Forex_League_Analysis

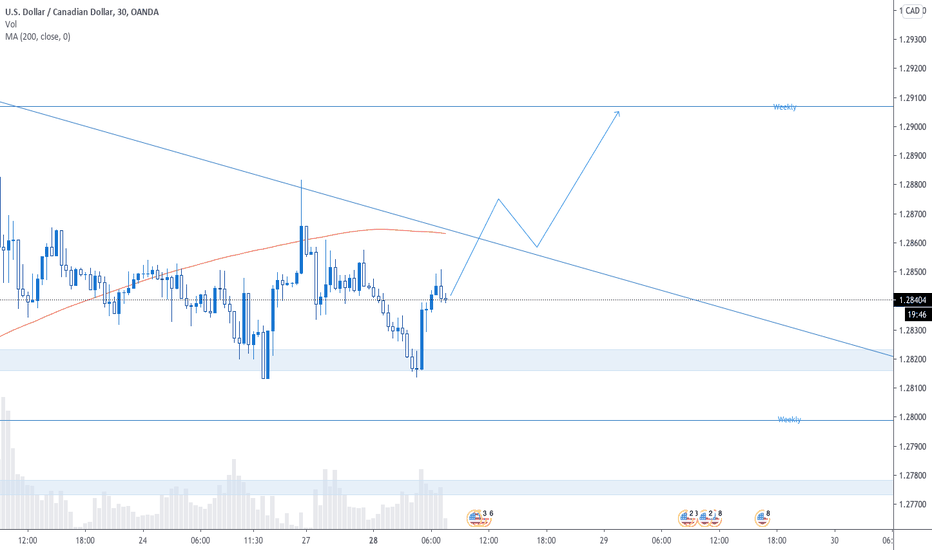

Price has continued to melt to the downside close to our key weekly level at 1.280. Trade Scenario 1: Bullish- We can look to enter long off bullish engulfing/variations off the weekly level. Trade Scenario 2: Bearish - For us to look short we need to see price pullback and form a clear LH. We would like to see price pullback to the 1h 200MA and act as...

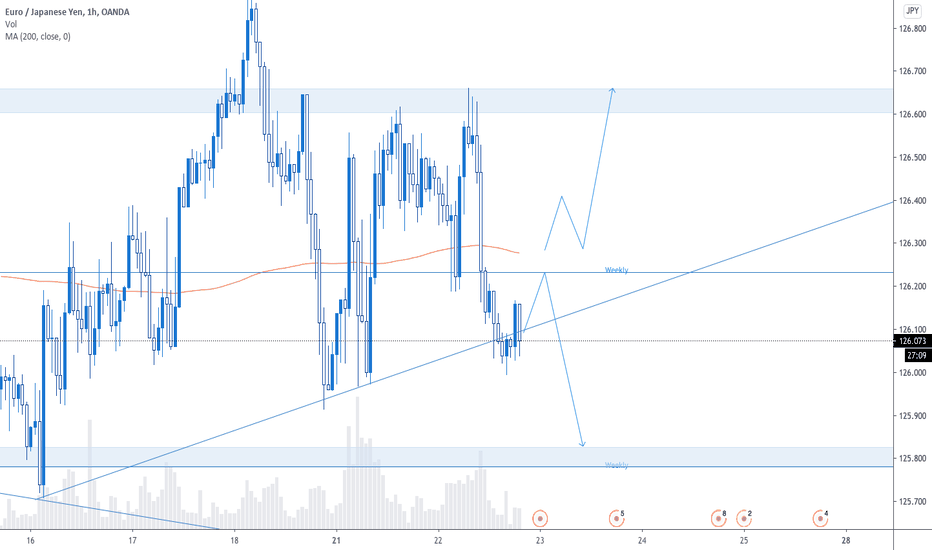

Price has broken out of our range and is starting to form a clear HL above 126.70. We are waiting for another pullback to form a double bottom to enter long on. Enter on bullish engulfing/variations around the 126.70 level.

