Kani_forex

This one is a gamble. But one with taking as the risk to reward is excellent with a tight stop loss. I based this trade on the Month, Week, Day trend with back up from the COT data. We can expect further pullback for some liquidity but if this trade is well cooked, we dont want to miss out.

We can still expect a move to the downside for now, not sure for how long, hence we can't commit to any trades to the downside. What I am sure of however, we are at a strong area pf support and can expect an accelerated move to the upside with very little pullbacks. This is a swing trade, enter at first pullback and followed by a close of a bullish candle. Please...

Hi Traders. We are currently seeing a strong bearish movement of the GBPUSD. This usual market rules, this should not last, we are looking for it to test the strong support range set out in the blue highlighted area. If the market breaks that support area we will invalidate our possible trade as per our rules. What we do want to see is a test of the support...

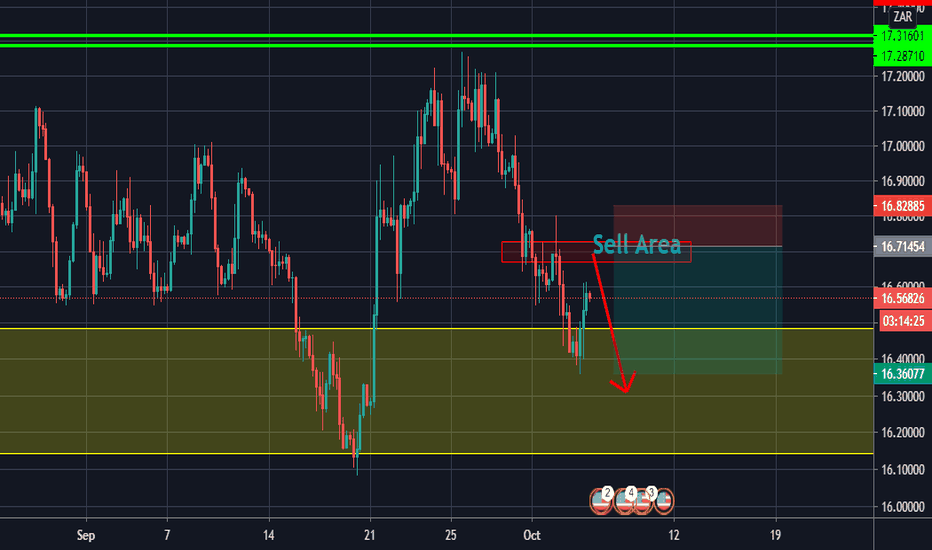

Wait for the re-test pull back and sell. Good risk to reward ratio. Monthly, Weekly and Daily all still bearish. Always trying to enter at an area of value.

While price is still above the blue line, there will be no entry. Once we dip under the blue line, re-test as resistance and give confirmation of a bearish candle, one is free to go short. We missed the previous pull back opportunity of entry, hence the big stop loss. You can make it much tighter, but the big boys might want to have one more go at the bears for...

The NZDCAD is simply heading for a H4 chart M formation impulse correction move. 1.7 risk/reward ratio. Around 70pips expected reward. :-) One can enter at the close of the current bullish candle. GOOD LUCK.

We can go long on this one, simple intra-day trend following after pullback. Stop loss is tight enough, great risk to reward.

We can clearly see the GBPNZD is looking to test the strong support area to the upside. however, there is weak resistance standing on it's wait to the strong resistance area. ENTRY Wait for bullish candle to break above the weak resistance, retest it as support and wait for a bullish candle to close above it. That will be a short term swing opportunity. With a...

We still expecting the EURNZD to continue it's bullish momentum up to the 1.78557 area before expecting a pull back to the downside. The risk to reward ratio on this trade is about a 2.30 range.

Our D1 right down to the M30 chart is indicating that we are still bearish. We are likely to face some retrenchment to the upside, but should close the day off with continuation to the downside.

This is what is most likely to occur with the Gold. It is currently at a high level of support and has retested multiple times before and failed.