Forex_League_Analysis

Price is at the top of our descending channel, our key structure zone, and the 30min 200MA. Trade Scenario 1: Bullish - For us to go long we need to see price breakout of our descending channel and above 1.2740. We will then wait for a quick retrace and for 1.2740 to act as support. Enter on strong bullish setups. Trade Scenario 2 Bearish - For us to go short...

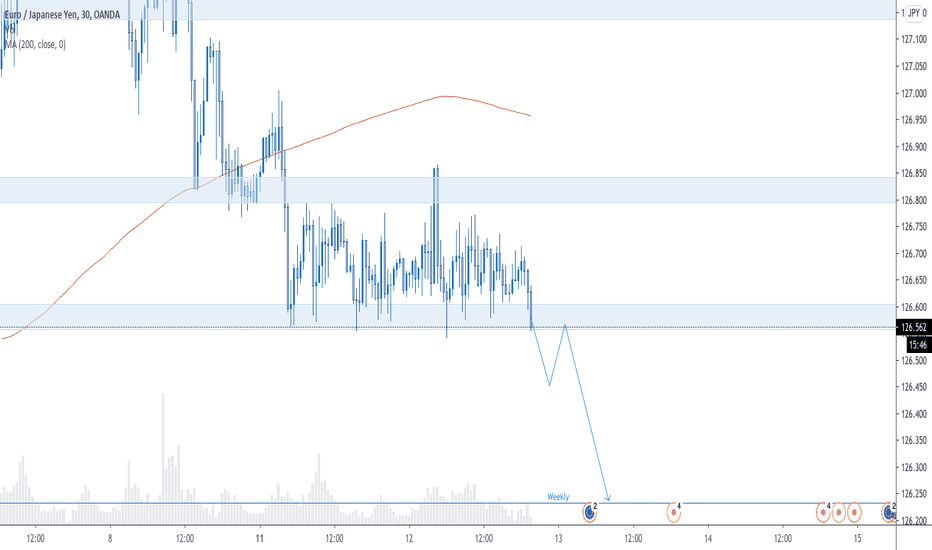

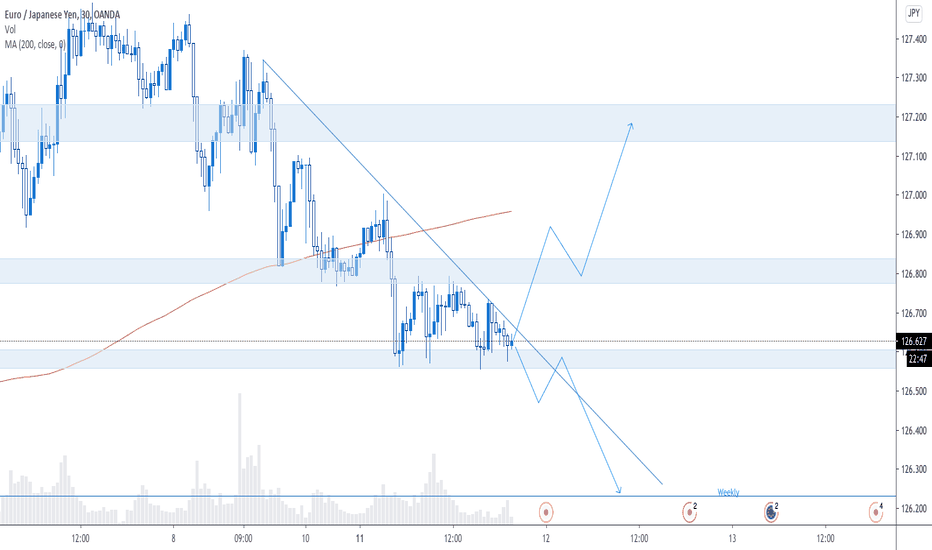

Price has been in a tight consolidation for the past 24 hours. We are looking for price to break down past our support zone of 126.550. We will then wait for a retrace and for our current support zone to flip as resistance. Enter on strong bearish setups. First targeting our weekly level at 126.230.

Price has broken above our key structure zone and the 30min 200MA. We are now waiting for a retrace back to our structure zone of 80.500. We will then look to enter on strong bullish setups at this zone. Targeting previous highs around 80.900