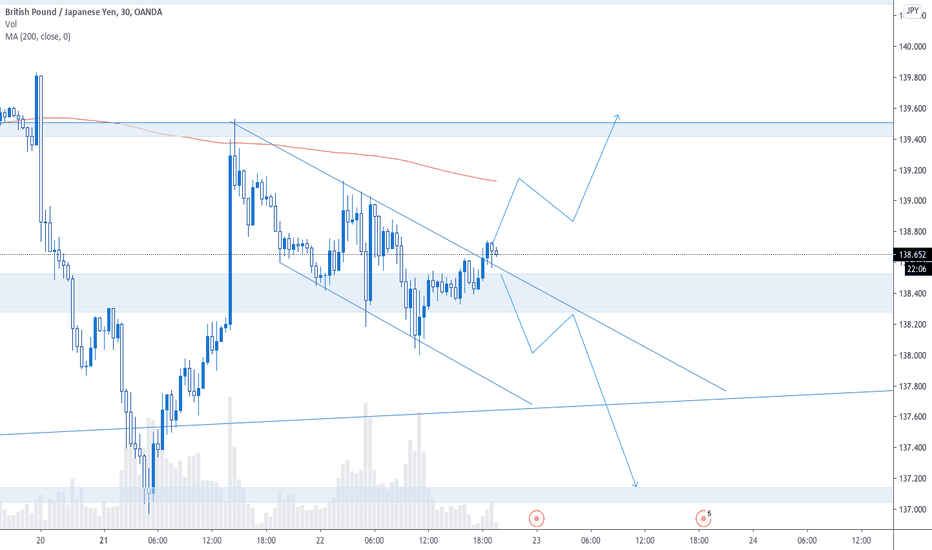

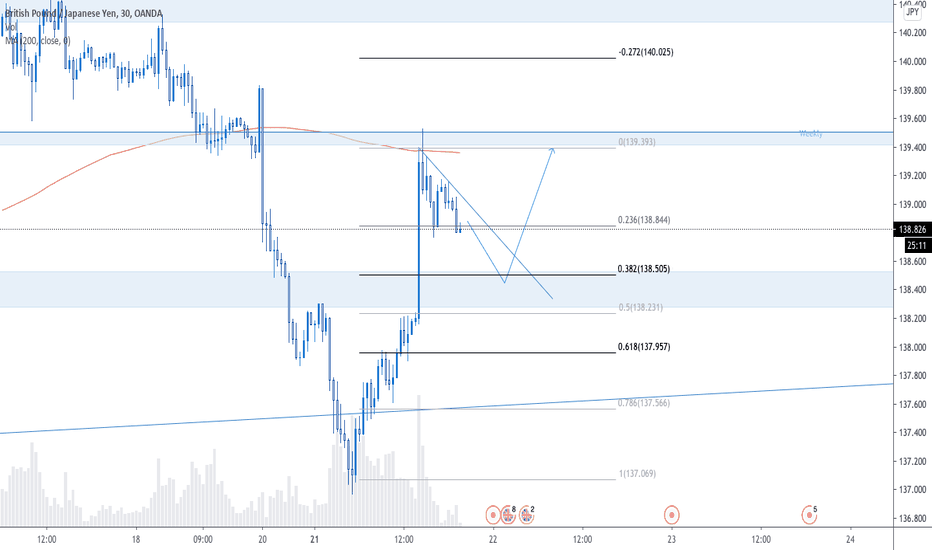

Price has retraced back to our key weekly level and the 30min 200MA. Trade Scenario 1: Bullish - For us to look long we need to see price break out of our descending channel and form a clear HL above 139.90. Enter on bullish engulfing/variations. Trade Scenario 2: Bearish - For us to look short we need to see price break below the key weekly level and 200MA on...

Price has broken above our key zone of 103.700, has retraced and formed a bullish engulfing on the retest. We are waiting for further bullish pressure/variations at this level to enter long.

