards the north, we might see a drop southward again. In this instance, $500 will again be the main psychological support level. The trendline on my chart will be a great point for me to start applying my DCA strategy for...

Pi has broken an important TL where is PI going from here? Do you see $1.22 coming to reality?

Google -GOOG at a critical juncture If this asset breaks above the trendline sustainably, I will expect this asset to push further to the north. The TL will become support level and my SL will be below the TL as shown on my chart. Trade with care

TON the sell is not over. Keep in view $0.18 Have you bothered to look deep into TRX monthly chart? I feel $0.18 is solid place for TRON to cool off its selling pressure long term. I look forward to this shit happening for me to load my shopping cart

Short-term trade for Cardano Let us see how this ADA trade will go. I hope fundamentals favour it. It is a RR trade of 1:2 We need patience to activate this trade.

4H view for SOLANA A push above the current zone might send this asset to $136 - $137 A fall below might push this asset down to $120, or the worst case scenario $111 zone. This is a short term trade anlysis

Tesla Stock Analysis: Navigating Key Support and Resistance Levels. Tesla (TSLA) has experienced significant volatility, with its stock price retreating nearly 50% from its all-time high (ATH). The last major rally, which began on October 23, 2024, at approximately $211, propelled the stock to an ATH of $487 on December 18, 2024. However, since reaching this...

NVIDIA Stock Analysis & Forecast Price Outlook: $140 - $150 in Sight NVIDIA (NVDA) has consistently been one of the most rewarding stocks for investors, delivering substantial returns over the past few years. However, following its all-time high (ATH) of approximately $153 on January 7, 2025, the stock experienced a notable pullback, declining to around $105....

XRP at $1.5 will be a good buy We made it to out $1.96 forecasted level. However, if the sell pressure continues, we may see this baby ride to $1.5. I will load this asset if it makes mistakes down to $1.5 zone

Solana (SOL) Price Analysis and Forecast: Can the $125 Support Hold? Solana (SOL) recently experienced a sharp dip to the $110 zone before rebounding swiftly. From a technical analysis (TA) perspective, the $125 support level is currently a key defence zone for the asset. If SOL maintains its position above $125, we could see a continuation of bullish momentum....

Bitcoin Market Analysis and Forecast Bitcoin has retraced over 50% from its all-time high (ATH). Despite a rebound from the Fibonacci 50% level to its current price of $84,600, continued selling pressure could push BTC lower toward the Fibonacci 61.8% retracement zone, which lies between $74,000 and $69,000. This potential pullback presents strategic entry...