Price is approaching key support zones that previously triggered impulsive rallies. Oscillators are flashing a potential bullish divergence, and the $2.00 level stands out as a short-term demand zone. 📌 Scenarios: — Scalp Long Setup: Reaction off $2.00 with a tight stop below the recent low. Suitable only for short-term trades or scalps. — Swing Buy Zone: Sits...

After a 400% monthly rally, price is now testing major resistance at $0.93–$1.00, which aligns with: — Monthly supply zone — Psychological level at $1 — Key breakdown structure from earlier 📌 Key observations: — First retest of the level that triggered the previous collapse — Signs of local weakness on the daily TF after tapping resistance — Untapped D1 order...

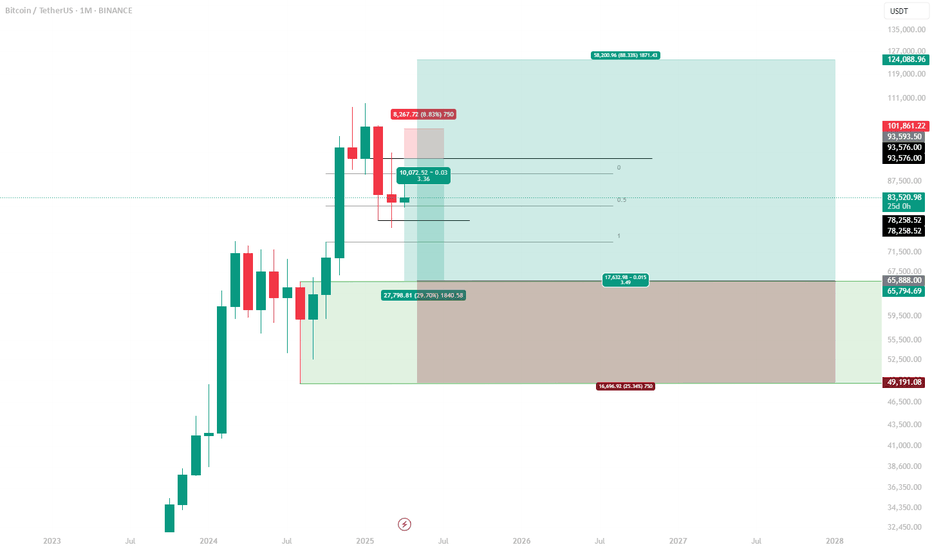

Bitcoin continues to respect the trend continuation structure, following a textbook pattern: 🔴 Retest of previous highs → 🟢 Local bottom formation on former resistance → 🚀 Trend continuation. 📌 On the chart: — Every new high gets retested, forming a solid base. — The most recent ~ FWB:73K level has held — local bottom confirmed on April 7. — One more leg up...

Technically solid setup for BINANCE:HBARUSDT : 🔸 Consolidation after Nov-Dec rally at key Fibonacci support. 🔸 Local accumulation above daily OB suggests reversal strength. 🔸 Bottom structure forming, awaiting confirmation. 📈 Trade Plan: Long entry upon strong reclaim above $0.20. Targeting $0.28–$0.30 with momentum. 🛑 Invalidation: Drop below $0.18 with...

Whales are quietly stacking SEED_DONKEYDAN_MARKET_CAP:IMX tokens despite recent price dips, accumulating over 4.55M tokens in the last 3 months. The recent closure of the SEC investigation into Immutable significantly clears regulatory uncertainty, boosting institutional interest. 🚀 📌 Key Insights: Significant whale accumulation indicating bullish...

On the 12H timeframe, BINANCE:WIFUSDT is attempting a clean S/R flip upwards. 📌 Key support: $0.52 zone. As long as it holds, bullish bias remains. 🎯 Target: $0.70 ❌ Invalidation: Loss of $0.52 support and close below. Quick scalp play—watch closely how the price reacts at support!

New safe setup based on fundamentals & market structure. 🧠 Ethereum is still the market’s tech locomotive — accumulating capital, awaiting major updates (ETF, staking, etc.). Entry: $1,600 DCA: $1,155 Estimated liquidation: ~$790 ⚙️ Execution: 30% at market 50% limit buy 20% margin addition 🎯 Take-Profit Strategy: TP1: $2,066 (+78%) → 20% TP2: $2,486...

