Iapiew

This is entirely based on speculation and not an analysis. With an inverted head and shoulder formation in the coming weeks will be comforting news for the crypto peeps. RSI & MACD aligns with the view of weakening bull ahead and possibly a bear emergence. July, August, September are likely to be tough to the stock market. Historically and situationally, the...

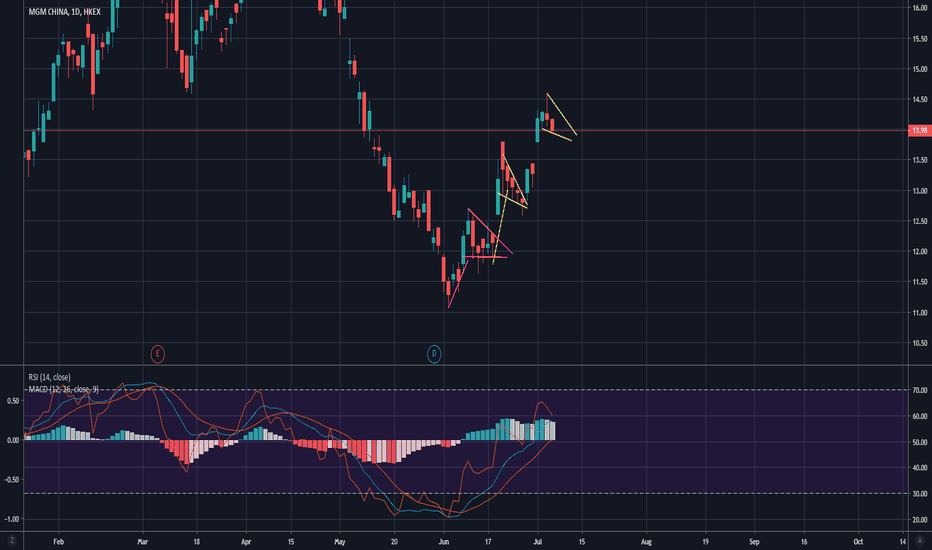

I am seeking alternative views and opinions on this. I see a head and shoulder formation forming right after a head and shoulder formation. Current price is positioned at the key resistance neckline of both formations. Let me know your views on this! Iapiew

If the cycle were to repeat itself, NEO is set to have a good run. With an average of the (both) historical "good" run, NEO is set to have a bullish run for the next 170 days (based on extremely vague assumption). RSI & MACD (Both daily and weekly) aligns with this good sign. One way to make sure that the trend is on track is through the parallel channel band

AMD shows energy, still. Prices remain very disciplined within the parallel band and it retracts whenever the upper band is tested. Based on the Fibo Retracement, a drop in the prices back to the strong support line of 0.382 will be a great time to enter. This is expected to come between now and the next two/three weeks. Allow the bull to tuck in before the...

Still a relatively unstable stock in general of approximately 40 days of stability before a drastic change in price. the stock is still trending downwards within the parallel band. 75 remains as a strong resistance line which can become a strong support line after a breakthrough. A confirmation of breakthrough out of the band will be a great indicator of...

Not a good time. Stock remains very range bound and is sitting on the 50% range of the band. While MACD & RSI remain in the positive zone, bull energy appears to be lowering and it expected to head downtrend in the short term if MACD & RSI head into negative territory. $60 remains as a strong resistance and support. If stock price is able to float around...

More to come. Entry now will be a form of gamble as MCOUSD continues to show downside trend within the resistance band. MCOUSD is holding strong to 50 SMA but a break below this will means the next strong resistance line will be tested. Wait a little more before entry will be a more rationale position

Triple bottom has been breached and this is an indicator of economy enter into the downhill. Governments across the globe are already ready or has started pumping money into their economy to support the impact of the virus. Strong resistance line of the triple bottom formed by US 10Yr Yield has been breached, mainly fueled by economy greatest enemy - fear....

Potential Head and shoulder formation

Fundamentals vs Technicals Fundamental mover ahead: US Payroll result on Friday affecting global sentiments Technicals Bullish Flag formation

Wynn Macau Ltd HKG: 1128 Fundamentals: Since 2018. Wynn Macau is one of the one casino in Macau to capture most of high-roller gambling activity, consistently leading Macau on the VIP drop. Galaxy and Wynn contributed to close to 45% to the VIP volume. Why VIP Volume? Investors place heavier emphasis on main revenue driver, revenue numbers, which are mostly...

Prior to trade talk resumes, Nvidia is seen here to be expected to consolidate further before it bulls run. US Recession signals are still being digested by the market as 3 month and 10 year yield curve inversion leads to global equity sell off. US Tech industry is expected to further consolidate as markets anticipate the outcome of trade talk. Trade talks have...