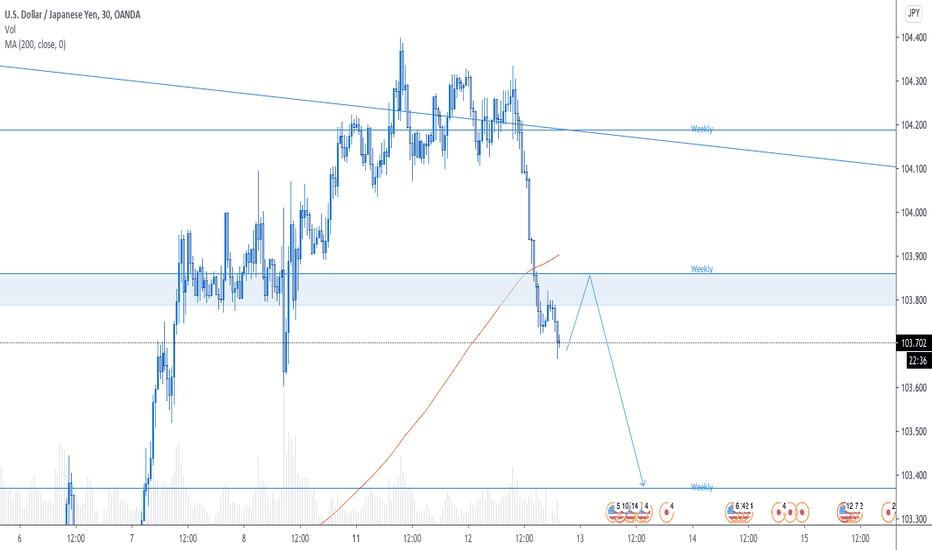

Price had a strong rejection off the top of our large descending channel and weekly level at 104.200. We are now waiting for a retrace and a clear LH to form. Ideally we are looking for a rejection off the weekly level at 103.850 and below the 30min 200MA. Enter on strong bearish setups at these levels.

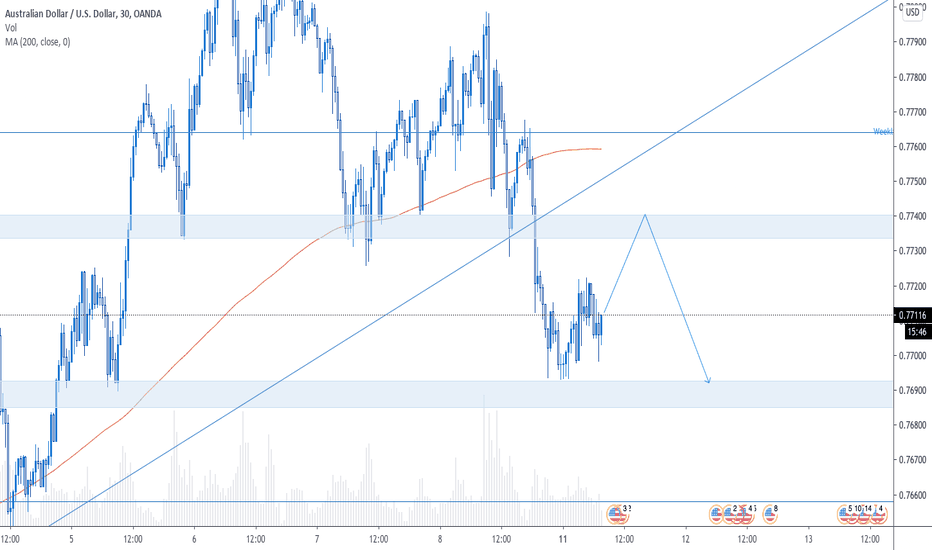

Price is currently testing the 1hour 200MA and our key structure zone at .77350. Trade Scenario 1: Bearish - We are looking for further bearish pressure/engulfing here. We will look to first target the key monthly at .7660 Trade Scenario 2: Bullish - For us to go long we need to see price break above the 1h and 30m 200MA and our key structure zone of .7740. We...

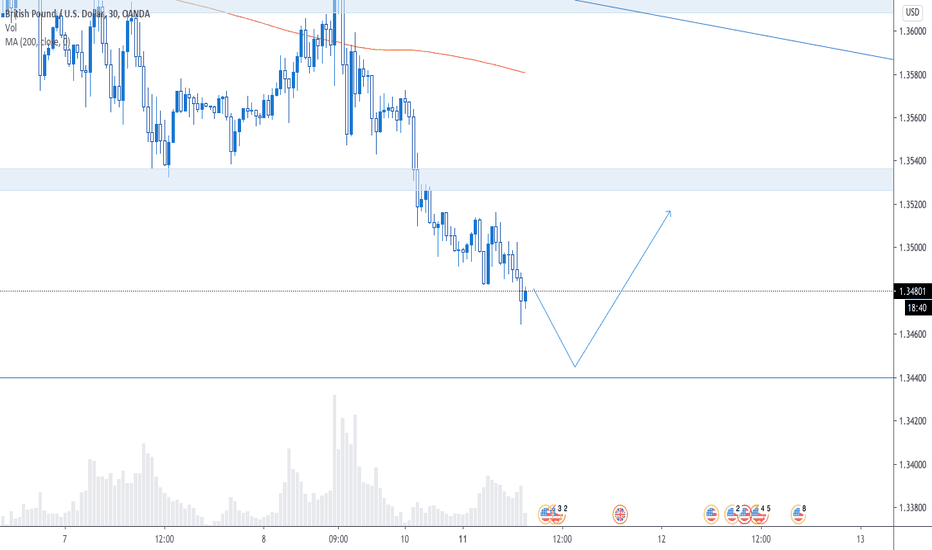

Price is at the top of our descending channel and the 1h 200MA. We are looking for further bearish pressure to enter short on. First targeting our key monthly at 1.3526.

