JHartCharts

PlusUS indices are poised to fill downside gaps from Friday's close. Could be good for a bounce w/ upside cash gap targets higher.

Originally posted on 3/12, but blocked b/c I referenced my X account. Looks like a bearish move could be materializing alongside broader risk asset weakness: Is the XETR:DAX topping out? Monthly RSI @ 80+ w/ weekly nosing over and daily bearish divergences observable. Index high from 3/6 coincided with the 261.8% Fibonacci extension of the 11/2021-10/2022...

Reposting my analysis from 3/8 as it was delisted b/c I referenced a non-TV external account. Also, a disclaimer since I've quickly discovered that people like to chirp and demean ideas on TV: This is an IDEA. I maintain bull and bear cases for every underlying I analyze. My opinion about an underlying can change exceedingly quickly based on price action and...

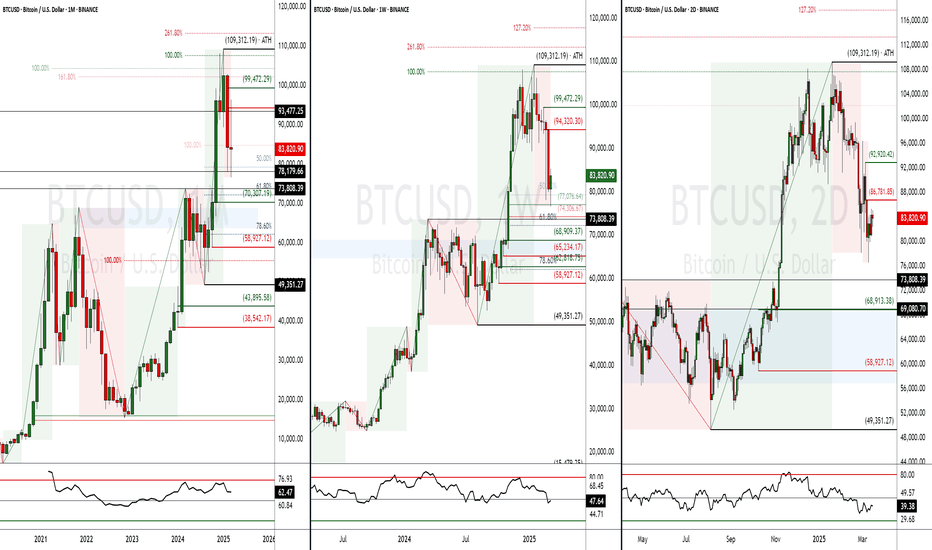

Bitcoin bounced from the daily demand (76874.75-74306.67) that was highlighted in my "Bitcoin Uptrend Continuation" post from 5 days ago (see related post below). However, the rubber will now meet the road as BITSTAMP:BTCUSD could break higher or continue lower from current price. The in-play 1D sell zone, which is admittedly doesn't have great structure, is...

I originally posted this idea several days ago, but it was flagged b/c I linked one of my social media accounts. Apologies for any typos - the format of my post got jacked up after copying/pasting. Crypto's going to break one way or another from current levels. Bitcoin has a wide supply zone (not super strong) 86267.86-92920.42, so watch how it reacts... Strictly...

While credit spreads, which reached near-historic lows in 2024, remain tight, they have widened notably since the beginning of 2025. If this trend accelerates, it could put substantial pressure on the bond market, resulting in tighter financial conditions and corresponding headwinds for the domestic economy. The last 2-3 weeks have seen risk assets come under...

Quick TA for Solana $SOL. Many cryptos are at inflection points and will likely break higher or roll over from current prices (I think a move down is more likely, per long-term charts, and am hoping this happens for the sake of buying opportunities). Solana, like many other cryptos, has failed to develop meaningful 1D bullish momentum (RSI holding below 50)....

Quick analysis of BTCUSD downside targets. Remains to be seen whether the near-term Bitcoin lows will hold, but if they don't, a "bear trap" setup could be in play. There's a daily demand zone (77075-74305) wedged between the 50% and 61.8% Fibonacci retracements. The bear trap will be dependent on momentum, but watch this area if we get a flush below 78180. If...

While the decline in copper persists, @HG is nearing areas of previous demand on intermediate-term timeframes. Specficially, we will be watching the industrial metal's action between the prices of 4.1130-4.0605 (with hypothetical stop lower @ 4.0250). Given the current momentum and potential add'l downside per larger timeframes, we recommend watching for micro-TF...

Quick idea here as we look to get back in a groove with analysis/posts after a very light October. Not going to include a lot of elaboration, but we're looking to take advantage of a swing short (price depending) via a low timeframe (5-minute) RTY supply zone (defining candles not pictured here since sub-15-minute charts cannot be posted). If price approaches the...

Considering a trend continuation long in NG here. Per the attached charts (also using futures for zoning), we've had a decent pullback and are nearing intermediate-term (daily) demand. Using the futures chart, there are multiple 15-minute demand zones stacked 3.058-3.006. So, if we penetrate that zone (flirting with it now), look for micro timeframe reversal cues....

Not a market we trade super often, but there has obviously been a LOT of opportunity in natural gas as of late. After a long period of accumulation, NG has finally broken out to the upside. We are looking for potential trend continuation longs. Ideally, we would like to enter this trade around the ~3.00 level (roughly coincides with Anchored VWAP +...

For this trade to be in play, Bitcoin still needs to drop about $2,000. That said, we hope BTC eventually trades down below 25K. This setup is considered a “bear trap” because traditional support/resistance traders are likely to be watching/sell a break below the 24756 low which printed on 6/14. Despite what traditional technical analysis suggests, making a...

While it's unclear whether crude, which has experienced large moves recently on account of the developing conflict between Israel-Hamas, wants to trade higher or lower over the longer-term, we’re looking to take near-term longs after filling the downside futures gap formed 10/6. We’re only showing down to a 30-minute chart here, but there are some smaller...

Quick take/analysis, but consider scooping some low-risk crude contracts here (break above 84.84). Better demand zones are lower, but we've had a sizable downdraft into buy areas + are testing a key support/resistance area (~84-85), so those traders may be at our backs. The US dollar has finally taken a pause at the supply zone we ID’d in posts from earlier this...

Possible volatility short/equities long shaping up. Still a lot of downside momentum/catching a bit of a falling knife + we'd rather see the NQ fill its gap south of 14400, but it could be time to start thinking about index longs given the levels both stocks and vol are approaching. Given that the Nasdaq still has further to fall before completing its gap fill,...

Very incomplete analysis here, but looking for confirmation of reversal on low timeframe charts. Additional zone lower, so keep that in mind, but these levels haven't been seen in quite some time and there was an imbalance favoring buyers last time we were here, so consider a buy despite very negative headlines, recent USD strength, etc. Stepping in front of...

Given USD strength and the sustained pressure of ever-increasing US interest rates, gold has been taking it on the chin. However, we’re getting into buy levels/demand where it may be poised for a near-term recovery. Keep tabs on gold (spot, futures, GLD), but if you see signs of accumulation/trend reversal (use small timeframe charts), consider climbing aboard....

![Bitcoin (BTC) "Bear Trap" [Daily] Long BTCUSD: Bitcoin (BTC) "Bear Trap" [Daily] Long](https://s3.tradingview.com/e/erjFnXjd_mid.png)