GerryB

Looking at the indicators I observe a similar pattern as 20 May 2021. Compare the green vertical line to today on the daily. If I take the ensuing consolidation of approximately 1 month and bring it forward to today a possible further down momentum of 31% might be in play to a target of between $23007.04 and $21933.23. 1. The Trend is very low on the Trend...

Much uncertainty is an under statement looking at the overall market. Whether it's the regulatory processes underway currently and or other FUD bringing about extreme fear I still see a further possible short setting up. The market is out of wack and not syncing. The whale and institutional money are way above the current price indicating to me at least, that...

Looking at the overall sentiment and metrics I observe the following 1.The emotional index vs Price is Neutral. Indecision in the market. 2. The Long vs Short Trades favors the shorts although the trades in favor are quite low neutral, closer to the 'good long trade' position 3. There is definitely whale and institutional money flowing in waiting to buy the dip 4....

I am shifting my position into a possible long scenario based on 1. Overall Long positions vs shorts have increased, 2. We are holding the 50MA, 3. The Trend Exhaustion Indicator indicates a strong oversold asset, 4. The price vs Whale Money is starting a slight upwards momentum, 5. a similar pattern as 19 July is printing on the Heiken Ashi. I still believe we...

Looking at the Heiken Ashi model on the weekly printing shadows above and below is a sign of volatility while remaining in a downtrend sentiment although prices might fluctuate positively on the shorter timeframes. However, looking at the higher time frames I am suggesting that although the Trend is overly exhausted looking at the Trend exhaustion indicator, it is...

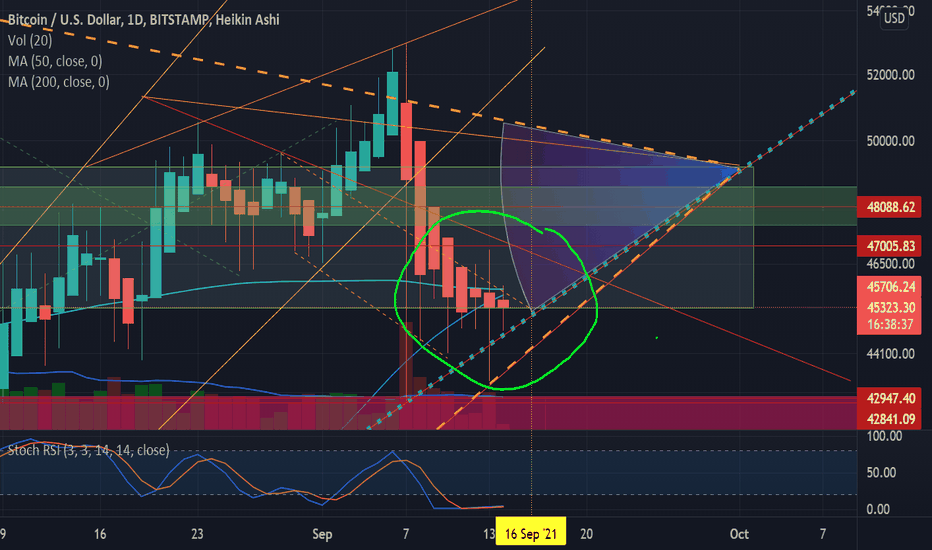

Maybe overstating my subject but it does seem, looking at the indicators I use, that on the weekly scale we can anticipate a strong move up How strong is debatable. Whale Money is below price and the Trend Exhaustion is nearing the bottom red zone. Using the Heiken Ashi along with these indicators suggest that a sentiment shift is happening favoring a long position.

Looking at the weekly indications we are in a Rising wedge which will eventually break to the downside imo. However the indicators are printing a possible relief rally within this rising wedge with the Trend Exhaustion touching the lower red zone. The Price vs Whale money flow shows that money is definitely flowing into a long position for now. The weekly candle...

Good day to all traders. ETH is still favoring a downtrend using the combination of Heiken Ashi, Tend Exhaustion and Money flow indicators. The vertical line I have printed provides a clear picture at this stage. Although ETH is trading slightly higher today it still correlates with the down trend using these indicators. Having said that and as the wedge is...

Eth seems to be in a possible bull flag currently drifting downwards. Using the Heiken Ashi along with the Trend Exhaustion and Price vs Money flow I am quit confident that we will see a further, although short, downtrend. The Whale vs Price indicator must be below the price for money to flow into a long position and the Trend lower or touching the red bottom...

Switching to the Heiken Ashi candles it is clear that the overarching trend, for now, is downwards favoring the shorts especially with the resent history of longs being liquidated. Ranging within the ascending triangle it is possible that the lower trendline will be tested before we see a move up within this triangle until a squeeze diverts the direction. If...

As we are ranging within a ascending triangle on the weekly it would be hard not to take major resistances into account. From a purely pattern standpoint it does not support major moves up. Looking at the Trend exhaustion we notice a potential move up as it has ranged at the bottom red section, however it seems as if the Price vs Whale money is flattening out and...

Good day all, It seems that on the larger picture ETH is within a larger rising channel. It has however fallen back into a narrower rising channel forming a rising wedge at its top. The 9 MA has crossed the 21 MA with a strong upwards direction with the 200MA currently supporting the rising channel and wedge. Volume has decreased slightly and continuance of this...

Using the Heikin Ashi candle there is no confirmation of a a trend reversal yet. The geen candles on the normal candle has no significance on the trend. We observe a flat top HA candle with a shadow below which is expected from this HN approach. Ons some wicks are formed above each candle it normally indicates indecision. However. We skould eait for a long green...

We are clearly seeing a sentiment shift on the Daily. The Heikin Ashi are still printing shadows top to bottom which indicates some indication. The next 1-2 candles needs a smooth bottom, without a shadow or wick, to confirm the Trend shift imo. NFT

It is clear to me that the Heikin Ashi candles has correctly predicted the sentiment shift on the Daily.

I am still of the opinion that the Heikin Ashi candles is printing a market sentiment shift indicated by 3 doji's on the daily. It might be a short term shift but printing non the less. It might just be enough to give the bulls the 50/200 cross.

Understanding Heikin Ashi candles provides a much smoother and clearer picture of the current sentiment and trend. With no to little shadows on the down trend it was clear that the overall sentiment was short term bearish (same with an uptrend). It is then possible when we see the shadows or wicks forming as doji's that there is a possible market sentiment shift....

Having plotted the blue dotted median awhile back as a trend indicator on which the 50 sms was leaning on heavily it would seem that this setup in some sense can be used for trend analysis. Using the Heikin Ashi the trend is red with stronger buy pressure on the daily. Although just slightly, but non the less. We are still ranging within the descending channel...