The U.S. Dollar Index is neutral on its 1D technical outlook (RSI = 48.335, MACD = 0.03, ADX = 16.853) as it took a turnaround on the HL trendline of the 2 month Bullish Megaphone. The 4H MACD will form a Bullish Cross today and once the 4H MA50 breaks, we will have the buy trigger for the new bullish wave. We expect this to test at least the LH trendline (if not...

The Crypto Total Market Cap excluding the top 10 coins hit this week the 1W MA200 for the first time since the week of the U.S. elections in early November. Last time that was a huge buy entry. One more rebound here will be in our perspective the decisive one to start the usual Altseason of the last year of each Cycle. A +931.44% rise as in the last Cycle would...

Super Micro Computer Inc turned neutral on its 1D technical outlook today (RSI = 51.775, MACD = -1.260, ADX = 17.645) as it crossed over the 4H MA50. The 4H MA200 remains the long lasting resistance ever since the July selling commenced but the recent 2 month Channel Down looks like the right shoulder of an Inverse Head and Shoulders pattern. If it is that indeed,...

WTI Crude Oil is bearish on its 1D technical outlook (RSI = 40.837, MACD = 0.030, ADX = 37.618) which is natural as it's trading inside a Channel Down. The pattern formed a 4H Death Cross yesterday and even though it's technically bearish, the last time it was formed (October 24th 2024), it marked a bottom 4 days later. The bottom was formed on a HL trendline and...

S&P500 is neutral on its 1D technical outlook (RSI = 53.735, MACD = 16.510, ADX = 17.690) as it just crossed over the 1D MA50 again and after a 1D MA100 rebound remains relatively low inside the Channel Up pattern. The 1D RSI is also bouncing on the S1 level, where the September 6th 2024 bullish wave originated and reached the 1.786 Fibonacci extension. That is an...

Nasdaq is neutral on its 1D technical outlook (RSI = 52.467, MACD = 38.030, ADX = 17.154) since the index has been consolidating for the past 6 weeks. This offers great opportunities to buy low and sell high. At the moment the 1H RSI oversold bounce indicates that we has started a similar Channel Up so Jan 13th and Jan 27th. The symmetric RSI level suggests that...

EURUSD is neutral on its 1D technical outlook (RSI = 49.247, MACD = -0.001, ADX = 21.205) and just formed a 4H Bullish Cross between the 1D MA100 and 1D MA200. This hasn't had a bullish effect in the past 12 months as the two times we saw it in 2024, it immediatelly market the top of the short term trend and caused pull backs to at least the 0.618 Fibonacci level....

Gold has turned overbought on its 1D technical outlook (RSI = 74.055, MACD = 39.900, ADX = 58.383) and even though the long term trend remains bullish and that shouldn't affect it to a great extent, a short term Bearish Divergence on the 1H RSI (LH) and the fact that the price hit today the top of the 1 month Channel Up, calls for a quick sell. The two +4% bullish...

Bitcoin is on the most desirable buy levels long term as apart from only being neutral on its 1D technical outlook (RSI = 47.257, MACD = 281.800, ADX = 29.399) it just validated today the enormous buying zone that was waiting on the 1D MA100. This is a level that has worked as a buy entry over and over again these 2 years of the Bull Cycle. The last time it did...

FARTCOINUSD is about to turn neutral on its 1D technical outlook (RSI = 43.244, MACD = -0.099, ADX = 22.114) as it is approaching the 4H MA50. This is a little under the top of the short term Channel Down and is where the last sell signal flashed. Consequently it is a technical sell entry to target near the S1 level (TP = 0.55000) but tight SL needed. The reason...

Dow Jones just turned bullish on its 1D technical outlook (RSI = 56.676, MACD = 255.440, ADX = 30.051) as it hit the 4H MA50 after an instant rebound on the 4H MA100 inside the same session. This is a strong bullish reversal but the buy signal will be validated if the price crosses over the 4month Rectangle pattern. The rally from its January 13th bottom has been...

