Justfxtrades

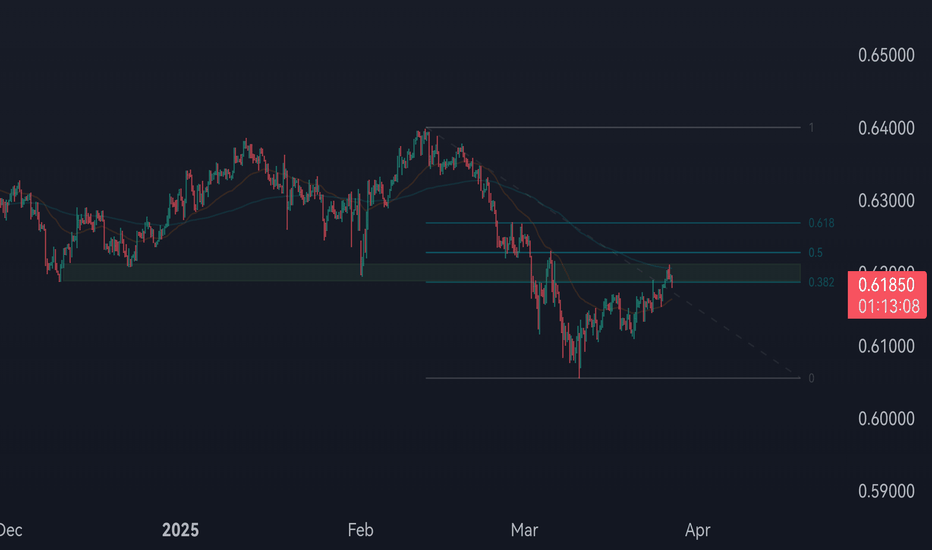

The New Zealand Dollar is consolidating, lacking clear directional momentum. However, the short-term outlook appears bearish following a confirmed closure below a key structure zone. A break below the 0.5710 level could serve as confirmation for further downside continuation, signaling potential bearish momentum ahead.

The price is currently in a strong position, retesting a key resistance zone, which aligns with the 50% Fibonacci retracement level. Additionally, the 200 EMA is acting as dynamic resistance, reinforcing the bearish bias. Given these confluences, a downside move is anticipated, in line with the prevailing trend.

price declined from a supply zone and made a made a clean break and retest on the structure zone, by looking at EMAs (21,50 and 200) we can clearly see that price has broke through them with a strong bearish candle, and currently price is trading below moving averages indicating a bearish control in the market, I expect price to continue down

it is a shiny year for gold so far, it kept reaching new all time highs since Trump declare tarrifs on canada, Mexico and china, that causes big demand on gold admit world war trade fears, we have also the geopolitical side while Israel resumes war on Palestine after months, my setup is wait for a pullback on last structure zone confirmed by Fibo, then it would be...

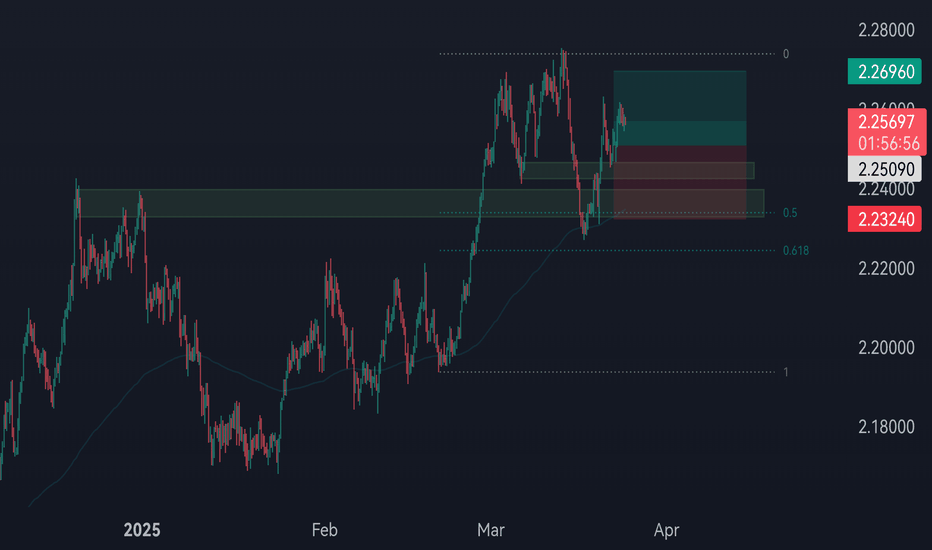

price is on an uptrend, after testing last resistance zone with 50% Fibonacci level price has confirmed my scenario to go long after break and retest a minor structure, entry would've been more precise on the 200 moving average touch, but that was missed and price give me another good sniper entry after retest, and I expect bullish run

On technicals, The price reacted to the bearish cypher pattern and started dropping, breaking the support level with a strong candle. It seems likely to continue its decline toward the 166 level. Right now, we’re waiting for a retest of the broken 172 support, which could be a good entry point. On the fundamental side, Swiss GDP dropped by 0.4% in the third...

USDCAD price is still testing resistance for the third time and failed to break it up, the price now is forming a triple top pattern following by bearish candle, the seller are already showing their presence, my forecast is the price will continue down until level 1.3900

Even with the Fed cutting interest rates this month, the dollar continues to rally, reaching positive levels. From a technical perspective, the USD/CHF is moving in an upward trend within a rising channel. Currently, the price has broken through the resistance level of 0.8912 and is now retesting this level after the market opened with a price gap. The price is...

Currently the price is on a downtrend, forming a bullish butterfly harmonic pattern following by AB=CD pattern, waiting for the price to arrive to our demand zone and confirm the patterns then we must look for a long position, all eyes on the AUD CPI data next week.

Currently the price is on a downtrend, forming a bullish butterfly harmonic pattern following by AB=CD pattern, waiting for the price to arrive to our demand zone and confirm the patterns then we must look for a long position, all eyes on the AUD CPI data next week.

Gold is still moving in an upward trend despite breaking the trend line, which turned out to be a fake out. It is expected to continue its rally and break its ATH amid ongoing geopolitical tensions in the Middle East and especially the escalation between Ukraine and Russia following Washington’s approval for Kyiv to use long range missiles.

Sellers responded to the supply zone in the 4H time-frame and the price started moving downwards forming a lower highs and lower lows, waiting for the best entry.

As you can see clearly the price was moving in a bullish momentum, then began to forming a double top pattern, then broke out the support zone and returning to test it, currently we are starting to see reactions from sellers, so I expect a decrease in the price of the Australian dollar against the Canadian dollar.

After the price retested the brocken support zone 1.3513 on the daily time-frame, as you can see it formed a double top pattern on the 4H time frame , waiting for breaking the neckline support level (1.3413), then we could see some bearish moves after a retest confirmation .

The gold price appears to be retracing after hitting its record high of 2147 since the year started. I anticipate a continued downtrend in the gold price in the upcoming days, with all attention focused on the NFP report next week.

After the strong rise of the price that came after the completion of the harmonic pattern ab=cd Which is all enough to break through the previous resistance, the price started corrective moves to retest the area, forming a parallel descending channel, which broke through it after retesting the area and touching the 61% level of Fibonacci, so I think that the price...