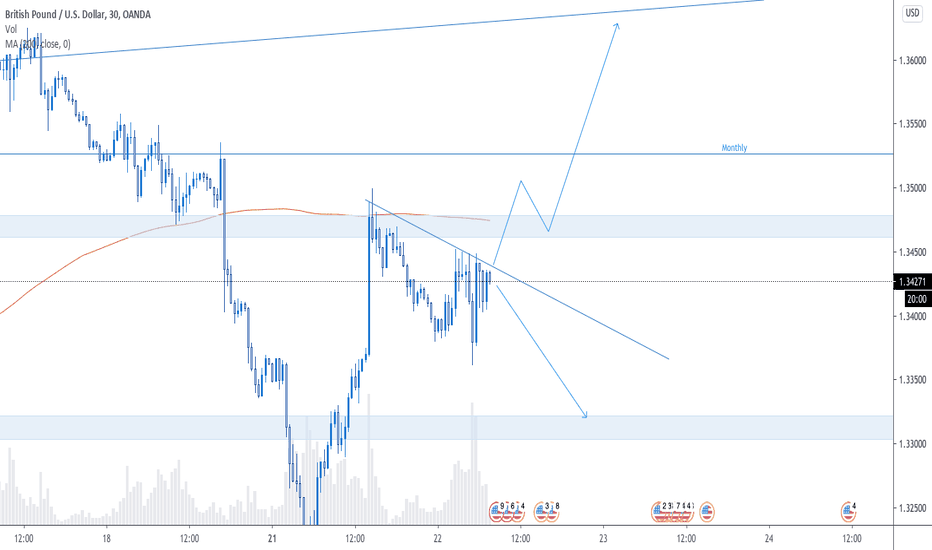

We are starting to see a double top form on the 4h timeframe but price is at a key structure zone. Trade Scenario 1: Bullish - For us to look long we need to see strong support form at 1.348. We will then look for a break and retest of our monthly zone at 1.3527. Enter on bullish engulfing/variations. Trade Scenario 2: Bearish - For us to look short we need to...

We are waiting for price to pullback to the .8890 level to see how price will react to the bullish trendline and 200MA on the 30min timeframe. Trade Scenario 1: Bullish - If we see strong bullish pressure/engulfing/variations at .8890 we will look to enter long. Trade Scenario 2: Bearish - For us to look short we need to see price break through the supporting...

We can see price is starting to form a double bottom at our key structure zone. For us to look long we need to see price break out of the resistance trend line and above the 30min 200MA around 1.2860. We will then look for a retest and a clear HL to form above 1.2860. Enter on bullish engulfing/variations.

Price is at our supply zone and is respecting the 200MA on the 30m timeframe as resistance. Enter on bearish engulfing/variations here. Targeting our weekly level at .75330

Price is currently respecting the 30min 200MA as resistance and is within our supply zone of 1.346. We can also see a H&S forming on the 4h timeframe. We are looking for further bearish momentum/engulfing to enter short here.

Price is back at our key weekly level and the 30min 200MA. We are looking for any bullish variation/engulfing/momentum off this level to enter long. First targeting 103.550

Trade Scenario 1: Bearish - We can play a short off this 30min bearish engulfing at our previous support zone of 78.20 that has now look to be acting as resistance. Trade Scenario 2: Bullish - If we are to look long we need to see price break above 78.20 and act as support once again. Enter on bullish engulfing/variations at or above this level.

Trade Scenario 1: Bullish - Price is starting to break out of our flag pattern. To look long we still want to see price break above the 200MA on the 30min timeframe. We will then look for price to retrace/consolidate at or above the 200MA. Enter on any bullish engulfing/momentum. Trade Scenario 2: Bearish -To look short we need to see price break below our...

Trade Scenario 1: Bearish - Price has broken below our 200MA on the 1h and 30min timeframe once again. If we are to look short we need to see a clear LH form below the 200MA and around the weekly level at 126.23. Enter on bearish engulfing/variations. Trade Scenario 2: Bullish - If we are to look long we need to see price break above the 200MA on the 1h...

Price is starting to create a flag pattern after our bullish push phase in yesterdays NY session. Trade Scenario 1: Bullish - If we are took look long we still need to see price break above the 30min 200MA and current supply zone around 1.3470. We will then look for a retrace and for resistance to flip as support above 1.3470. Enter on bullish...

Price is forming a small H&S pattern on the 1hour timeframe. We are looking for price to break through the neckline/support zone and then come back to retest 103.300 as resistance. Enter on bearish engulfing/variations.

Price has created a nice double top and clear LH. We can enter on 30min bearish engulfing or drop to lower timeframes (15m, 5m) and look for LHs to for. Targeting our key weekly level at 1.280

Price has printed a strong bearish engulfing on the 1h timeframe, followed by further bearish pressure through the 200MA. Trade Scenario 1: Bullish - For us to go long we will need to see price form support at our current demand zone of 78.20. Enter on strong bullish candles/variations. Trade Scenario 2: Bearish - For us to go short we will need to see price...

Price is starting to retrace after a strong bullish push during the NY session today. We want to see price retrace back to at least the .382 fib level and key zone around 138.50. Enter on bullish engulfing/variations.