Natural Gas is neutral on its 1D technical outlook (RSI = 47.119, MACD = -0.072, ADX = 39.523) as the bearish wave of the long term Channel Up found support on its bottom and the 1D MA100 and is rebounding. It hasn't yet crossed over the 1D MA50 but when it does the bullish signal will be validated. On any occassion, last time the 1D RSI rebounded near this level,...

The Coca-Cola company just turned bullish on its 1D technical outlook (RSI = 56.409, MACD = 0.210, ADX = 24.907) as it crossed over the 1D MA50 following a clean HL at the bottom of the long term Channel Up. The 1D RSI is already on a bullish divergence and this validates technically the start of the new bullish wave. The previous one increased by +42.18% so a...

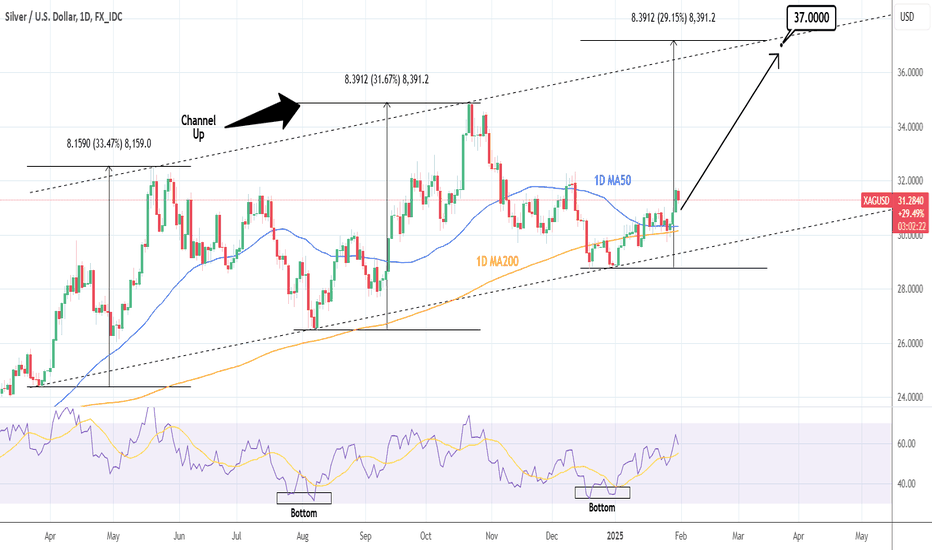

Silver turned bullish on its 1D technical outlook (RSI = 59.696, MACD = 0.197, ADX = 24.838) as it has validated the start of the new bullish wave of the long term Channel Up. The price has been detached from the 1D MA50 and is approaching the December 12th high. The 1D RSI is expanding a rebound from a Double Bottom much like Silver's previous low on August 7th...

Pepe is still bearish on its 1D technical outlook (RSI = 42.958, MACD = 0.000, ADX = 31.752) despite today's rise as the price remains close to the bottom of the 10 month Channel Up. Still, the 1D RSI just got oversold and immediately rebounded, which is what happened on the August 5th 2024 bottom that gave rise to the new bullish wave. Both prior bullish waves...

AUDJPY is neutral on its 1D technical outlook (RSI = 45.920, MACD = -0.220, ADX = 20.692) as it is trading inside a Rectangle pattern. The price hit the pattern's bottom yesterday and today is rebounding towards the 4H MA50, already hitting the 0.382 Fibonacci retracement level. Such rebounds have always reached the 0.786 Fib at least, so with the 4H RSI also...

WTI Crude Oil is neutral on its 1D technical outlook (RSI = 46.798, MACD = 0.400, ADX = 43.927) as it hit the 1D MA50 and so far it is holding it. The correction of the past 2 weeks has been significant but the 4H RSI is posting a bullish divergence on HL and we might be technically having a bottom like February 27th. We anticipate an identical +18% rise (TP =...

Bitcoin turned bullish on its 1D technical outlook (RSI = 59.434, MACD = 1198.600, ADX = 26.499) as it found support on the 1D MA50 and is rebounding. The emerging pattern is a Channel Up and coming off an Arc consolidation in December, it draws strong comparisons with the price action after August 2024. The 1D MACD shows that once BTC rebounded on the 1D MA50...