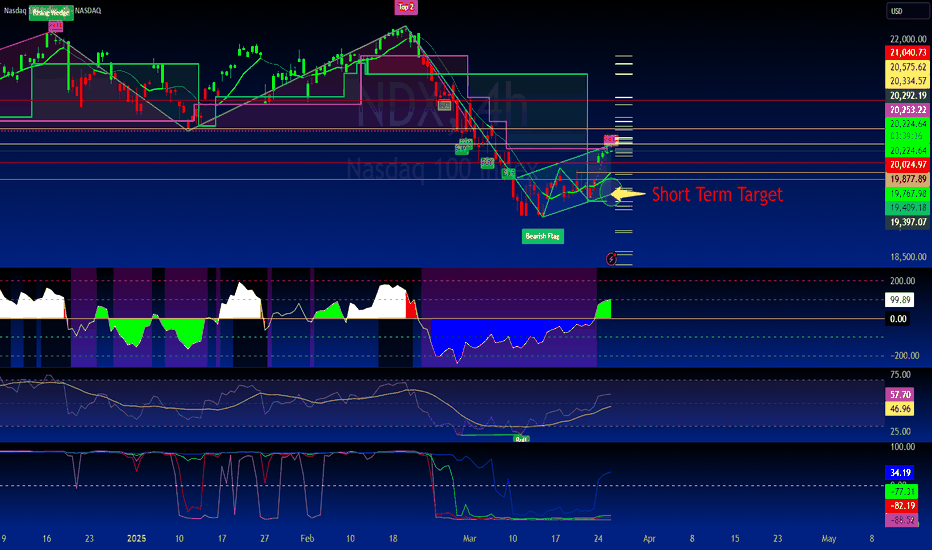

As we can see on the NASDAQ:NDX there is a Bearflag pattern that has yet to be broken. As it develops on the lower time frames we will watch for price to trade in this channel and develop on the higher time frames. After struggling at the top, we expect a short term rejection of the channel back down to the 19,516 Level.

I don't do Intraday chart posts for various reasons however this chart is the most important watch of the year. Right now we are testing a very important triple top where heavy resistance is being printed in the pre-market. Several times bull have tried to break through with large one minute candles and being stiffly rejected. This is of extreme importance...

This is most certainly set to be a short analysis. While everyone is talking about NASDAQ:TSLA no one is talking about NASDAQ:META at the close of the first quarter. We are at the end of a massive rising wedge ending in a double Doji soon to be Missive blow off top. Previously when we called the 70%+ drop on NASDAQ:META in 2021 is was only the first...

While NASDAQ:TSLA is quite good at manipulating their own shares, there are questions that need to be answered. It has always been suspected that NASDAQ:TSLA has defrauded their investors and cooked the books. Finally there is evidence. 1.5 Billion missing from their balance sheet!?!? Given Elon Musk's supreme affection for Hitler and his morbid stupidity,...

On BTCUSD we have a classic Inverse Cup With Handle. The move you are seeing bouncing hard off the 78k bottom is a corrective move designed to draw in Longs for a second wave of Margin calls as it tops out to form the cup handle, and sells off to retest the Breakout Zone. If you bought this rally you should think again, We wont know BTCUSD true direction until...

NASDAQ:TSLA is a great stock to trade, especially on options. Multi-thousand percent trades to be made every day both up and down. Bulls and Bears alike enjoy this stock for it's volatile nature. The fact of the matter is TSLA is a dying company with nothing of value to offer. It's leader is addicted to drugs and in disarray. Someone with no clear path or...

We have several things going on with the SP:SPX Right now. Some say its a bullflag, Some say it's a head and shoulders. The simplest explanation often being the best, SP:SPX is testing a downtrend line that was formed as a result of price action continuously rejecting at a Supply Level. Price is consolidating, however with the aggressive short attack on...

Not sure how many of you out there believe in the call to Maga. I personally don't care because anyone dump enough to buy this shit coin deserves what's coming to them. Trump does not love you, care about you or anyone else. They were Cash poor and on the brink of Destruction. This meme coin launch is a desperate attempt to regain wealth along with power....

You only need to connect a few dots to see where BITSTAMP:BTCUSD is going, and where it has been. Upon completion of it's multi-top retesting of it's historical upper trendline, the Bitcoin crowd will once again be treated to a massive dump and cries of foul play. Oligarchs will scoop up the declined Token off the lows between 20 and 40k and World leaders will...

Upon closer inspection of the worlds first shit coin NSE:BANKNIFTY , we find there is an extremely bearish reversal in this dynamic supply channel. With the CCI on the verge of collapse and a number of huge wide open space fair value gaps below we will find our short term price targets at 38k for Target 1 and 20k for our second Target 1. The next financial...

NASDAQ:TLT has currently been granted a stay of execution as the relief rally kicks in. On the daily we can see clear signs of a bull flag pattern with upper level targets at the gaps of 95, 96, and 98$. Currently having turned green on the Bull/Bear Indicator, this little yield is getting ready to slaughter bears in the short term and return zombified gains....

NYSE:ACHR is a unique up and coming Flying Robo Taxi, Long Haul Aviation Renewable Electric Vehicle corporation aiming to transform the transportation industry as we know it. Given the many unique and viable products this company has developed and it's massive growing interest, weather you see a cup with handle or big double bottom on the high time frame, you...

Here on NYSE:MO we can see a very clearly defined double bottom on the Quarterly chart with the current quarter candle pushing into and above the breakout zone. Quarterly CCI is also firmly broken out into positive momentum sure to keep those milky double d bottoms producing sweet sweet buttermilk all the way up to our 75$ Price target. Get some baby!

NASDAQ:BKNG is still on a monster rally. Having busted through the 1.618 Extension and an apparent rotation into Industrials, NASDAQ:BKNG is set to strengthen into it's next target at the 2.618 with a price tag of 6918$. On the monthly and quarterly charts we have the same strong and unwavering signal from the CII that this high probability long is far from...

One thing is for sure, the market programmed their algo's to draw the Republican Elephant all over the SP:SPX charts and stampede away with retailer profits. Come Monday we will rally off this line of gap support and head up to sweep liquidity at previous highs. Once we grab the liquidity we will really find out who is in charge. Elephants, or Donkey's?

It does not take a rocket scientist to see that NASDAQ:MSFT is forming a well developed Head and Shoulders Bearish Pattern. Plan on a moderate target but expect the dump is my motto. When she goes, she will take the market with it. Is there any surprise BITSTAMP:BTCUSD will dump at the same time too? The tech sector is trading near 82 times their forward...

That's right.. The sheep were told we broke through the great depression trendline and to prepare themselves for a new paradigm.. As you can see we have broken through one of the great depression trendlines. And Still you can see we have one to go.. Our last touch of this trendline ended up with a stiff rejection, and we are dangerously close to another fatal...

For some time now Hindenburg has published reports about NYSE:RBLX poor financials and very suspect safety concerns regarding NYSE:RBLX and their users. Time and time again Hindenburg has misled and proved incorrect on these allegations. One of the article's they published as a safety concern for users of NYSE:RBLX was completely inaccurate with links...