On Friday evening, the spot gold price broke below the key support level of $3,000, which was in line with previous expectations. After reaching a phased high of $3,057, the market witnessed a rather significant downward movement. However, the support at the $3,000 level was relatively strong. Although the price briefly fell below this level, it failed to...

Last week, XAU/USD showed a pattern of high-level consolidation. After reaching the key psychological level of 3000 USD on March 17th, gold prices entered a sideways phase. On March 20th, gold hit a new all-time high of 3057 USD per ounce before pulling back. By March 22nd, gold prices had fallen for two straight trading days, briefly touching 2999 USD per ounce....

This week, the GBP/USD exchange rate has experienced notable fluctuations. As of March 22nd, the pair stood at 1.29114, down 0.00540 (0.42%) from the previous day. The intraday high reached 1.2971, while the low touched 1.2887. On Thursday (March 20th), the Bank of England announced its interest rate decision, keeping the benchmark rate unchanged at 4.5% with an...

Recently, although inflation data in the United States has declined, it remains elevated, and the labour market continues to be tight. The Federal Reserve may maintain a hawkish stance, which is supportive of the US dollar. Meanwhile, the economic recovery in the eurozone has slowed. Weak manufacturing PMI data has dampened business and consumer confidence,...

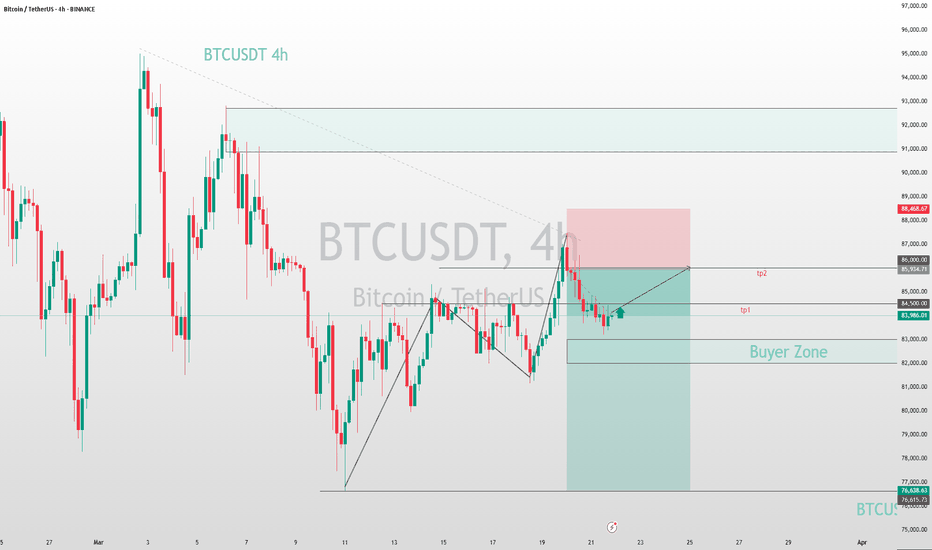

The BTC/USDT price is currently consolidating within a range. You can focus on the 82,000-83,000 zone; if the price retraces to this area and finds support, consider entering a small long position. The target take-profit levels are between 84,500 and 86,000. If the price reaches 84,500, consider partially closing the position to lock in some profits. If it breaks...

Gold has weakened once again, with the price dropping rapidly and breaking through the support level of 3022, heading towards the sub - 3000 zone. The previous strong upward trend in the gold market has come to an end! The price has dipped to test the 3000 level for the first time, and the market direction has turned bearish. The bearish trend is now firmly...

