GOLD In-Depth Analysis: Exploring Both Scenarios Watch out for a possible double top pattern. Gold's price has risen today, but without a clear reason. The market is mostly speculating about tariffs. However, in my view, there might be something bigger driving gold’s movements, as its price tends to shift even when the market seems quiet. You can watch...

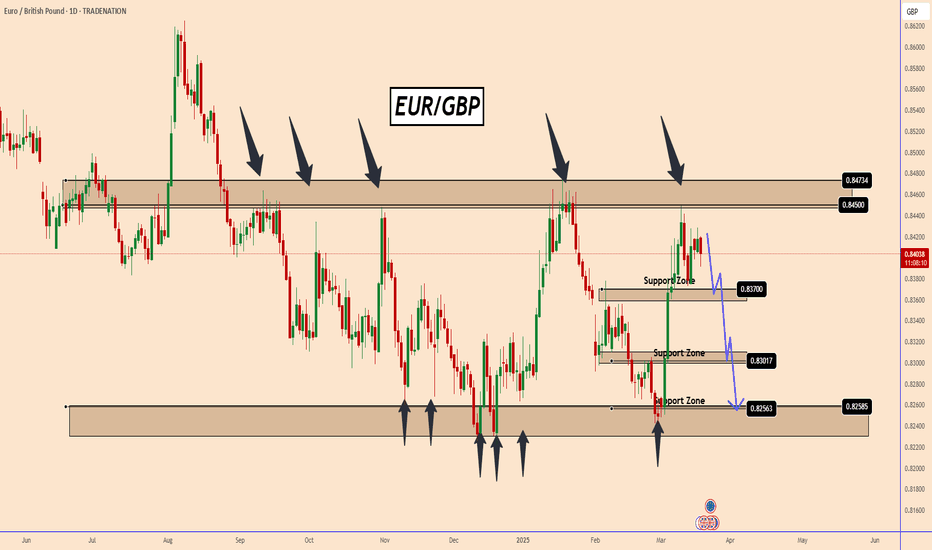

EURGBP: A Multi-Time Frame Analysis EUR/GBP recently tested a strong resistance zone near 0.8440, prompting a notable price reaction. Based on historical price behavior, there is potential for the pair to move downward again. The bearish momentum could gain further support from tomorrow's Bank of England (BoE) decision, which may influence market sentiment and...

EURGBP: Bullish Harmonic Pattern in a Strong Zone EURGBP has completed a bullish harmonic pattern within a robust zone. Despite this, the likelihood of the price testing the entire red zone remains high. It's crucial to be careful and closely monitor the price's reaction. Key resistance zones for the harmonic pattern are 0.8307, 0.8335, and 0.8370. You...

Bitcoin is gradually rising within its channel. The trading volume remains low, so there's still a risk of a bearish move. However, Bitcoin is in a bullish trend for now, and that trend hasn't been broken yet. If the volume picks up, BTC could climb to 90,430, then 94,410, and possibly even extend to 98,500. Note: Be cautious—if the price falls below the...

EURUSD about to begin a bearish movement Seen in another perspective from Friday EURUSD was dominated more by a bearish volume. The price didn't manage to rise too much. Considering that also this week has not so important data the chances are that we can see more a release of liquidity on EURUSD. If EURUSD moves down a bit more from the current zone will...

Natural Gas: In a Clear Bearish Movement After Correction From our previous analysis, NG created a bearish correction that lasted for about 1 week and took place between 4 and 4.3. After the pattern ended, the price fell by almost 13% in just 6 days. News Today: Oil prices edged up on concerns about tighter global supply after U.S. tariff threats on...

Dow Jones Rebounds as Buyers Emerge Near 40,700 The Dow Jones (US30) entered a bearish trend at the end of January, with its downward movement largely influenced by the Trump administration's reforms and unconventional approaches to the trade war. Over a span of approximately 2.5 months, the index declined by nearly 9.7%. However, it now appears that buyers are...

GBPUSD Set for a Potential Decline as UK CPI Cools to 2.8% GBP/USD has been consolidating within a narrow range since the beginning of March, struggling to establish a definitive direction. This prolonged indecision suggests that the pair may require a correction before resuming any upward movement. The latest data from the UK further supports this outlook....

SOL: Key Support Zone and Bullish Potential: Targeting New Highs SOL recently tested a robust support zone near 112, which aligns with a significant structural level on the daily chart. This zone, originating from the left side of the structure, has demonstrated its strength over the past year. Historically, this area has been tested multiple times,...

BNB Poised to Resume Bullish Trend Since February 13, BNB has experienced a month-long decline, entering a clear 4-hour bearish trend. However, the price appears to have completed a "Descending Channel" pattern, signaling a potential shift. Currently, BNB is demonstrating renewed strength. A decisive move above the descending channel could propel BNB upwards,...

NZDUSD Continues to Develop A Large Channel Pattern NZDUSD began a bullish movement at the beginning of February and the price is in a bullish movement taking the shape of a large channel pattern. Price is already near to a strong support zone and it can resume the bullish movement between 0.5720 - 0.5660 zone Given that the price is also holding strong the...

GBPCHF: Waiting for Breakout to Show Price Direction GBPCHF takes a complex shape that is not often observed in pairs like GBPCHF. The price shows both trading opportunities from this triangle pattern. Another problem is related with the market volume that we had soft events yesterday and today and many charts are in correction. Only the breakout above or...

GOLD: The Bearish Pattern is Still Valid From our last analysis on GOLD that I shared with you on Friday we can see that the price already moved down and reached the first target. Given that the bullish trend is yet too strong we faced in a profit taking zone corresponding to a strong psychological number 3000 and the price increased. Currently GOLD tested the...

XRP Found Buyers Near 2.35 From our previous analysis, XRP reached our third target and decreased again. After this taking profit moment, XRP decreased by nearly 9% from 2.59 to 2.35 The price reaction from 2.35 zone looks strong again and also clear, so XRP may resume the bullish trend again as shown on the chart. XRP may rise again to 2.56, 2.63 and 2.76 ...

GBPJPY: Potential Inverse Head and Shoulders Pattern GBPJPY is showing the possibility of forming a potential Inverse Head and Shoulders Pattern. The fundamental situation related to the Bank of Japan (BOJ) remains a bit confusing. Government data released on Friday indicated that Japan's consumer prices are on track toward the BOJ's goal of achieving stable 2%...

GOLD: The bearish pattern in gold appears more distinct Today, the bearish pattern in gold appears more distinct. However, a bearish movement depends on a solid candle close below the 3,025 level. Until this occurs, the pattern remains inconclusive and could potentially evolve into an alternative scenario. You may watch the analysis for further details! Thank you

GOLD: Potential Bearish Head and Shoulders Pattern GOLD recently peaked at 3057 after breaking through the significant 3000 zone. The 3000 level garnered substantial market attention as a strong psychological area, but high trading volumes occasionally drive prices higher, as seen in this case. Currently, the price appears to be losing momentum, forming a...

EURUSD Technical and Fundamental Analysis Today Germany's Bundesrat upper house of parliament is set to vote on Friday on a spending splurge aiming to revive growth in Europe's largest economy and scale up the military for a new era of European collective defence. This was also voted on Tuesday: The vote was 513 in favor and 207 against. The vote needed 489...