CAPITALCOM:GOLD h2 timeframe Gold pair analysis for today 23 April 2025 Gold analysis based on Elliott Impulse wave and Elliott Triangle Wave We first consider the (1 to 5) Elliott Impulse Wave which succeeded in going up from the bottom. Now we will consider the (ACBDE) Elliott Triangle Wave for the coming days which indicates going down from the top to 3050....

Analysis of the BTCUSD pair for today, April 22, 2025, btcusd formed a double bottom in the previous day, which the market bounced off and went up, then bounced back up from the sideways chill, but I analyze it going to 94000 we consider buying Entry 88.350 TP 94.000 SL 86.000

Gold pair analysis for today, March 25, 2025 Pattern: Double Bottoms appear in a downtrend and reverse it to the upside as price breaks through the resistance line. It is considered a bullish reversal chart pattern since the price holds a low two times and eventually continues with a higher high. The bounce between the two lows should be moderate. Support and...

BTCUSD H1 timeframe. we are looking at a trend line going from top to bottom that has seen a bullish breakout indicating a trend, on the other hand, the upside liquidity has also broken out, indicating that Bitcoin is showing a bullish trend, we would consider buying. BITSTAMP:BTCUSD Entry Buy level: 85,200 TP: 88,000 TP: 90,400 TP: 92,700 SL:...

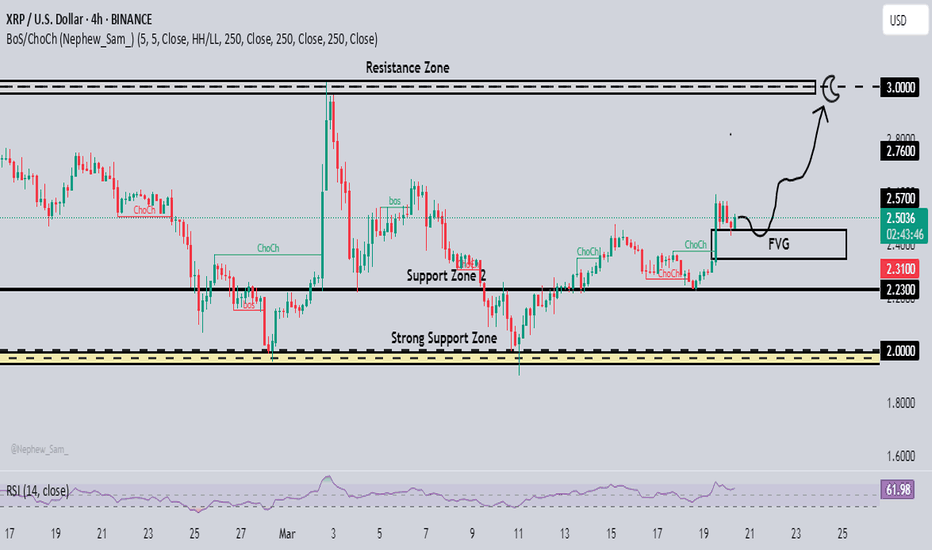

BINANCE:XRPUSDT My Analysis XRP vs US Dollar shows a candlestick chart for XRP, a common tool in financial trading. It highlights support and resistance zones, which are key concepts in technical analysis. Key Points: First we look at the RSI which is hovering around 62.70 indicating an uptrend. On the other hand we look at Support and Resistance. Strong Support...

CAPITALCOM:GOLD On the H1 timeframe, if we consider the line going up from the bottom to the top, it indicates an upward trend. On the other hand, the RSI, which is struggling to rise again from the 70.00 level, is in a trend according to my analysis and we would consider buying. CAPITALCOM:GOLD Gold Buy Entry Level: 2992 TP: 3000 TP: 3010 TP: 2025 SL: 2975

BITSTAMP:BTCUSD On the H1 time frame, if we consider the trend line going from top to bottom, which indicates a bearish trend, on the other hand, the RSI is currently at 47.98, indicating a decline below the midline. In the past, it has been moving sideways for a few days, which turned upward. Where there is liquidity on the upside, this also shows that Bitcoin...

FOREXCOM:EURUSD Charts using candles. Price fluctuations are displayed within a specific time frame. This analysis covers a 1-hour time frame Support and Resistance Zones: These are marked areas where the price is likely to find support (bounce up) or resistance (down). Key levels: Strong Support Zone : 1.06800 Support Zone 2: 1.07670 New Support Zone 3:...

CAPITALCOM:GOLD H4 Timeframe. My analysis shows a candlestick chart for gold (XAUUSD) against the US dollar, a common tool for financial trading. It highlights support and resistance zones, which are key concepts in technical analysis. Key points: Strong Support Zone: 2935 The price has previously bounced off this level, suggesting buying interest Support Zone...

CAPITALCOM:GOLD today is CPI news for gold, I have made an analysis on the H1 time frame. First look RSI has reached the 54-00 level twice next RSI to 35.00 level which shows bearish. According to my analysis, this is bearish We consider selling. Gold selling entry point: 2917.97 Target: 2895 Target: 2870 Stop loss: 2930

CAPITALCOM:GOLD today is NFP news for gold, I have made an analysis on the H4 time frame. We consider the resistance and support seen on the chart, which is Strong Resistance, RSI has reached the 50-00 level twice, which shows bearishness. According to my analysis, this is bearish and gold will go down. We consider selling. Key Levels Resistance: 2947 Support...

BITSTAMP:BTCUSD On the h1 timeframe If we consider the trend line going from bottom to top, which indicates an upward trend, on the other hand, the RSI, which has not fallen below the midline, also seems to indicate that bitcoin is showing an upward trend, and we would consider buying. Key Levels Hourly - RSI : 58,54 Hourly - Support : 89,100 BTCUSD Buy Entry:...

CAPITALCOM:GOLD Hello Traders New Update on the H1 timeframe look at the fibonacci Retracement, which has crossed gold 0.618 fib level, which indicates a bearish trend. on the other hand, the double top pattrern a bearish. we consider selling CAPITALCOM:GOLD Sell Entry Point: 2915 Target: 2902 Target: 2885 Target: 2862 Stop loss: 2934

BITSTAMP:BTCUSD H1 Timeframe There is an Elliott Correction Wave in the H1 time frame which indicates a bearish trend and we will consider selling Btcusd Sell Entry : 93,118 Target :91,150 Target :87,000 Stop loss: 94,600

OANDA:EURUSD Hello Traders Eurusd has got Rising Wadge pattern on H4 time frame which shows bearish as per my analysis it is bearish and on downside we consider sell. Entry Point: 1.04630 Target: 1.04000 Target: 1.03000 Stop loss : 1.05400

BITSTAMP:BTCUSD I have been analyzing on the H1 time frame since the fair. If we look at the chart in the BITSTAMP:BTCUSD H1 time frame, we can see a bearish train line that indicates a bearish trend, while on the other hand it shows that the supply curve will take some time to move up, and now that BITSTAMP:BTCUSD has reached support, we will consider...

BITSTAMP:BTCUSD h1 timeframe first look Uptrendline that indicate a bearish trend ans will continue its downward trend again. We can only consider selling BITSTAMP:BTCUSD SellingEntry Point: 99,488 Target: 96,000 Target: 91,000 Target: 84,000 Stop Loss: 102,000

CAPITALCOM:GOLD H1 Timeframe Gold is trending higher in the H1 time frame. If we look at the bottom up trend line which shows bullish trend, on the other hand there are Moving Average Convergence Divergence which points up as per my analysis we will consider to buy. GOLD Buy Entry Point: 2914 Target: 2926 Target: 2945 Stop Loss: 2897.5