Is it possible that the Euro may need a little consolidation against the Japanese Yen? Or will investment in the euro increase?

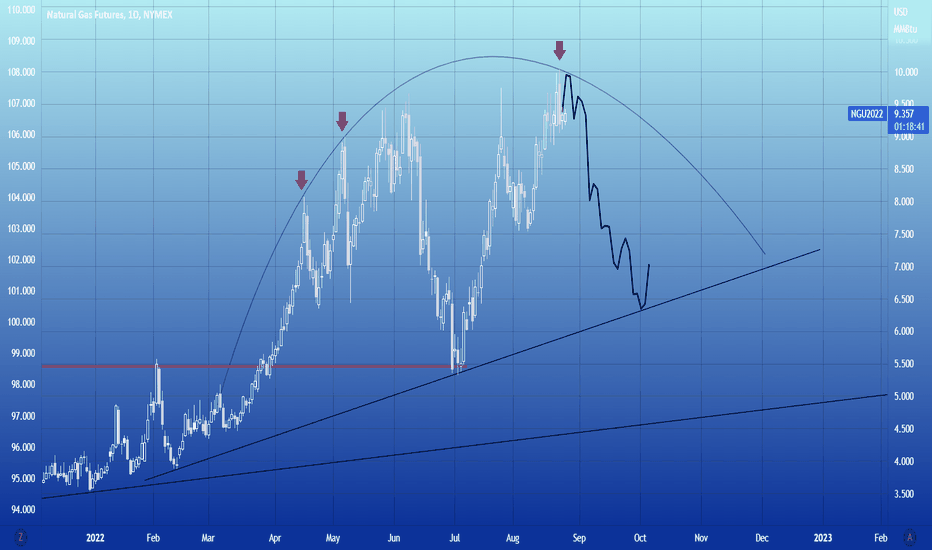

I always think it's great to look at the screen in the evening until you notice the patterns. In this example, however, I find this not so uninteresting, as gas prices will also fall due to the rising dollar. Perhaps a brief cooling of inflation. Definitely not an easy topic. Your opinions?

Not a meaningful analysis but a very interesting pattern. You should definitely still pursue.

Macroeconomically very clear: When the dollar gains strength, it is the market that anticipates. When interest rates are raised, it is the market that suffers first. the other way around, it is the market that benefits first of all. So much for fiscal policy influences. Perhaps it is still very interesting to consider how the chart is to be viewed for the...

In fact, that view is one I'd rather favor on my latest crude oil idea. For whatever reasons? Very easily: - Especially since it has been empirically proven in the past that when the USD strengthens, resource and crude oil prices weaken. - an effect which has not yet occurred due to the Ukraine purchase shock and the inflationary pressure. Consolidation has so...

This is actually not a forecast that I would fundamentally agree with, but I just find it very interesting. Perhaps this is a scenario in which inflation levels off over the years and then strikes again with new magnitudes. Like I said, it's just a thought. What are yours?

As in the previous move, if the US Dollar continues to strengthen, it will continue to weaken the market. My problem with this is that while the central banks are trying to bring inflation down with a stronger dollar, doing so when your own country is in debt can be quite dangerous. As a reminder, the current debt level in the United States is estimated at...

In response to the Corona Crash, the Trump administration immediately lowered interest rates to the lowest level. The economic consequences of this are still having an impact. In addition, to combat historically inflationary conditions, interest rates are being raised faster than ever before. This is very interesting to look at analogically. When the market...

At the last hour of the evening a pattern for the coming week. Do you think this is a bearish triangle or an upward trend channel up to the upper trend channel mark. It will definitely be interesting what the coming week will bring.

Here you can express yourself very simply without going beyond the scope: As long as interest rates are raised, Bitcoin (and thus the rest of the crypto market) will be affected by liquidity withdrawals. Furthermore, I find that this is also a good indicator. Do you have an opinion? I would like to be interested!

I think one of the most asked questions right now is how things will continue after this week's bear market rally. There are always two things to keep in mind: 1. The environment determines the market & 2. The market is pricing in news. As I'm not a fan of writing doctoral papers on Trading View, I'll summarize the main points for an easy overview. On a...

Whats up guys. When I took a look at the Russel 2000, I noticed this interesting downtrend. Consisting of a primary and a secondary resistance line. Therefore, if we break through the first, we still have the second burden ahead of us. As long as we are still in this trend, the bear market will continue. From my perspective, I don't think it's at all unlikely...

If the chart technical pattern is correct, we could see turbulence in the market again in the near future. It cannot be ruled out given the international situation. The question is what should also happen that the market hasn't priced in yet. What are your thoughts ?

Nothing to see here. Just a normal Head and Shoulders formation on Ethereum. Your thoughts ?

With the attack on the Ukarine, gold prices hit the old peak from Corona August. After the last interest rate hike was announced, there was a series of consolidations on the commodity markets. Including the gold and silver prices. Unlike the gold prices, the silver prices have hit an important support line, which I will also provide an update on. Nonetheless,...

The question is what will happen that will bring the euro to its knees so much to the Swiss franc. Your thoughts?

After the next rate hike was confirmed for May, commodities and equities alike took part in a sell-off. Copper, like silver, was very volatile. However, I think that the next interest rate hike has already been priced into commodity prices. The reaction to the Ukraine invasion has been sold off again and is again reaching the pre-level. From a technical point of...

I will keep it simple: - Strong support - Geopolitical Situations - Inflation - Gold / Silver ratio - Strong CRB Commodity Index All in one: Commodity bull market going through next round. If you want anything to add please write it in the comments. ▼ Thank you for your attention. TVC:SILVER