100 shares should be the maximum allocation in your portfolio on a $100,000 of capital. Once price exceeds $150, trailing stop should rise to $135 minimum. I do not actually use stops when trading equities (only in FX). If price closes below my acceptable point of risk I exit my position before market closes. Update 4/16: Closed all at 154. It smells funny....

Average decline since May 2013 with no retracement is 9.45%. Since gold broke what I consider its major intermediate term support of 1235, the probability of it falling rapidly to 1175 - 1190 is high. Would not surprise me if we see it down $40-50 overnight this week or next. Medium term I see it falling much lower.

Update 3/10: A perfect failed trade. When your wrong this well, it means your analysis was excellent. What I mean exactly, is when price breaks out and uses your stop as new support, it's indicative of great structural analysis. Also notice it peaked at the top of the horizontal line and matched its 52 week high on December 2014. The real mistake was not taking a...

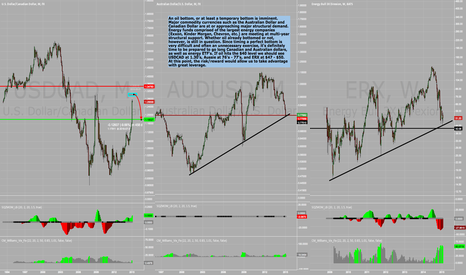

An oil bottom, or at least a temporary bottom is imminent. Major commodity currencies such as the Australian Dollar and Canadian Dollar are at or approaching major structural demand. Energy funds comprised of the largest energy companies (Exxon, Kinder Morgan, Chevron, etc.) are meeting at multi-year structural support. Whether oil already bottomed or not,...

An oil bottom, or at least a temporary bottom is imminent. Major commodity currencies such as the Australian Dollar and Canadian Dollar are at or approaching major structural demand. Energy funds comprised of the largest energy companies (Exxon, Kinder Morgan, Chevron, etc.) are meeting at multi-year structural support. Whether oil already bottomed or not,...

As ugly as BABA's news and price action has been, there is still strong support at the 97 level. We're held by the 618, diagonal and horizontal support. Frankly, today's report was awful enough to completely close out of the position. Tomorrow's earnings will be extremely important. Something tells me its impact will be underwhelming in either direction. If that...

Could go both ways... but looks like it's setting up for a bullish head and shoulders pattern.

Coiling. Breaking out soon toward 107 or going to 102.80 for a breather. Needs to break and close above 105.30.

Max risk is about 4.3% based on an entry of 1307 and a stop of 1360. If you buy GLL, risk about 8.5%.

Even the father of gravity went bankrupt buying an asset he'd never think would go down. Don't feel too bad if you got caught up.

Cross red horizontal line and it may be a reason to go short.. Otherwise, this looks good for 300 - 500 pips on the upside. The long term is very questionable due to symmetrical R/R and probability from a technical and fundamental standpoint. (The purpose of trading is to find asymmetric probability or asymmetric risk/reward.) I will probably stay away from this...