Still watching patiently. 🔹 Price has broken the parabolic downtrend, but no confirmation of reversal yet. 🔹 AO (Awesome Oscillator) is printing a clean bullish divergence — first signal of momentum shift. 🔹 We’re sitting just above the Point of Control (POC) — the area with the highest volume traded. 📌 My preference: Would love to see a final flush sub-$0.10...

📉 BINANCE:AAVEUSDT | #2h Bottom Formation Watchlist #long 💬 Scanning altcoins for base-building signs after the markdown phase — EURONEXT:AAVE is one of the more interesting setups on radar. 🔍 Key Observations: — Price is hovering near a major support level — Current bounce looks corrective, not impulsive — No clear bottom structure yet — watching for...

Context: After a clean fakeout below the green demand zone, KUCOIN:HYPEUSDT reclaimed structure and is now holding above the range low — potential start of base formation before trend shift. 🔍 Local Range Setup: ✅ Fakeout confirmed ✅ Reclaim above range low 🎯 Next: Retest of red supply zone ($18.9–21) on the table 📌 Trading Strategy: — Waiting for potential...

Current Setup: We’re still under pressure post-structure break, but price is hovering above the previous ATH zone — a key high-range level that defines what comes next. 🔍 Why this zone matters: If it holds — we’re looking at a potential continuation of the macro bull cycle + altseason ignition. If it breaks — expect deeper correction and a long grind back up. 📌...

🔹 Bitcoin just printed a bullish RSI divergence on the 3-day chart. 🔹 Price is making lower lows while RSI is pushing higher — a classic sign of fading bearish momentum. 📌 Key observations: — $78k support continues to hold despite aggressive selling pressure. — RSI divergence signals potential reversal — or at least the beginning of an accumulation phase. — Even...

Despite aggressive downside on CRYPTOCAP:BTC , CRYPTOCAP:ETH is holding up structurally — price remains within the well-defined range, with a clear demand zone (highlighted in green). 📌 Key notes: — CRYPTOCAP:BTC ’s Monday high deviation + daily selloff is increasing market-wide risk. — However, if CRYPTOCAP:BTC holds above $74k or reclaims it fast, ETH...

The H12 bearish OB has been broken and now acts as a bullish breaker — a shift toward a more bullish market structure. Currently forming equal highs just below the lower H12 swing high — potential liquidity trap setup. 📌 Potential setup: — Sweep above local highs → retrace into the H12 bullish breaker — Support near the range low ($10.7–12.0) could offer a long...

Price holds above the February low — a level tested during peak macro/trade war pressure. Buyers have been defending the ~$78k zone for 40 days. 📌 Key Observations — The recent breakdown below $78k was a fakeout: quick reclaim + strong daily close = bullish daily block — Currently consolidating above that block — a bullish sign. 🎯 Trade Plan ✅ Long: If price...

Position looks solid here: ✅ Entry zone: – Bottom Retest of the log channel (green support) – Clear bullish RSI on 3D TF 📌 Structure: Trend still bearish overall, but short-term bounce odds rising. Invalidation = below channel support. 🎯 What to watch: – Hold zone + volume pickup = demand confirmed – Break of local high → possible move toward upper channel...

Strong support confirmed above $80–82K. Market structure points to $95K next — but don’t ignore what happens after. Analysis: 🔹 Holding above $80–82K = major support (50% monthly FVG + yearly VAH) 🔹 Next upside magnet: $95K — likely first-touch rejection 🔹 Break and hold above $100K = bullish breakout, invalidating bear scenarios 🔹 Rejection at $95K → potential...

BINANCE:ENAUSDT is showing signs of a potential reversal. Price just swept local lows into a 1D FVG zone — now we watch for confirmation. Setup: 🔹 Price tapped into daily imbalance (1D FVG) 🔹 Structure forming around key trigger: $0.369 📌 If the daily candle closes above $0.3692, a bullish reversal gets confirmed 🎯 Target = $0.70 — major liquidity zone &...