After finding value here @ $1.20. I had a quick look at the charts and sold @1.62. we either go back to $1.20 or have a sharp drop but quick and continue this trend. I'll be watching closely here. Like all new technologies some companies make it some don't. But for now charts indicators showing sell ....but I could be wrong

My 3 favourite Indicators have all aligned for Silver . 1. Price above 20MA daily 2. Stochastic RSI on the upside of momentum 3. Short over the long also the price is above 50MA daily, but on the weekly it is acting as resistance that has to break. anyway it is all looking positive for Silver price.

I thought the bitcoin run came to an end, but as I look at the chart I see momentum turning bullish again Stochastic RSI coming from an oversold area and plenty of upward trend to go. The MACD not quite crossed over but 5 days of buyers coming back. lastly a close above the 20MA looks like closing. The NVT only dip in the black for a short period so, By July we...

Currently XRP is my 2nd biggest Holding. to buy and sell back to BTC. If you look at coin market cap the USD BTC price are close and the Volume has picked up alot. I am expecting BTC to breakdown in price this week but Alts to make a run until mid june But XRP to be one of the best performing as already BTC already near 300% gains LTC 500% ETH 300% but XRP only...

Hi All I am back in continuation of my analysis using The bollinger bands to find the Bitcoin Bottom. Right now this may seem very unpopular but we still have an almighty chance of touching $1500 - $2500. I have added the NVT and MFI, where they seat today isn't pretty for the short/mid term of BTC. They are both extremely overbought. History shows us a major...

Looks like we have formed a higher low. When you look at the weekly chart you get to see the bigger picture. The stochastic RSI is oversold. Not financial advice but like the other top Alts ADA will be one of the best performing coins from until the cycle ends which is in mid June. The only concern here is that there is still room for prices to touch the...

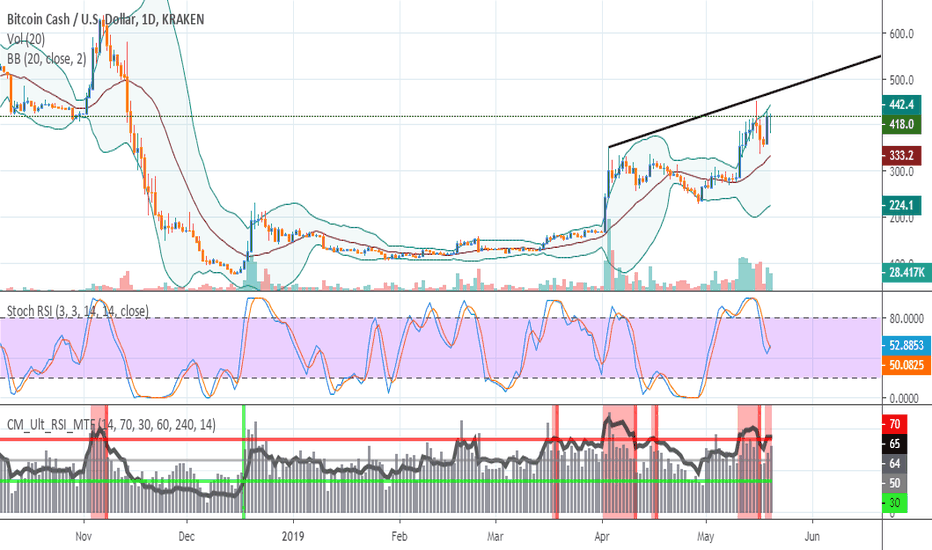

Price expecting around $550 - $600 solid buying while BTC is about to drop money should be moving to bitcoin cash as it is playing catch up. Bitcoin should drop to around 6-7000 before a short uptrend.

Daily - Looking for a Double top in the market, possible slightly up this week as StochRSI showing upward momentum A labour win will see this drop - possible market doesn't like change especially if a Government changes the market. Weekly- Stochastic RSI crossed below the 80 on the close Vix Fix showing a top RSI up high but not overbought yet

Now is a good time to scale into Tron if your looking to get in.

I look at the weekly for long term bullish against BTC, XRP showed on Sunday to many Buy indicators, moving away from oversold RSI, STochastic RSI and Bottom finding Indicator. They all aligned. Not only that on Coinmarketcap when ever the BTC & USD pricing collides a move up is imminent. We are close.

We have a very strong oversold indication on Ignis. RSI @ 27 Candle dropped below lower Bollinger band Stochastic RSI in oversold territory (Though give it 2 weeks or so and it will be better placed) Holding off for a couple of weeks than drip buying over 2 months from here would be better then to buy now. Along with IOTA Ignis best buy ATM

Here are the NEW rules 1. We only use Weekly chart for buy and sell signals BUY: Weekly candle must be above the 20MA Stochastic RSI upward but not above 80 MACD at least 3 histogram bars in a reverse swing buyers momentum if all rules are met buy on the week start Sell: Sell 50% if Stochastic RSI has been above 80 and drops below - sell into the 2nd...

The following rules would have generated $8,299,810.26 from $10000 instead of Holding $5,140,425 beginning from 17th September 2012 to now. 1st off I have to say this didnt take long to back test. It is pretty simple Here are the rules 1. We only use Weekly chart for buy and sell signals BUY: Weekly candle must be above the 20MA Stochastic RSI upward but not...

What was support becomes resistance. LTC has confirmed rejection from previous support trend line. Looking @ $44 as support here.

Looks like Creating another higher low here RSI turning around Stochastic RSI on the low side Has to break resistance at $0.46 for it to have any chance of ATH

The biggest Concern to EV's is that the Battery will not be reliable, especially in a country like Australia where you would need to drive long distances. However this Aussie Company Talga Resourses (TLG.asx) solution to infuse Graphene into the concrete to keep the batteries in your EV's charging while you drive.

I missed last week on purpose and will do it every 2 weeks until we get more of an accurate reading. As another week goes by The weekly Bollinger bands changed. It is lower than last results. We have a Bitcoin price $1928, However this depends if $4000 is broken, which is where the 20 Weekly MA is. A break below a 20 MA on the weekly becomes a bearish sign. If I...

Last week this Indicator (which provides change for the long term) has just signalled a Long Position to take. This is the 1st time this has triggered since October 2015 and we saw what happened then. A short position was triggered in March 2018. However now that has changed for the bulls. I am still expecting a 30 - 35% pull back, but after that it would be a...