Gold_Street

We see gold creating a strong support and a reversal pattern for a possible bullish momentu. With proper risk management we can have our stop loss at 3285

Bulls seem to have pushed gold from support and now have broken the upper trend line. W wait for retest of demand zone to stay long. We only look for buy opportunities if the support zone holds.

The new week opened with a gap which got filled then gold pushed to the upside breaking resistance. We expect retest of support to continue bullish.

We have seen gold consolidating and testing key supply zone multiple times without breaking it. Below, we still have the liquidity zones untapped. Possibly, we could see gold taking out the equal lows, tap the demand zone and keep with the bullish momentum.

Following recent news, gold has dropped massively. BUT... where's the turning point? We have the daily support... the only after the massive bullish move since a few weeks ago. Will it hold? With proper risk management you can monitor the support area to the consolidation zone below the support line. Let's see if it holds

A closer look at price action we see equal lows forming critical supply zone for bulls. Watch price take out the equal lows

We are looking for sells ONLY IF gold closes below support.This means a complete H&S pattern forming and one we close below support our stop loss shall be above right shoulder. Risk management applies

We caught 4 buy entries as gold took a turn to the upside and breaking the trendline.

Gold has recently closed below support on 1h and 4h time frame. Currently doing a retest and we could see sell opportunities upto 2910. The current swing low could hold as strong support for buyers.

Currently we have a range on higher time frame where Gold has a strong supply zone with equal highs and a demand zone with a swing low. Both sides are likely to be tapped with TP on the opposite side. The liquidity on both sides will give an idea of possible breakout side by which a trend will begin. Proper risk management is advised as both sides tend to be manipulative.

Observing gold at current high shows some strong consolidation going on and H&S on 1h. I'm going in with proper risk management as overall trend is bullish.

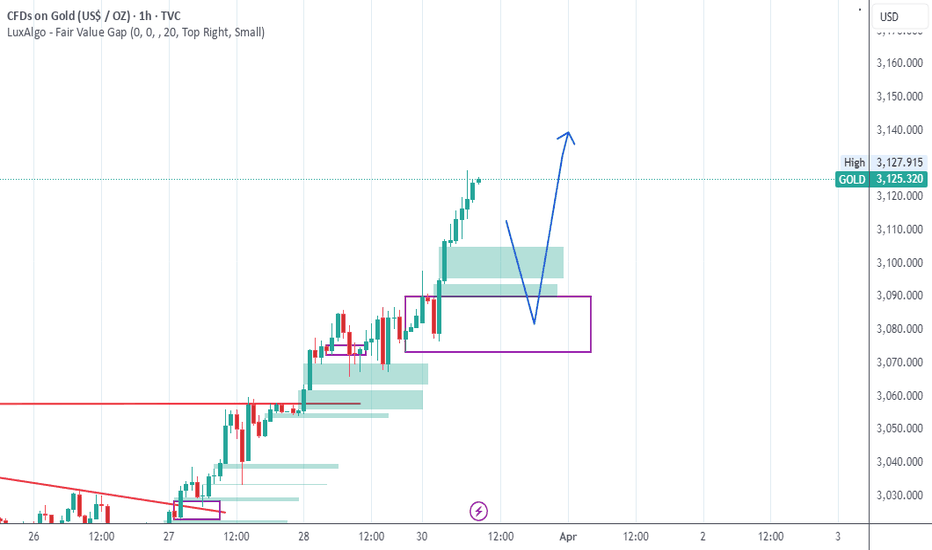

Gold reached all time high. Technically we could see some consolidation and a retracement before pushing further up. Proper risk management is encouraged as could be a volatile zone.

The bulls have kicked in and gold broke resistance on 1h and 4h. We wait for close of 1h candle atleast to confirm bulls have resumed. 4h candle close above structure will also be a strong confirmation for buy opportunities. Use proper risk management and find suitable entries based on your risk size.

Gold took out equal highs around 2720 on higher timeframes. This could act as a possible liquidity grab to go short and take out buyers. BUT... we can only watch the behavior at current high against the previous high as fundamentals are king. Technically, 2720 is a strong support and price can bounce to continue with up trend.

Risky trade. Gold has been pulling upwards creating higher lows untill yesterday when gold broke resistance on 4H and Daily timeframe. As we wait for NFP, we can almost tell what the outcome is likely to be but we need confirmation of NFP data first. Trade this zone with caution.

Let's keep watching this two zones. Would be perfect if it plays out and breaks the high.

Gold formed a double bottom on 1h and 4h as possible reversal to continue bullish as it initially broke the trendline resistance. Once the double bottom and W is complete, next step is to see the previous high taken out then we could continue bullish. For entries, enter at the retest of neckline and add entries once previous high is taken broken.

Gold has recently formed a double bottom on 1h and 4h respectively. After breaking resistance on the trend line above, we saw a retracement which could be a reason for buys. BUT... we wait for the W pattern, double bottom to complete and we can buy with proper risk management.