GOLD: Geopolitical and Economic Turbulence During the last three weeks, there have been significant developments in the geopolitical and economic arenas. But what exactly happened? Geopolitical and Economic Developments: Trump's Tariff Threats: President Trump continues to threaten with tariffs, increasing market uncertainty. His recent comments have even...

EURJPY: A Large Corrective Pattern in Development The EURJPY currency pair recently encountered a significant resistance zone from above. Historically, the price has repeatedly declined after testing this dynamic zone, increasing the likelihood of another bearish movement. Adding to the downward pressure is the Bank of Japan's (BOJ) influence. The BOJ's recent...

Natural Gas: Potential Depreciation Towards 3.2 Natural gas has recently broken out from a strong support zone, which has now turned into resistance. The price may develop around this area before moving down again, especially given the previously strong bullish trend. A robust support level is expected near other structural zones at 3.8, 3.6, and 3.2. It is...

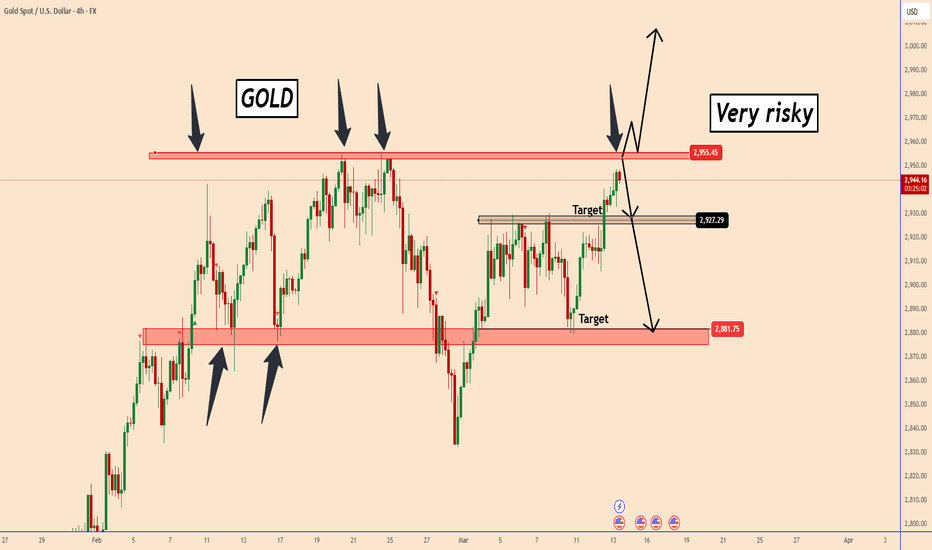

GOLD: In-Depth Analysis Today, I present to you an in-depth analysis of GOLD. In this analysis, I delve into the factors influencing GOLD's price movements, examining both the potential reasons for upward and downward trends, as well as various trading scenarios. You May Watch The Analysis For Further Details! Thank you:)

ETH Price Volatility: Beware of Trump's Comments From our previous analysis, the price reached the first target. After Trump posted new comments, ETH surged by nearly 17%, tested the structure zone, and then moved down again at a time when everyone was expecting it to rise further. However, it appears he may be playing with the markets, and hedge funds are...

GBPJPY: Inverse Head and Shoulders Pattern In our previous analysis, GBPJPY was developing the right shoulder of the inverse head and shoulders pattern and has since reached the first target. The situation with the Bank of Japan (BOJ) remains confusing, as their actions have lacked clear direction. Over the past weeks, BOJ has intervened multiple times in the...

DXY Price Analysis: Time For Correction? DXY corrected nearly 65% of the bullish wave in a short time. Currently DXY is testing a price zone that was seen for the last time at the beginning of November 2024, almost 3.5 month ago. The odds are that DXY has to create any correction before it moves down more. Also this wave is overextended too much and from a...

GBPUSD : 2 Possible Scenarios for GBPUSD On January 13, 2025, GBPUSD began a price reversal for the bullish wave, and since then, it has been on a continuous rise. However, in recent days, GBPUSD has paused, suggesting it might undergo another significant correction, similar to previous months before resuming its upward trend. Given the current data, it seems...

BTC - Still Bearish and Lacking Hope for a Significant Rise In our last analysis, BTC experienced a deep pullback, halting twice near the resistance zone of 90600 - 91600. Both times, BTC declined by 14.50% to 19.50%, even as the market anticipated a bullish wave. Currently, BTC is holding strong, with the highest potential being a possible rise to 90600 before...

ETH: Both Scenarios Explained In our previous analysis, ETH performed a complete transformation and confirmed a larger bearish wave. ✅The price broke below 2000, which exposes ETH to a significant devaluation. If the price remains below 2000, there's a higher likelihood of it declining to 1650 and 1450. This is the current trading scenario based on the data...

US500 May Continue the Decline to 5200 The US500 index has reached the targets we set in our last analysis. However, the market remains highly volatile, with future movements shrouded in uncertainty. This instability can largely be attributed to President Trump's policies, which have introduced a significant level of unpredictability. According to the New...

USDCAD Eyes on BoC Interest Rate Decision On Friday, the Bank of Canada reported a contraction in employment data. However, it was positive that the unemployment rate remained unchanged at 6.6% from the previous month, and the average hourly wages for February were higher than the previous month. Overall, the Canadian economy is performing well. Despite this,...

ETH: Bullish Harmonic Pattern ETH has completed a bullish harmonic pattern and subsequently moved down to test the $2,000 price zone, which is a significant psychological level for Ethereum. ETH is expected to recover as long as the price remains above $2,000. In the short term, I anticipate a possible retest of $2,195 and $2,280. However, a movement below...

EURUSD Reaction Post-NFP Data Release On Friday, the United States reported its Non-Farm Payroll (NFP) data. The figures were slightly lower than expectations, coming in at 151K compared to the forecast of 160K. However, they were significantly higher than the previous month's figure of 125K. Additionally, the unemployment rate increased to 4.1% from 4.0%, which...

GOLD: Bearish Movement May Resume Again Bloomberg reported that Canada is not open to lifting tariffs until the US takes them down. Yesterday President Trump and Trudeau had scheduled to speak. As Reuters reported - U.S. President Donald Trump will exempt automakers from his punishing 25% tariffs on Canada and Mexico for one month as long as they comply with...

US500: Bearish Pattern Signals A Bigger Decline The US500 index has broken down from another bearish pattern, signaling the beginning of a bearish movement. The price could continue to move down to the 5718 and 5780 areas, where it may find strong support. The bearish movement is also attributed to the turmoil created by Trump's tariffs on major trading...

OIL Testing 6 Month Low OIL Analysis Yesterday, OIL tested a very strong area dating back six months to September 10, 2024. OIL reached $65 per barrel after a long time. The market reaction was strong, pushing the OIL price up again to $67.3, an increase of nearly 1.7%. Impact of U.S. Tariff Policy The uncertainty around U.S. tariff policy is creating...

EURJPY is currently inside a large trading range pattern. Since the end of January, EUR/JPY has been moving in a volatile manner within a large trading range. This range is nearly 600 pips long and has kept EUR/JPY confined within this zone. The reason for this volatility is related to fundamental factors from both the ECB and BOJ. So far, EUR/JPY has tested...