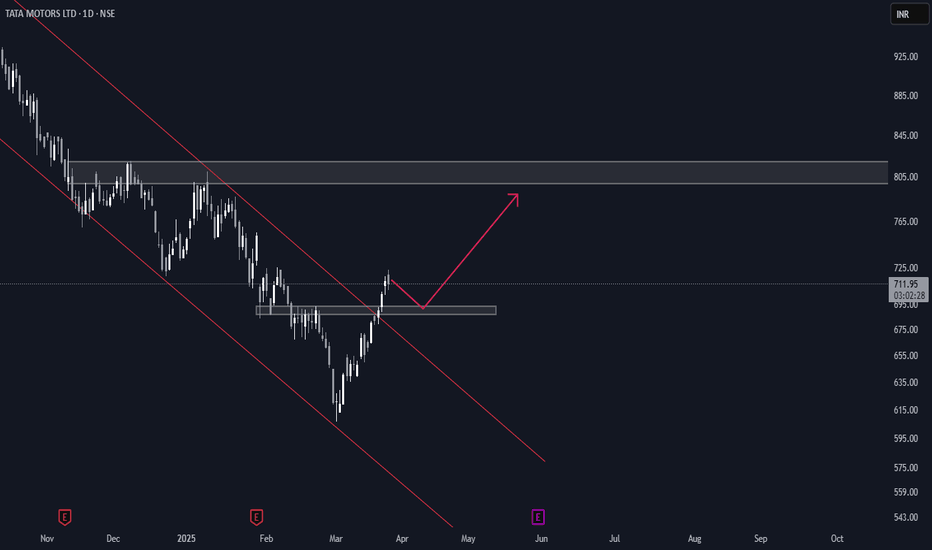

KARTHIK_GREEN_CANDLES

I am feeling bullish on Tata Motors for the short term. Let's see how it reacts around the key level of ₹800. If it holds and shows strength, we can decide whether to stay bullish for the long term. For now, I remain bullish.

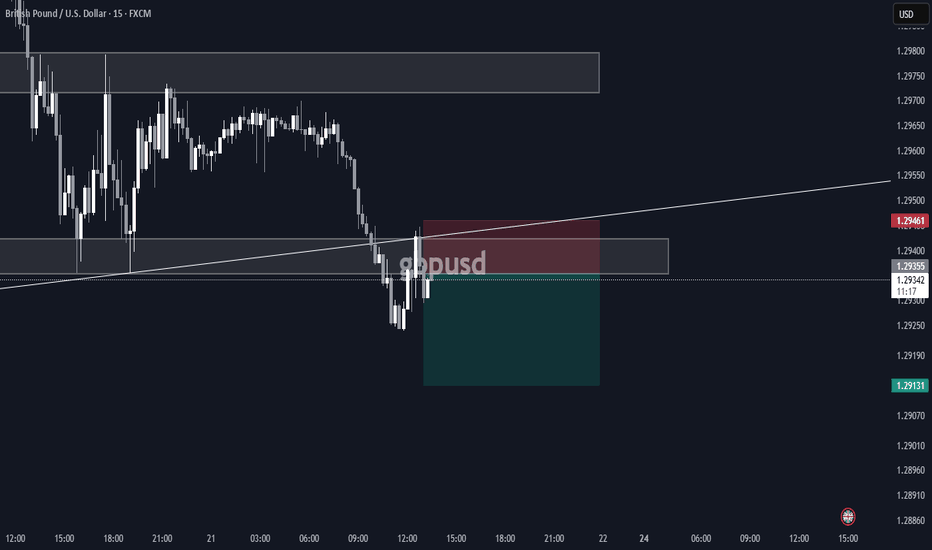

My Trade Idea My trade idea was simple: If EUR/USD breaks above a key level, I will look for a retest and enter a long position after confirming the entry with candlestick confirmation. If it breaks below, I will wait for a retest, confirm with a candlestick pattern, and enter a short position. This is a very short-term trade, so I’ll skip if the setup doesn’t...

My trade idea was simple: If GBP/JPY breaks above a key level, I will look for a retest and enter a long position. If it breaks below, I will wait for confirmation and enter a short position. The key is to follow the market, not predict it. Always trade what you see, not what you think will happen. Let the price action guide your entries.

Just a quick trade—I'll update afterward. Follow for simple and effective trades faster! 1RR

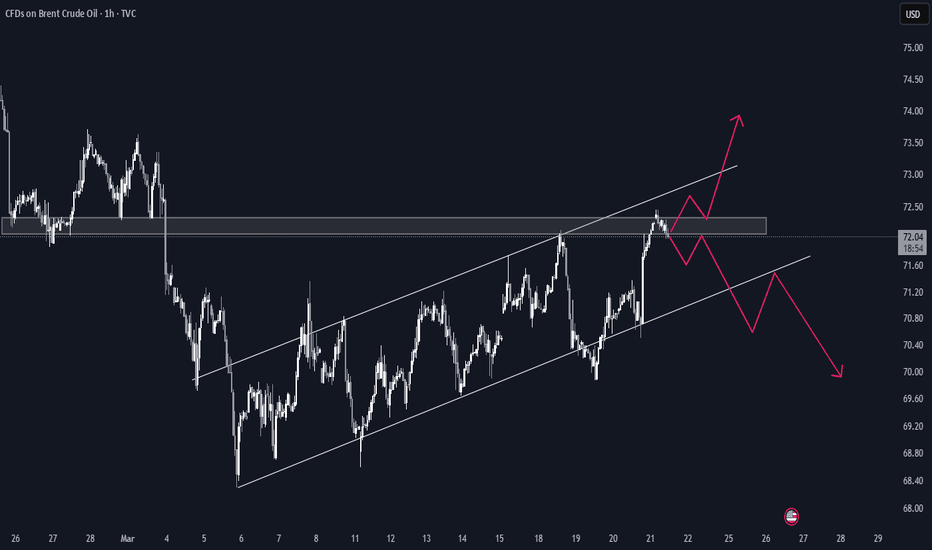

Just a straightforward textbook trade opportunity—let's see how it goes. #UKOIL

If you missed my previous XAU/USD 1:10 trade, don’t worry! There’s a great setup in NZD/USD for a short trade right now. Set your stop loss at 0.56252 and target the 15-minute swing low at 0.55428.

This trade setup is based on a confluence of key price action and market structure levels, with a focus on key support/resistance areas, price reactions, and trend confirmation across multiple timeframes.

Executed a short position on XAU/USD with a strategic entry at 2690.766. Using my standard market structure analysis, I identified a solid resistance level and potential downside momentum. Placing a stop loss at 2700 to manage risk and targeting 2593.019 for a solid risk-to-reward ratio. Ensuring a calculated approach with every trade.