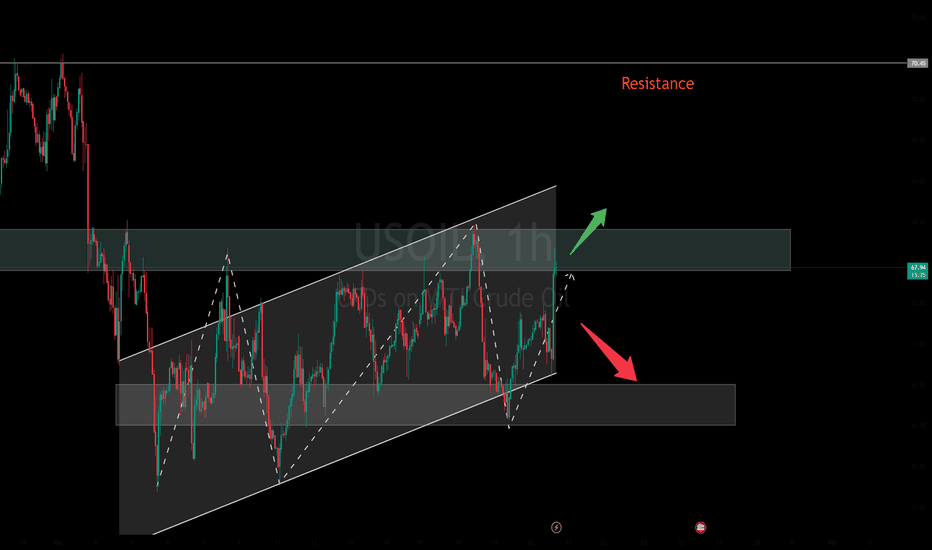

Currently, USOIL is trading around $67 per barrel. On the supply side, while OPEC+ plans to increase production, ongoing geopolitical tensions in the Middle East are adding supply uncertainties. On the demand side, U.S. fuel demand remains resilient, but the subdued global economic outlook may limit crude oil demand growth. Technically, the daily chart shows...

As of now, ETHUSD has dropped to $1,961, registering a daily decline of $94.9. Earlier, it exhibited robust upward momentum, surging past the $2,000 threshold. However, it has since experienced a pronounced downturn. In terms of technical analysis, although the MACD doesn't clearly indicate a trend, its histogram has transitioned from positive to negative and is...

Recently, in the 1 - hour chart of XAU/USD, the upward channel has been broken downward, indicating that the short - term upward trend has temporarily stalled. Currently, the price is in the buyer zone, which has certain support. If obvious signs of price stabilization emerge, such as formation of a bullish K - line combination, one can attempt to place long...

The recent trend of the USD/JPY has been highly volatile. On the economic data front, the rise in Japan's unemployment rate and the decline in corporate capital expenditure have triggered selling pressure on the Japanese yen. However, factors such as corporate wage growth provide grounds for the Bank of Japan to consider raising interest rates. From a technical...

MACD histogram turned positive, indicating emerging short-term bullish momentum despite a $2843 daily drop. RSI (14) at 43.54 shows a neutral-to-weak state, with bears slightly ahead but not in oversold territory, suggesting limited room for further declines. Bitcoin's volatility and recent drop have made investors cautious or even panicked. Some are exiting the...

The recent substantial rise in gold prices has prompted some investors to take profits, leading to a subsequent price pullback. Additionally, the Federal Reserve has maintained the benchmark interest rate within the 4.25%-4.50% range. Projections suggest two rate cuts are likely in 2025. The Fed's interest rate decision has once again disappointed the bears....

The one - hour chart of GBPUSD indicates that the current price is 1.29750, with the market showing potential bearish sentiment. The 1.30000 level acts as a key resistance zone, with multiple support levels below. If the price fails to break through this resistance, a decline is likely. GBPUSD sell@1.29600-1.30000 tp:1.28500 Traders, if this concept fits your...

Gold has been on a sustained upward run, yet the bullish momentum is largely spent. Thus, extreme prudence is of utmost importance when contemplating long positions. After surging to approximately 3045, the gold price plummeted sharply and then rebounded vigorously. Nevertheless, it fell short of breaking through the 3045 level in one attempt. If it fails to...

The USDJPY is currently at a critical level, with the price fluctuating around 149.00. The resistance level above is at 150.00, and if broken through, it may further test 151.00. The support level below is at 148.50, and if it falls below, it may drop to 148.00. Recently, the market has been focusing on the monetary policy trends of the Federal Reserve and the...

The uncertainty within the global macroeconomic landscape wields a substantial influence over the trajectory of BTCUSDT. On one hand, the escalating anticipation of a deceleration in global economic growth has spurred investors' appetite for safe - haven assets. Bitcoin, characterized by its capped supply and decentralized nature, has been singled out by a segment...

Traders can seize a high-reward trading opportunity with an attractive risk-to-reward ratio by patiently waiting for the price to reach the golden pocket and support zone. As with all trading scenarios, implementing robust risk management strategies is essential to effectively navigate inevitable market...

Currently, AXUUSD is oscillating in the vicinity of 3030. A thorough market appraisal uncovers a distinct bullish impetus. Amid the global economic uncertainties, such as trade disputes and erratic monetary policies, market participants are increasingly flocking to gold as a haven asset, driving the upward trajectory of AXUUSD. Technically, pivotal indicators such...