Forex_League_Analysis

Price is forming a falling wedge which favors a corrective bullish pattern. We are looking for price to find support around 78.20. We can enter aggressively there on bullish engulfing, or we can wait for a break and retest of the corrective structure. Looking for a clean break above 78.4. Drop down timeframes to play the retest, and enter on bullish engulfing/variations.

Price is at a current supporting zone and thee 200MA on the 30min timeframe. Look to enter on strong bullish momentum or bullish variations.

Price has broken below minor support and is consolidating around the 30min 200MA. Trade Scenario 1: Bearish - We need to see price reject off the 30min 200MA and previous support zone around .7078 zone. Enter on bearish engulfing/variations Trade Scenario 2: Bullish - We need to see price break back above .7080 then make a HL at or above this level. Enter on...

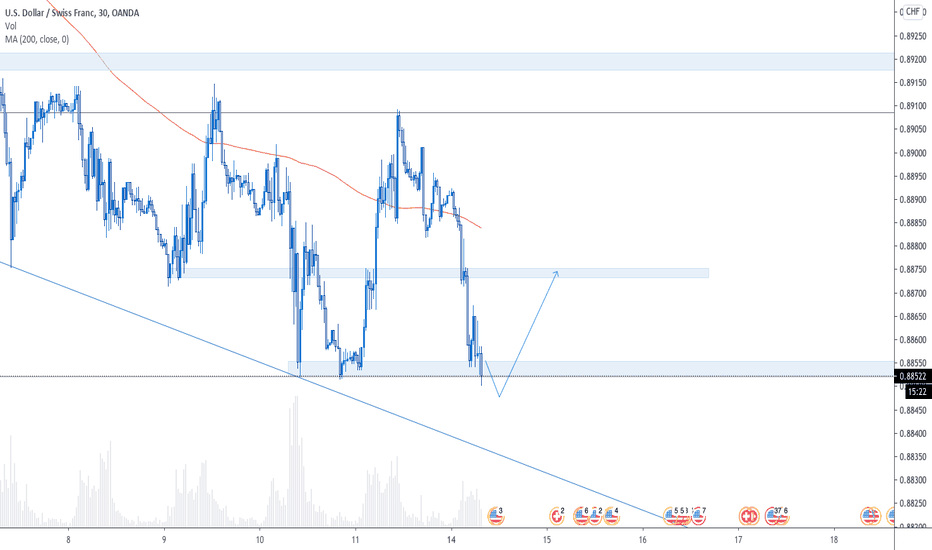

Trade Scenario 1: Price can find support here again and make a push to the upside to retest the 200MA on the 30min timeframe around .8875. We will look to enter on bearish engulfing/variations. Trade Scenario 2: We need to see price break below .8850 and come back to retest the .8852 zone as resistance. Enter on bearish engulfing/variations.