Price has been retracing since our break of structure yesterday. We are looking for price to find support at our key structure zone and 1h 200MA around 1.2725. We will then wait for strong bullish setups to enter long.

Price is at our key structure level finding support and we are looking for price to break out of the current downward trend. Trade Scenario 1: Bullish - For us to go long we need to see price break above 126.800. We will then look for a retrace and for price to find support at 126.800. Enter on strong bullish setups Trade Scenario 2: Bearish - For us to look...

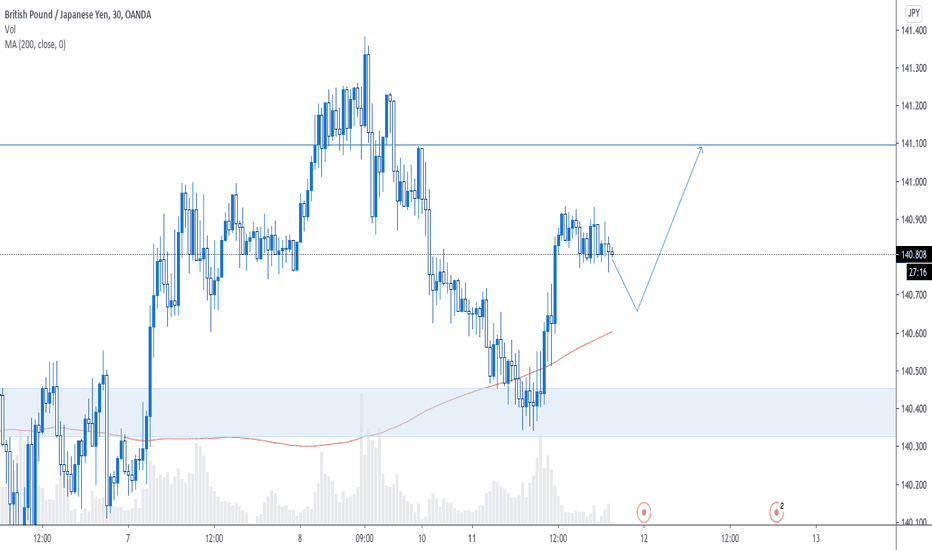

Price has respected our key structure zone and the 30min 200MA as support. We are now looking for price to retrace back to the 200MA around 140.700 and find support once again. We will enter on strong bullish setups and target the key weekly level at 141.100

Price is currently at our key structure zone of 80.200. Trade Scenario 1: Bullish - For us to go long we are looking for price to find further bullish support at our structure zone of 80.200. We will look to enter on strong bullish engulfing/variations off our structure zone. Trade Scenario 2: Bearish - For us to go short we need to see price break down through...

Price has broken out of our ascending channel and below the 30m 200MA. We are now waiting for price to retest our key structure zone around .7740 to create a clear LH. Enter on strong bearish setups/engulfing at this zone.

Price is in a strong downward trend but is coming up on key support and our weekly level at 1.344. We will wait for price to test this area, forming strong bullish setups before taking a position.

DXY is gaining strength and pushing all USD pairs to the upside but price is at key resistance levels. We are testing the 4h 200MA and our key weekly level at .8920. Watch for strong rejections up in this area. We will want to see strong bearish setups/engulfing past the .8900 level to look short. If we want to be patient and look long we can wait for a healthy...

Price is within a rising channel respecting the 30m 200MA as support. For us to go long we are waiting for price to retrace back to our key weekly level and supporting trend line of channel at .77640. Enter on strong bullish setups off the weekly level. First targeting previous highs around .78150

Price is still consolidating between our two structure zones. Currently price is at the 30min 200MA which price has recently respected as resistance. Trade Scenario 1: Bearish - For us to go short we want to see strong bearish rejection off the 200MA pushing price below 1.3580. We can aggressively enter shorts on bearish engulfing off the 200MA or we can wait...

Price is currently pushing to the downside but we are waiting for price to find support between our weekly level and our key structure zone around .8820. We will then look for strong bullish setups at these levels to enter long.

Price is at the top of our descending channel and supply zone. We are looking for a double top or other strong bearish setups and engulfing past 103.750. First TP at our supporting trend line and weekly level at 103.400.

Price has been consolidating through the NY session today but still in a bullish trend. For us to look long we would like to see price retrace back to our key structure zone and the 30min 200MA around 140.500. Our second scenario would have price push to the upside past our key weekly level at 141.100. We will then wait for a retrace and for our weekly level to...