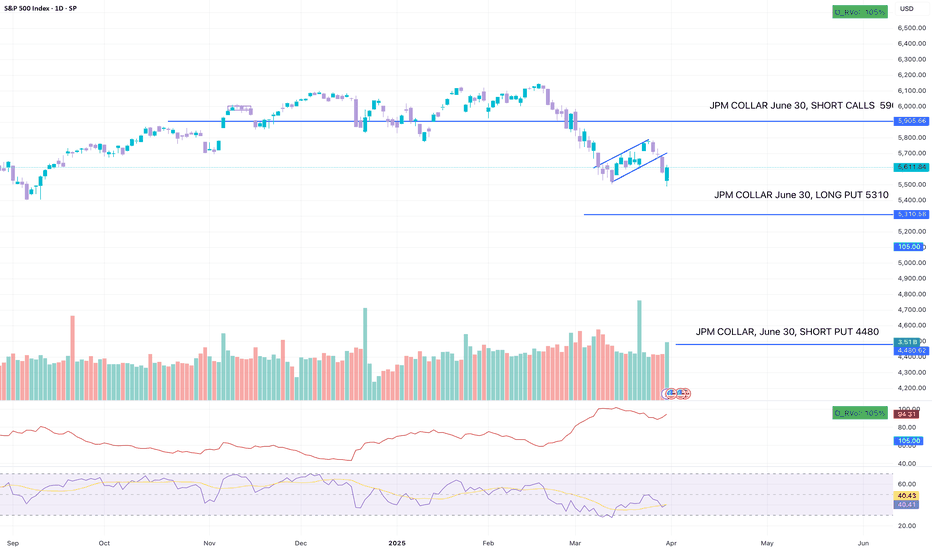

SP:SPX NYSE:JPM collar expires June 30th 2025 40k times (updated strikes) . Short calls Long put Short put

Long breakout above 324 and we can see higher prices.

Market doesn't look great so far in 2025 and last week of 2024. But if we bounce, TTD is sitting on a nice support and could make it up towards the 126, which is 50MA. Would give it a tight stop. In case selling continues.

CAT didn't disappoint after many years when it comes to dividends and growth. I recently added CAT into my dividend portfolio. It's a good stock to own for any Presidential candidate.

NVDA above 127.57 could be a nice long trade again. Ugly candle yesterday.

Seems like sitting on a nice support here. In a strong demand zone, sitting on POC as well. Insane volume, above 119 could fly. Also closed at the 10EMA, and we can see buying pressure. Stop loss for me would be 113.30. Risk to reward is there.

VRT has been an incredible stock. It's moving like it would have cured cancer or saved the world. 50EMA nice support, now closed above trendline and also 20EMA. Great trend, and hopefully it keeps running back to the 108 and more. I'm long as of now.

Bringing to your attention that TSM is ready to breakout. Semiconductors are still hot. Above 142 next stop 148, 158.

BABA broke out the diagonal trendline, closed nicely above 200SMA and volume is also great. Next stops 87, 90, 92 unless it's another fakeout. BABA had many of them in the past. Also we have earnings coming up on the 5/ 14. Undervalued company, sadly we're dealing with Chinese government thus it makes the investment a bit more complicated.

I like this breakout on XBI. I'm in with a bigger position and we're sitting right at the 100SMA> We could retest from here closer to 88/86 but below that I'd cut the trade. It's also sitting in a demand zone and ideally moves above $92/ 93.

After crazy carnage on earnings, SNOW got out of the downtrend and now in short term uptrend. For long I'd be paying attention to volume, you want to see increase in volume and strong buying pressure to make it to next resistance levels 164, 172 and 182. Beware of earnings on 5/22. Could run until then and earnings are always a gamble.

AAPL - got out of the 170-180 chop. It's sitting right in the gap from mid-February and that can act like a resistance. I'd like it to stay above 100 and 200SMA around 180 and not fall below. Below I'd be out.

AMD - it's down almost 40% from ATH. It's been a slow and stedy selloff since CNBC spoke about NVDA and disregarded AMD. For a short term trade you can trade the breakout of the trendline but beware of the 162 level that is resistance and start of a chop. Later on around 165 you have a ton of overhead supply. This all stands in the way for the stock to really...

SNAP has insane earnings gap. Whoever gambled to the long side, good for them. Stock is most likely going to take a break here and consolidate before making way higher. If it gets below $15 or %13.80, I'd as a long trade I'd be out.

NVDA touched the 50EMA just for a second and rallied off of those levels. Target 890/900.

Gold is breaking out on a weekly, not only from the channel but also from the pennant.

I love SHOP. It's really fun to trade. Right now at the 200 weekly SMA and let's see if we get over.