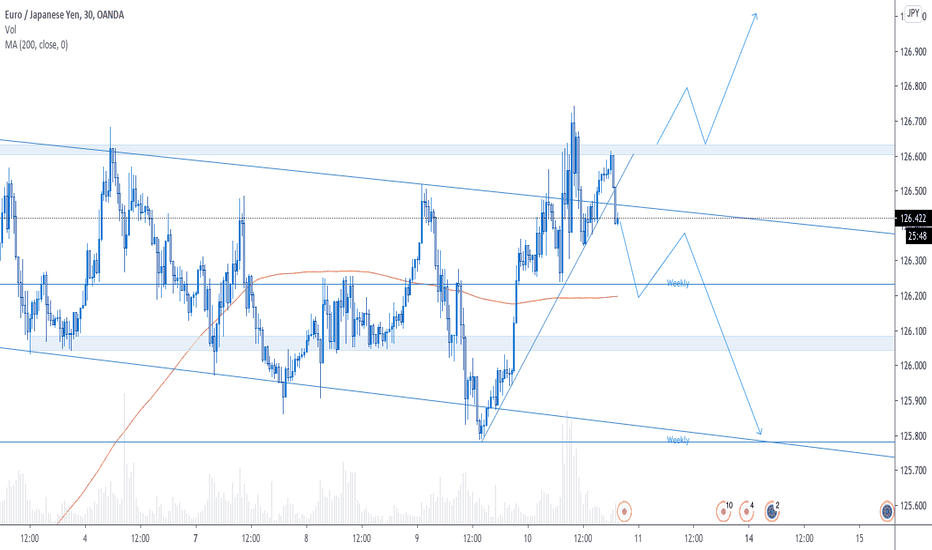

Price has pushed to the upside to start the week. We are waiting for a retrace back to the .382 fib or the weekly level around 126.23. Enter on bullish engulfing/variations. Target previous highs and -.272 level around 126.63

The weekly zone is still being defended at 139.50. Trade Scenario 1 - Bearish - We can enter on bearish engulfing at the 200MA on the 30min timeframe and target the current demand zone of 138.00. Trade Scenario 2 - Bullish - We can wait for a confirmed retrace back to the demand zone around 138.00. We will then wait for bullish pressure to form and enter on...

Price has been consolidating for the past couple of days and is forming minor support at 78.30 zone. Trade Scenario 1: Bullish - Wait for price to break out of the falling wedge. We can still see a possible retrace back to 78.30 again. Enter on bearish engulfing/variations. First targeting previous highs at 78.70 Trade Scenario 2: Bearish - We will need to see...

Price has respected the .618 fib level and previous structure. We need to see price retrace back to at least the .382 fib at 1.275 zone before looking short. Enter on bearish engulfing/variations.

We are bearish across all time frames but price is sitting at levels of support. We can see price respecting the 200MA on the 30min but we need to see price retrace back to .8875 handle before looking short again.

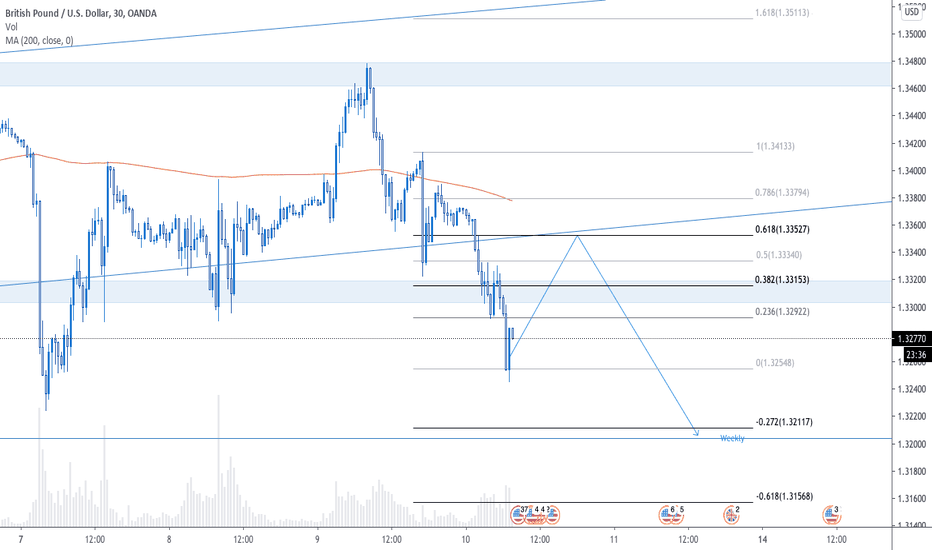

We see a ton of buyers step in to begin the week for GBP. Trade Scenario 1: Bearish - We are back in the supply zone and waiting for price to to form bearish engulfing/variations before looking short. Trade Scenario 2: Bullish - If we want to be patient for a long we need to see a significant pullback to at last the 1.340 handle. We will wait for a significant...

