GunMoney

Called this sell-off, support, and bounce perfectly so far. Let's sell-off into the weekend then we SOAR!

Bitcoin has broken above an 11-month old trendline that starts from ATH back in Nov 2021 and uses the April/May 2022 top as resistance. One more small sell-off (maybe) and it's a pump to $30,000....

I don't really want to spend too much time on my reasoning. But I will say this: - biggest wealth destruction in modern history already occurred - midterm election year, generally quite bullish - crypto market still holding 200W MA - short-squeeze, retailers have piled in short (behind the pack as usual) - consumer sentiment at ATL Long-story short, 2022 been...

Just a hunch. The "emergency fed meeting" this week will create some bullish optimism and pull markets out of this tailspin (stock indexes at least, crypto and metals holding), which will in turn pump us out of theses bottoms, but not before complete terror takes the first half of this market as stocks ending the quarter barreling down. But, retail is broke, and...

Finally looks like silver is basing and maybe setting up for a long trade. Bottom digging in well, global economy in a tailspin. 61.8% fib retracement from March 2020 bottom. $18 resistance now support. I waited patiently for this set-up, 10 months to be exact. I think my "long miners" has almost arrived.

CPI comes out Monday and if it continues to downtrend its blast off. Double-bounce off 200W MA, deploying longs…

Gold and silver are not looking good, and the momentum is barreling downhill fast. Chance of quick and powerful reversal in 2022 almost non-existent. Looks like crypto and stocks will reign supreme at least through Q3 2022, then start to see some weakness heading into Q4. Around October 28th we'll likely start seeing some crazy price action, maybe large selling...

The VIX has gotten the SQUEEZE. No idea to predict which way markets go. We either get squeezed hard and the VIX erupts, sending us into what will likely be a mega capitulation sell-off where stocks and cryptos get annihilated. Or, some amazingly good news comes out of the blue and markets surge and pump hard north. Wow, just wow, what a crazy intersection...

It seems we may have formed a temporary bottom in crypto and stocks. A good surge takes JASMY to 200D MA, or just around $0.03. A 200% increase from my buy yesterday at $0.01. RSI shooting up, MACD oscillating bullish. Could be a 3x in 3 weeks trade....

Bitcoin is WAY "oversold", weekly RSI is the lowest ever. We're on (below actually) 200W MA which is historical support. Yesterday the "fear index" was 7. Today, it's 9. Markets have priced in a recession, yet we're not even in one yet. Summer bounce possible, likely even, don't sell the bottom... but be prepared for anything.

Title and chart says it all. If we get any upward momentum here this week the resistance will be very challenging to overcome. But some alts may pump huge.

There is nothing but empty space below really until the low teens. Good luck!

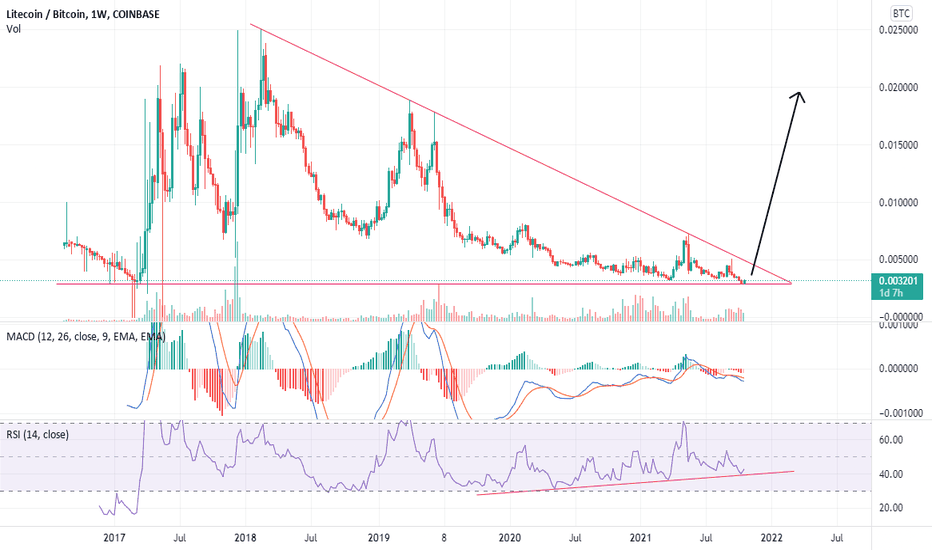

Litecoin, quite the sob story for the past year. Despite many if not most tokens sitting well above ATHs from 2017 LTC is still well below. But is it about to turn and rip?! Against 2017 LTC:BTC price ratios, LTC *should* be around $1200 currently, but yet it sits around $200. The fact the there are now more LTC wallets active than ETH wallets :...

We're likely going to pick a direction, with force, soon...

This stock has so much potential, I've been in for a while but may go in significantly heavier if we break north of this pattern. Rising weekly RSI. NFT partnerships. AR app ARKnet which has mega potential. This may be a unicorn in the making.

The chart explains a possible outcome in the coming week or two. Odds of happening exactly like this are slim. But, it's fun to play with TA :)

I've been bullish on individual tokens, but after taking a step back I think I'm going very defensive on crypto and stocks. With the precarious nature of markets right now (war in Europe, decade high inflation, recovering from a once in a century pandemic), it's not going to take much to torpedo stocks and crypto. The chart lists some bearish traits, on the...

Some major bullish factors for ETC: 1) Mystique hard-fork solving the double-spend issue and strengthening the chain back in February 2) The "fifthening" in 2 days (April 15th), block reward cut by 20% 3) ETH live testing (ghost network) PoS chain right now, target date for complete implementation June, miners likely switch to ETC en masse. 4) on ETC:BTC pair...