Good morning friends ! Today, we are looking to the weekly time frame on which, last week price action triggered a bullish engulfing pattern. In addition, W1 closing (@ 35428) was above an important resistance level (34'970) already mentioned in my previous analysis which may force to a view reassessment of the situation, depending of the followup...

This evening we are looking at the H4 time frame which is showing a rising wedge formation in progress. Current price action is attempting to pullback towards the downside breakout of this rising wedge formation. Therefore, watch carefully at the next H4 closing which will give more indication about the validation or invalidation of the rising wedge trigger...

Today we are looking at 2 time frames : D1 and H4 D1 : BTC reached an intraday high so far @ 32'930 still below the first significant resistance level (32960 /KS) on D1 and also currently still below MBB @ 32724. No change in my view , watch carefully 32'960 and 31237 on daily closing level. As mentioned, a breakout of one of those level would open the door,...

Today, we are going to look at the daily time frame and especially at the yesterday's price action which has been very interesting. Indeed, KS (32'960) worked, once again perfectly well as the important resistance level to break coupled with the failure, to also breakout on the upside the MBB (32'822). In addition, the downtrend channel is still intact. Therefore,...

M1 : Still in a broad bear trend. Monthly pivot level @ 34372 W1 : Same than M1, any recovery should still be seen as a corrective move only and not as a strategic trend reversal yet ! D1 : Clear downtrend channel in place, below TS,KS and MBB. Only a move above KS @ 32'960 would neutralise for a while the current downside selling pressure. First significant...

Today we are looking at the H4 time frame where you can clearly identify a falling wedge & downtrend channel ! BTC is currently below the clouds resistance area (33500-34000) in this 4 hours chart and also below 2 important levels which are, respectively : 1) MBB @ 32'822 2) Kijun-Sen @ 33'133 and slightly above Tenkan-Sen @ 32'384 (very shy !) So what next ?...

Looking at the Daily picture, we can see a clear downtrend channel; the 61.8% Fibonacci retracement @ 31'665 has been reached this morning and the BTC is currently trading below both the Kijun-Sen (Base line) @ 32'611 and the Tenkan-Sen (Conversion line) @ 33'344. A Daily closing below those levels would add further selling pressure over the coming session...

Looking at the Daily time frame we can see 2 formations in progress, the first one (in blue) is a rising wedge and the second one is a downtrend channel (in red) After having reached a low of 32'101, some corrective recovery took place (pullback towards the rising wedge breakout): failure to reenter in this pattern triggered a renewal selling pressure in building...

Failure t o breakout the important resistance level of 34'970 mentioned yesterday triggered a new selling pressure which pushed down the BTC, filling on its way the 50 % Fib retracement. Next support level is @ 31'665 (61.8% Fib ret) ahead of the triangle technical target of 30'300 which is also the 78.6 % Fib retracement and which is expected to hold ! Indeed,...

Looking at the weekly chart we can see that current levelis below both, MBB (@ 1.5630%) and Kijun Sen (@ 1.3851%). Wait for weekly closing for confirmation ! In the meantime, the expected target of 1.2890 % (38.2% Fib ret) has nearly been reached with a low so far @ 1.30 % ! Pressure remains to the downside , next significant supports levels being respectively @...

Looking at the Daily chart (D1), there is really one important level to watch at on the upside and this level is @ 34'970 ! Why ? 34'970 is the level of Kijun Sen & 50 % Fib retracement of the 41'341-28'600 downside move. In addition, within the rising wedge formation, yesterday's mentioned in my previous analysis, there is also a triangle formation in progress...

Looking at the D1 time frame there is a potential rising wedge formation in progress ! Below KS (34'970) and MBB (34'570) and currently around TS (34'320). Watch carefully at today's price action as a failure to recover above KS on a daily closing basis would add further pressure to the downside, A move below 32'500 on the downside would be the first warning...

Looking at the H1 time frame, a RSI bullish divergence triggered a short term recovery, in building on its way a potential double bottom, currently in progress. Trigger level @ 32'524 ! A H1 closing level above the trigger level would be the first signal for further upside towards the double bottom target which is @ 33777 which coincides with the bottom...

No change in my view which still express some tactical buying opportunity in a broad strategic bear trend ! Indeed, despite an intraday high of 35289 reached yesterday's, BTC failed to firstly close above Kijun (34970), and secondly is currently still below Mid Bollinger Band. Recent and current price action is confirming what has been said before and any...

Looking at the H4 time frame, we can see 2 successive dojis which took place over the last 2 H4 periods; it could mean some uncertainty and indecision about further direction. For the time being, the BTC hold above the former downtrend resistance line which also coincides currently with the level of the Mid Bollinger Band around the 33'400 area. So, next H4...

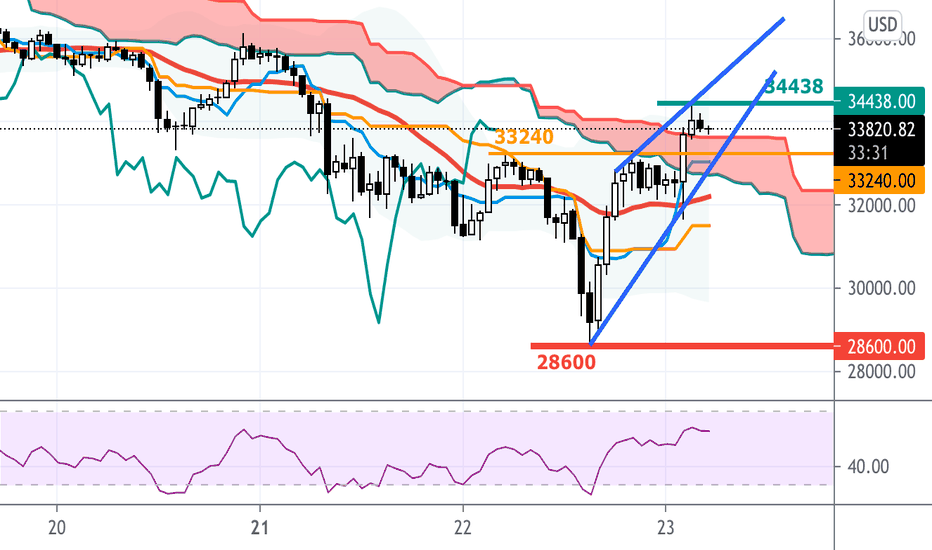

Unfortunately, my first significant technical target @ 27'169 has not been reached.. . Indeed, following the low of 28'600, reached yesterday afternoon, BTC managed a very nice recovery, in breaking up, very quickly, several resistance level on H1, beginning with TS, KS ahead of Mid Bollinger Band; interesting to note that MBB hold the pullback attempt in...

After having reached a low of 31'163 nearly (very close of my first target of 31'025 ), a bullish divergence detected on H1 triggered a corrective upside move towards a high so far of 33'240. As you can see on this hourly chart the Kijun-Sen worked perfectly well as resistance level to break ! In order to neutralise this ongoing selling pressure, BTC needs...

Last week price action (black candle) triggered, on a closing basis, a BEARISH ENGULFING pattern ! Ongoing bearish price action will continue to weigh on the BTC in opening the door for a retest of former lows of 31'025, 30'066, psychological 30'000 support level, for the next significant target of 27'169, being the 61.8% Fibonacci retracement of the...