Price is still pushing to the downside. We are nearing a key support level and the 200ma on the 4h timeframe. Trade Scenario 1: Bullish - Enter on bullish engulfing/variations around the 138.00 zone. First TP target would be key weekly level around 139.400 Trade Scenario 2: Bearish - We need to see price pullback to at least the 30min 200ma, if not back to the...

We are looking for price to continue downward towards the weekly level and 200ma on the 30min around 126.20 zone. We will then look for a clear LH around 126.40. Enter on bearish engulfing/variations.

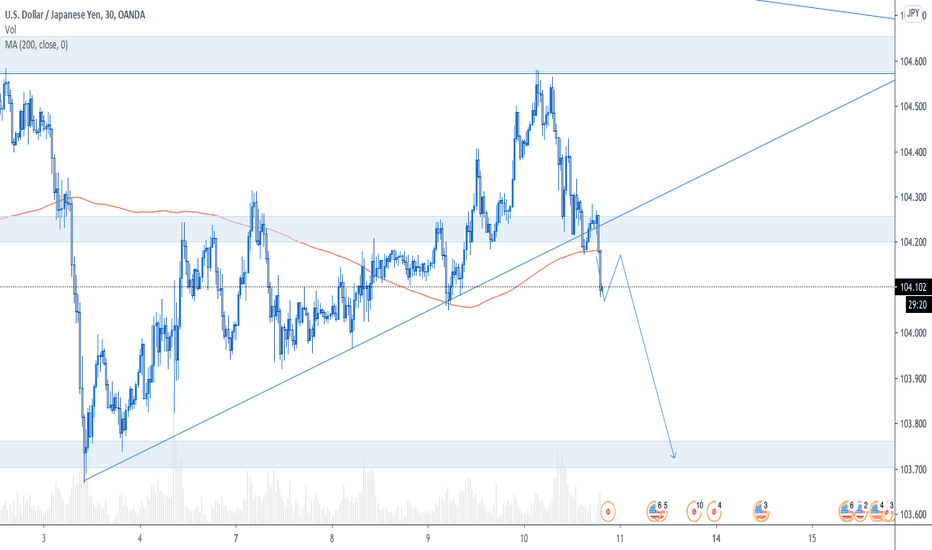

Price has just broken below our supporting trend line and the 200ma on the 30min timeframe. Enter now or wait for a quick retest of the 200MA around 104.180. First target is 103.75

Price is respecting the 200MA on the 30min timeframe as resistance. We are looking for a clear LH to form around the .618 fib level, previous support trendline, and below the 200MA. A lot of confluence in that zone of 1.336. Look to enter on any bearish engulfing/variation. Our first TP target will be the weekly level and the -.272 at 1.322

Price has come back to our weekly level around 104.57. We are looking for bearish engulfing here and more continuation to the downside. Our next entries will be a break and retest of our supporting trendline. Wait for price to break below the 200MA on the 1h timeframe. We will look for a clear LH there.

Price is respecting the range between 1.2825 and 1.2775. Trade Scenario 1: Bearish - We are looking for price to break 1.2770 with conviction and then wait for a retest of these levels. Enter on bearish engulfinig/variation Trade Scenario 2: Bullish - If we continue to respect this range watch for bullish engulfing here at 1.278. We can drop down time frames...

Price is rejecting off the 140.30 zone with strong bearish pressure, but price continues to make HLs. Trade Scenario 1: Bullish - We would like to see price retest the 139.30 zone again to form a bullish structure/double bottom. Enter on bullish engulfing/variations. Trade Scenario 2: Bearish - We need to see price break below 139/.30 with conviction. We will...

Price has retested previous resistance and the .618 fib level at 77.45 with good bullish pressure. We are looking for either a double bottom back to 77.45 or a quick break and retest above the weekly level and the .382 fib slightly above 77.60. Enter on bullish engulfing/variations.